Accounting Vouchers In Tally Prime: Users must continuously record various transactions for accounting, inventory management, and statutory compliance as a business owner. For these, business people use different vouchers such as Accounting vouchers in tally, receipt vouchers, journal vouchers, etc. In this article, we have discussed details about the various accounting voucher types in Tally Prime.

A voucher is a document used daily by the accounting department on an organisation or a business. Vouchers are used to systematically compile and collate data in invoices, purchase orders, certificates, and other information required to record the transaction and process the payment. A voucher can not be recorded without a ledger.

A ledger for the transactions needs to be created before the vouchers. To know how to create ledgers, click here to check our article.

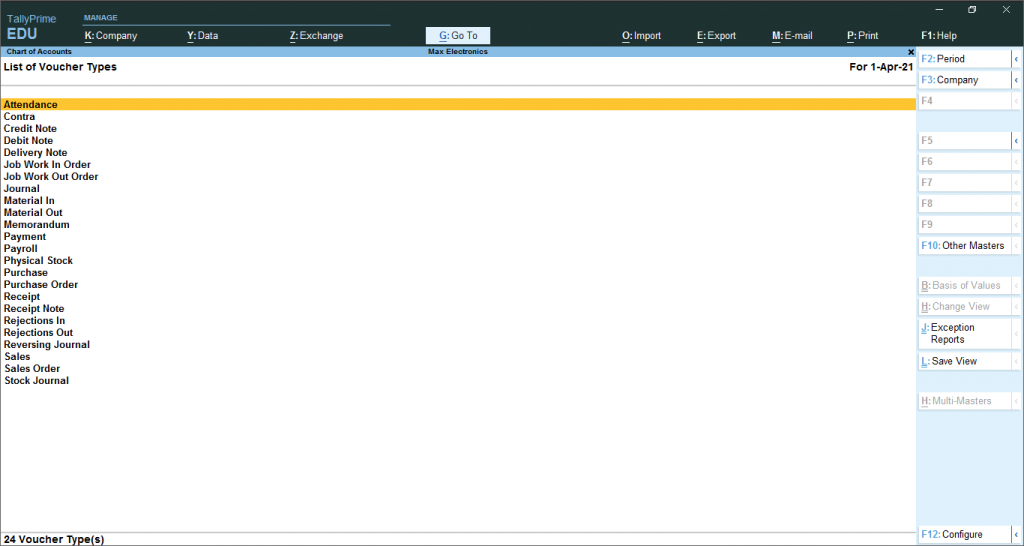

There are 24 predefined voucher types in TallyPrime. According to the voucher type, 24 vouchers can be classified in this way.

- Accounting Vouchers

- Inventory Vouchers

- Payroll Vouchers

- Non-Accounting Vouchers

The user creates other voucher types under these predefined voucher types as per your business needs.

For example, there is a predefined payment voucher for cash payments and bank payments. However, if You want, create two or more sales voucher types in TallyPrime for different sales transactions. For example, credit sales, cash sales, and so on.

Pre-Defined Voucher Types in Tally Prime

- To check the Different vouchers go to :

Gateway of Tally > Chart of Accounts > type or select Voucher Type.

Alternatively, press Alt+G (Go To) > type or select Chart of Accounts > Voucher Type.

