A salary slip is a document issued by an employer to his employees. Salary Slip Format in Excel, Download Salary Calculation Sheet. Salary slip is an important document proof of your income and so understanding its terms is necessary. The salary slip has details about the tax deducted, allowances provided by the company and our details etc. but many times all these components are not very clear.

The basic salary is the fixed part of your salary income based on which the rest of your perquisites and allowances are calculated. The basic salary is computed as per the employment terms or the grade

Salary Slip Format in Excel

Download Salary Calculation Sheet

Salary slip is a document that is received every month by the employee from the employer. It shows everything from gross salary to deductions. A salary slip can be defined as a document issued by an employer to its employees, containing the detailed breakdown of an employee’s earnings and deductions for a given month.

This document can either be printed out and given to the employees or mailed to them. As an employer, you are legally bound to issue salary slip to your employees as proof of salaries paid and necessary deductions made.

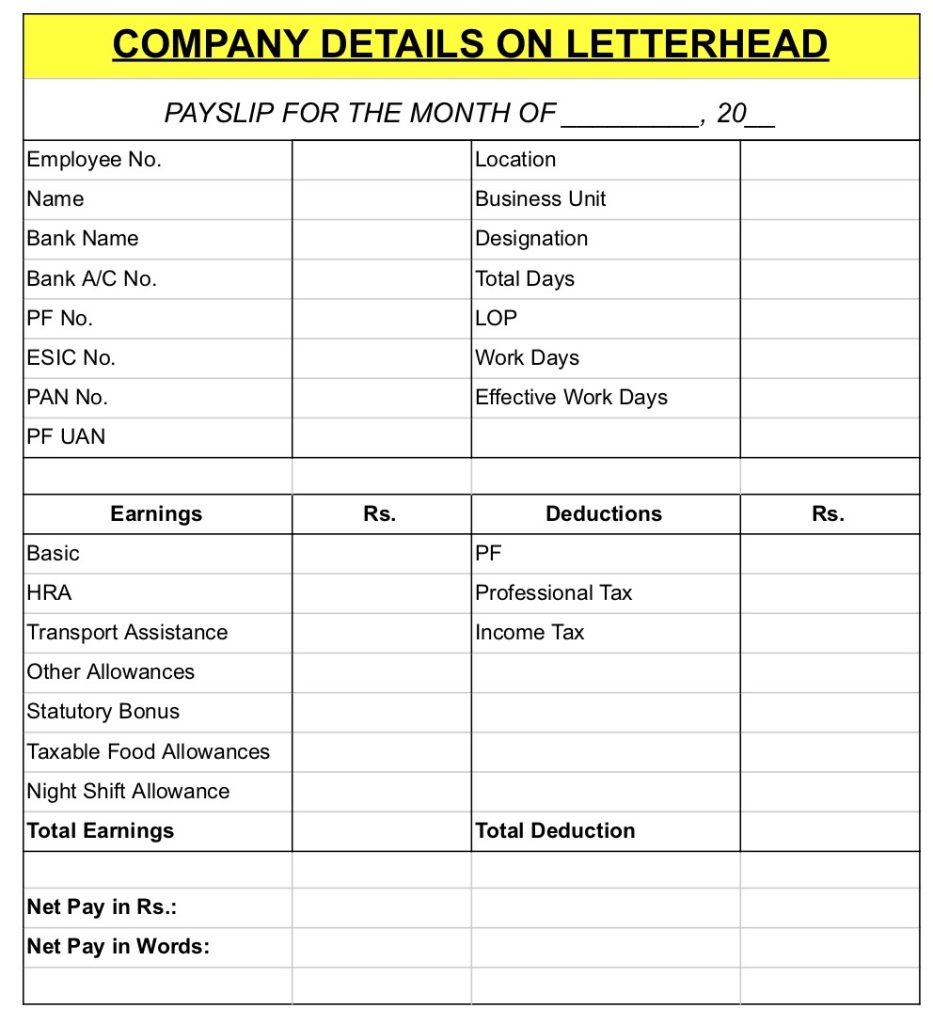

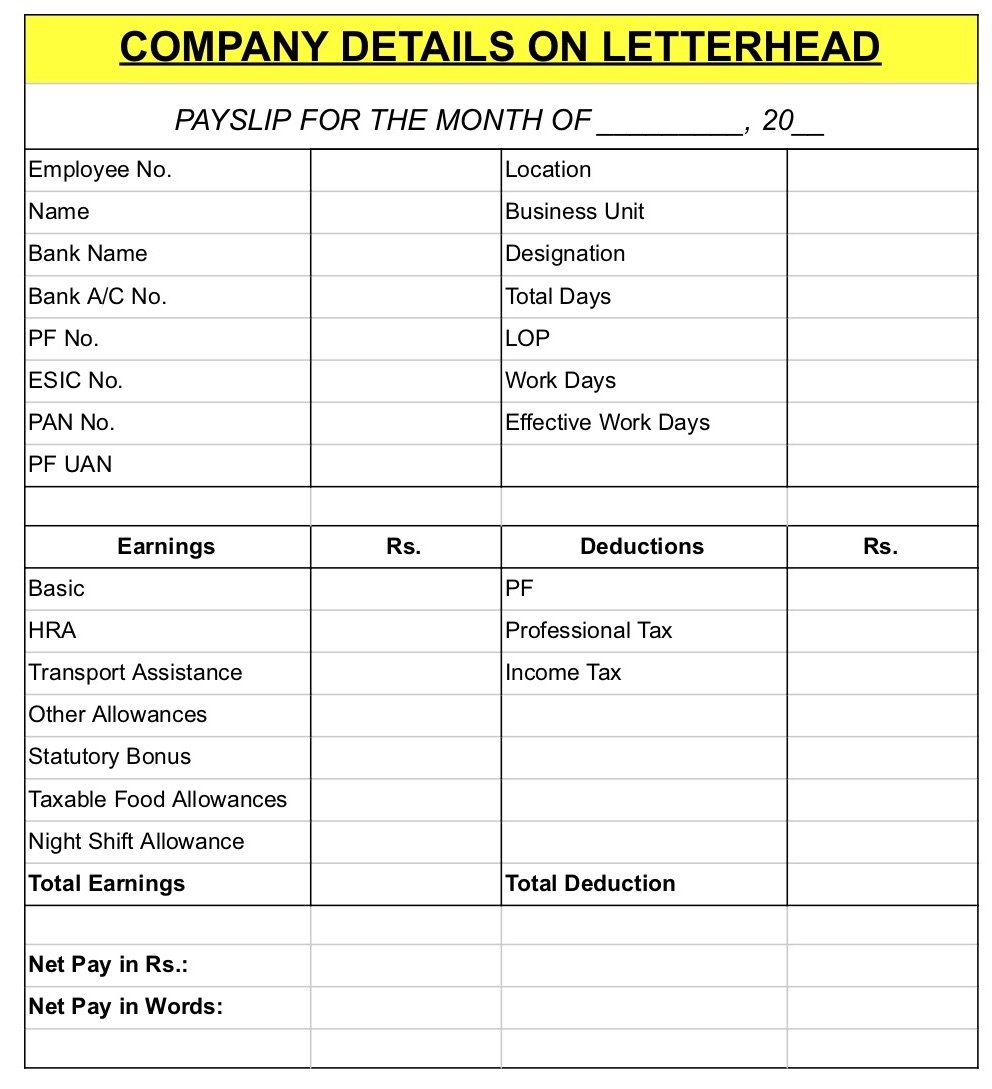

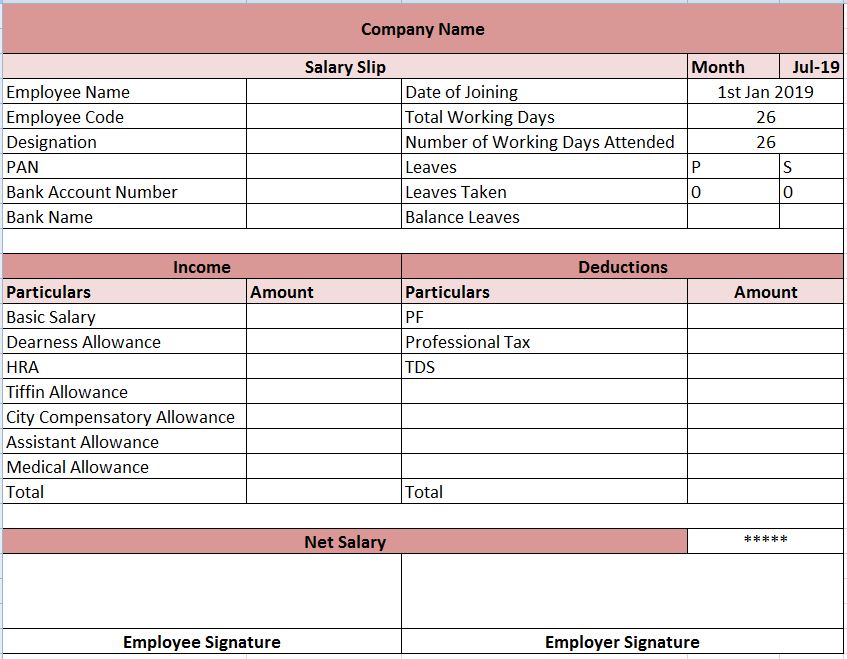

Here we are Providing Some Samples for Salary Slip Format.

Must Read –

- Experience Certificate format

- Relieving Letter Format

- Resignation Letter Format

- Appointment Letter Format

Here below we provide sample format of Salary slip, for use this format, please download below file in excel format.

| Company Address | ||||

| Payslip for the month of | ||||

| EMPLOYEE DETAILS | ||||

| CODE | NAME | |||

| DESIGNATION | PAY MODE | |||

| DEPARTMENT | ACCT. NO. | |||

| PAYABLE DAYS | PF NO. | |||

| LEAVE DETAILS | ||||

| Leave Type | Op. Balance | Accum | Availed | Closing Balance |

| CL | ||||

| XL | ||||

| EL | ||||

| SALARY DETAILS | ||||

| EARNINGS | RS | DEDUCTIONS | RS | |

| BASIC | ESI | |||

| HRA | IT | |||

| CONVEYANCE | MISC | |||

| MEDICAL REIM | PT | |||

| CH-WELFARE | PF | |||

| EDU-ALLOW | VPF | NETT PAY | ||

| SPL ALLOW | ||||

| GROSS | 0 | TOTAL | 0 |

Need Salary slip