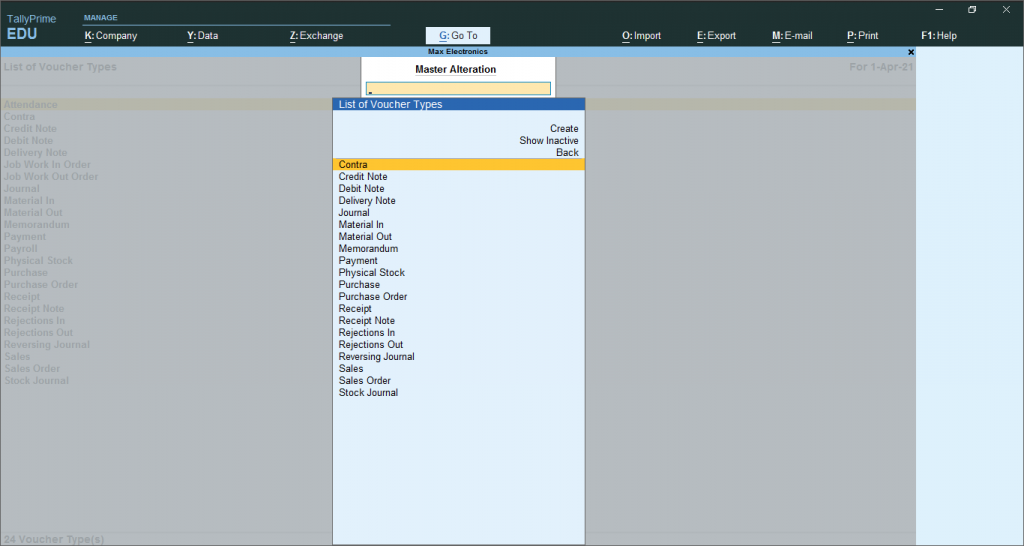

- One can also go to Gateway of Tally > Alter > Voucher Type. Alternatively, press Alt+G (Go To) > type or select Alter Master > Voucher Type.

ACTIVATE / DEACTIVATE VOUCHERS

2. In Tally Prime, the voucher must be activated to record. However, one can also deactivate the voucher if not needed. To activate/deactivate vouchers, go to

- Gateway of Tally> MastersChart of Accounts> Voucher Types> Select Voucher Type and then Press Enter.

- Now you can enable the option, “ACTIVATE THIS VOUCHER TYPE “into YES

- Accept the screen or you can press Ctrl+A to save.

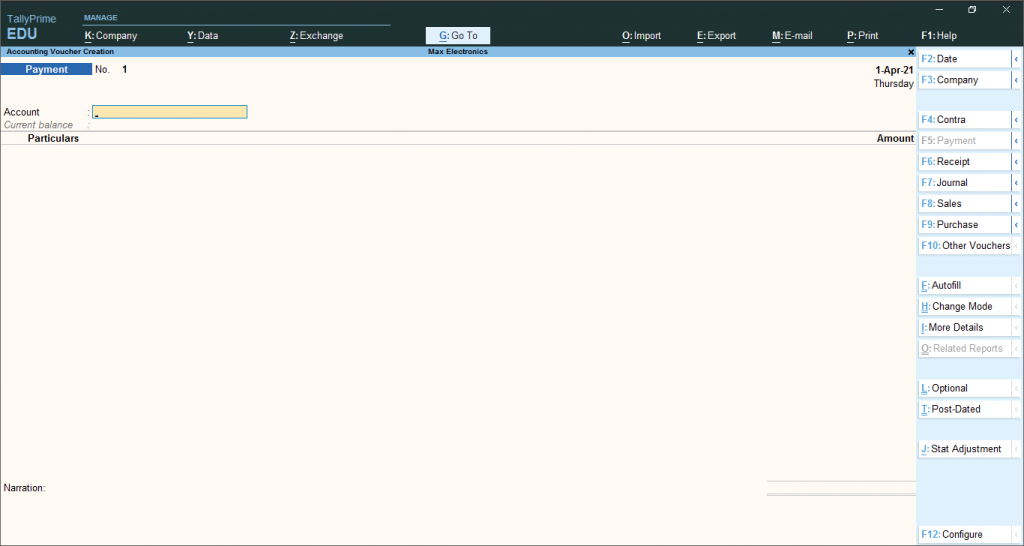

To record a new voucher, go to Gateway of Tally> Transactions> Vouchers.

Types of Accounting Vouchers in Tally

3. Payment voucher:

Payment voucher in accounting vouchers in tally records all business transactions related to Payment. Any payment made by the company through cash, cheque, online payment or any other mode comes under this voucher type. To record transactions, click Gateway of tally> Transaction> Vouchers> Press F5.

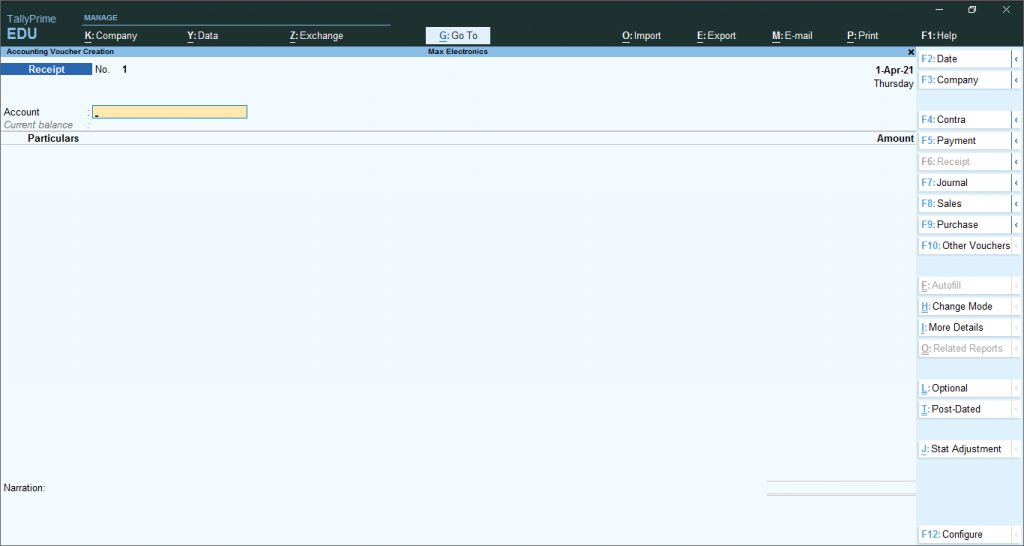

4. Receipt Voucher:

The Receipt voucher under accounting vouchers in tally records all money transactions received by the company. The amount received could be in the form of cash, cheque or online. When an accountant makes a receipt voucher in Tally Prime, all the invoices with pending payments pop up as a reminder. To record this transaction, go to Gateway of tally> Transaction> Vouchers> Press F6.

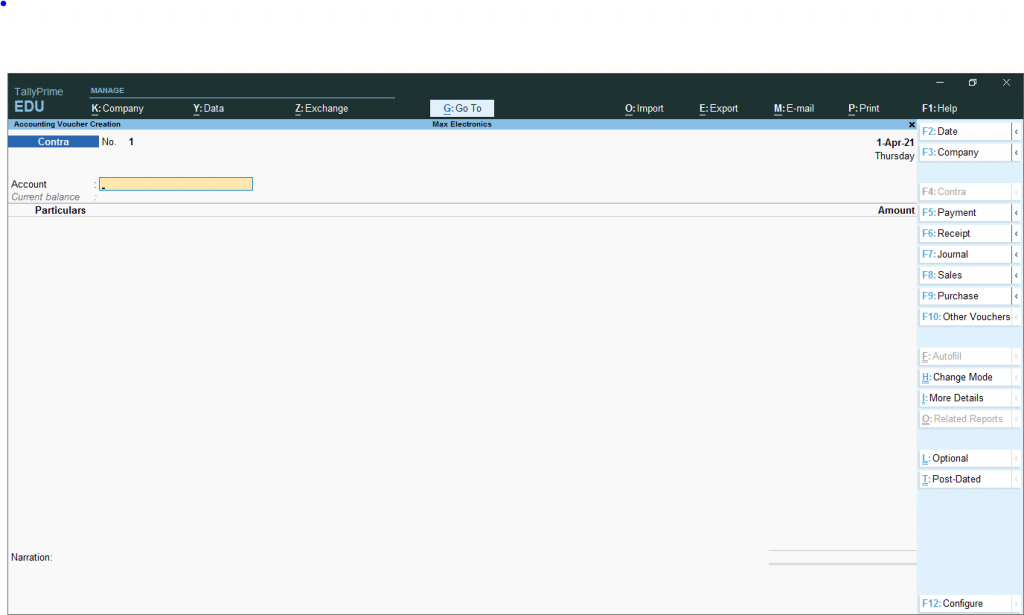

5. Contra Voucher:

In contra voucher, all the company’s transactions include deposits or money withdrawal from its bank account. The entry is made in this voucher if the amount is transferred from bank to bank or cash to cash. To record such transactions, go to Gateway of tally> Transaction> Vouchers> Press F4.

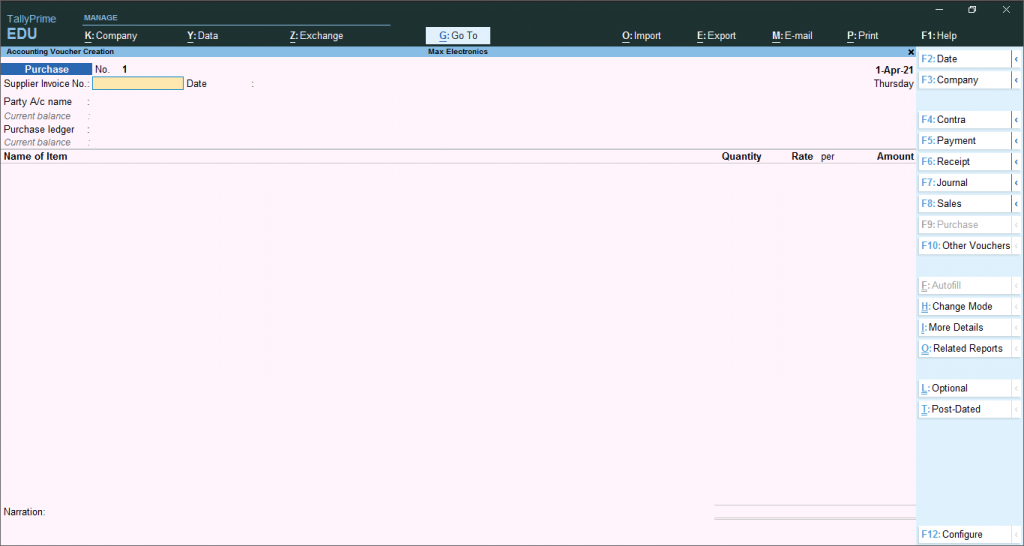

6. Purchase Voucher:

In this voucher, all the transaction related to company purchases is recorded. The purchase can be made in cash or borrowed or in the form of goods and services. To record the transaction, go to Gateway of tally> Transaction> Vouchers> Press F9.

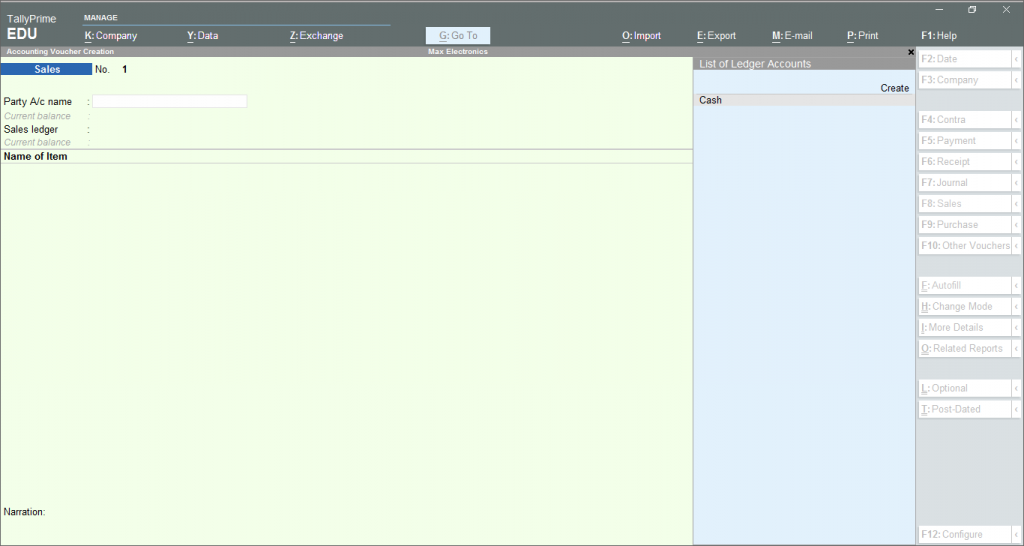

7. Sales Voucher:

It is one of the most used accounting vouchers in tally. Accountants can create two different formats, such as invoice and voucher in this type. Sales voucher records all sales transactions of the company in credit or cash. In vouchers, one can store transactional records electronically and print them for customers. To record this transaction, go to Gateway of tally> Transaction> Vouchers> Press F8.

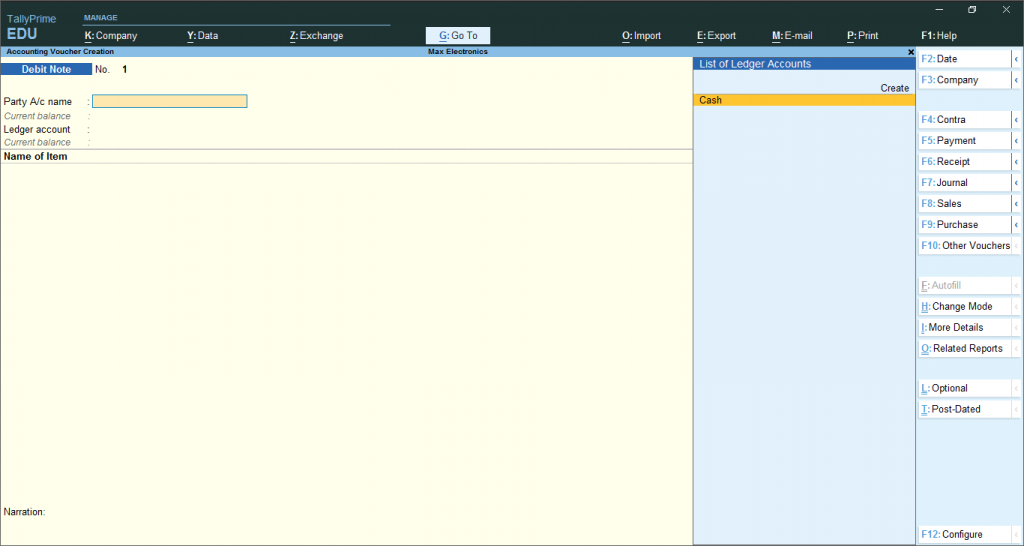

8. Debit Note

When a company returns the purchased commodity, it is recorded in these accounting vouchers in Tally. An accountant can also record interest calculations in this voucher. To record such transactions, go to Gateway of tally> Transaction> Vouchers> Press Alt+ F5.

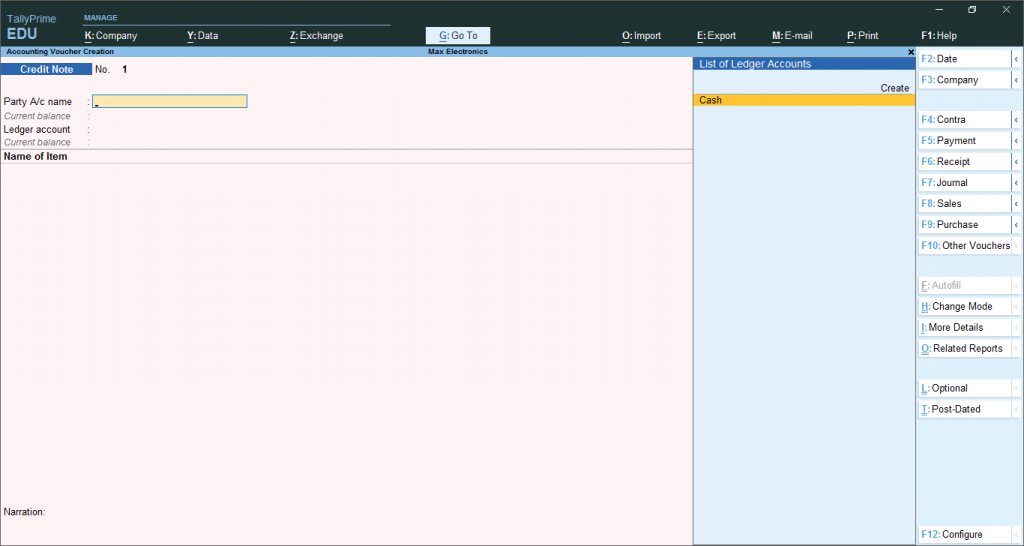

9. Credit Note

When a company returns the sold commodity, it is recorded in these accounting vouchers in Tally. An accountant can also record Transactions related to sales returns and interest calculations in this voucher. To record such transactions, go to Gateway of tally> Transaction> Vouchers> Press Alt+F6.

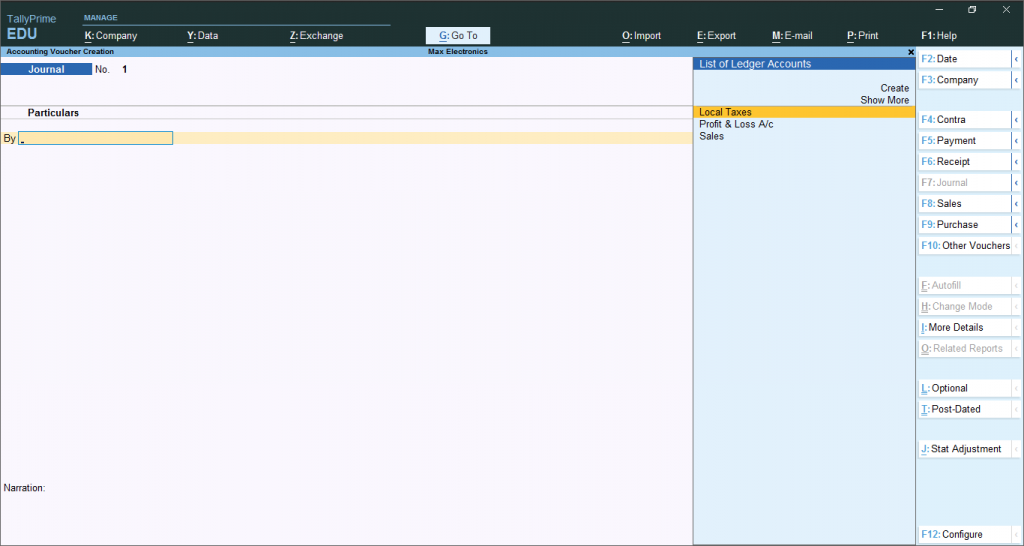

10. Journal

In Tally’s inventory and accounting vouchers, users can use it as an optional voucher in Tally to make sales and purchases. An accountant can also use it to adjust or transfer stock from one warehouse to the other and for tax calculations and tax adjustment entries. To open this voucher, go to Gateway of tally> Transaction> Vouchers>Press F7.

Recommended