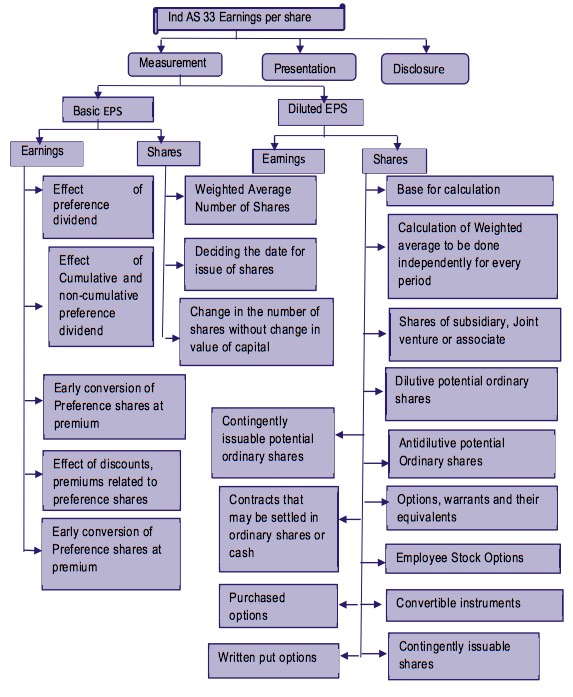

Ind AS 33, Earnings per Share: The objective of Ind AS 33 is to prescribe principles for the determination and presentation of earnings per share, so as to improve performance comparisons between different entities in the same reporting period and between different reporting periods for the same entity. The focus of this Standard is on the denominator of the earnings per share calculation. Ind AS 33 shall be applied to companies that have issued ordinary shares to which Indian Accounting Standards (Ind AS) notified under the Companies Act applies.

The objective of Ind AS 33 is to prescribe principles for determining and presenting earnings per share (EPS) amounts to improve performance comparisons between different entities in the same reporting period and between different reporting periods for the same entity.

Ind AS 33

An ordinary share is an equity instrument that is subordinate to all other classes of equity instruments. A potential ordinary share is a financial instrument or other contract that may entitle its holder to ordinary shares.

An entity shall present in the statement of profit and loss basic and diluted earnings per share for profit or loss from continuing operations attributable to the ordinary equity holders of the parent entity and for-profit or loss attributable to the ordinary equity holders of the parent entity for the period for each class of ordinary shares that has a different right to share in profit for the period. An entity shall present basic and diluted earnings per share with equal prominence for all periods presented.

Advertisement

Content in this Article

An entity that reports a discontinued operation shall disclose the basic and diluted amounts per share for the discontinued operation either in the statement of profit and loss or in the notes.

Potential ordinary share:

a financial instrument or other contract that may entitle its holder to ordinary shares

Common examples of potential ordinary shares

- convertible debt

- convertible preferred shares

- share warrants

- share options

- share rights

- employee stock purchase plans

- contractual rights to purchase shares

- contingent issuance contracts or agreements (such as those arising in business combination)

List of other IndAS

Basic earnings per share

Basic earnings per share shall be calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity (the numerator) by the weighted average number of ordinary shares outstanding (the denominator) during the period.

For the purpose of calculating basic earnings per share, the amounts attributable to ordinary equity holders of the parent entity in respect of:

- profit or loss from continuing operations attributable to the parent entity; and

- profit or loss attributable to the parent entity

shall be the amounts in (a) and (b) adjusted for the after-tax amounts of preference dividends, differences arising on the settlement of preference shares, and other similar effects of preference shares classified as equity.

Where any item of income or expense which is otherwise required to be recognised in profit or loss in accordance with Indian Accounting Standards is debited or credited to securities premium account/other reserves, the amount in respect thereof shall be deducted from profit or loss from continuing operations for the purpose of calculating basic earnings per share.

For the purpose of calculating basic earnings per share, the number of ordinary shares shall be the weighted average number of ordinary shares outstanding during the period. (Paragraph 19 of the Standard)

The weighted average number of ordinary shares outstanding during the period and for all periods presented shall be adjusted for events, other than the conversion of potential ordinary shares that have changed the number of ordinary shares outstanding without a corresponding change in resources. (Paragraph 26 of the Standard)

Diluted earnings per share

Diluted earnings per share shall be calculated by an entity by adjusting profit or loss attributable to ordinary equity holders of the parent entity, and the weighted average number of shares outstanding, for the effects of all dilutive potential ordinary shares.

Dilution is a reduction in earnings per share or an increase in loss per share resulting from the assumption that convertible instruments are converted, that options or warrants are exercised, or that ordinary shares are issued upon the satisfaction of specified conditions.

For the purpose of calculating diluted earnings per share, the number of ordinary shares shall be the weighted average number of ordinary shares calculated in accordance with paragraphs 19 and 26, plus the weighted average number of ordinary shares that would be issued on the conversion of all the dilutive potential ordinary shares into ordinary shares.

Potential ordinary shares shall be treated as dilutive when, and only when, their conversion to ordinary shares would decrease earnings per share or increase loss per share from continuing operations.

An entity uses profit or loss from continuing operations attributable to the parent entity as the control number to establish whether potential ordinary shares are dilutive or anti-dilutive. In determining whether potential ordinary shares are dilutive or anti-dilutive, each issue or series of potential ordinary shares is considered separately rather than in aggregate.

Retrospective adjustments

If the number of ordinary or potential ordinary shares outstanding increases as a result of a capitalisation, bonus issue or share split, or decreases as a result of a reverse share split, the calculation of basic and diluted earnings per share for all periods presented shall be adjusted retrospectively. If these changes occur after the reporting period but before the financial statements are approved for issue, the per share calculations for those and any prior period financial statements presented shall be based on the new number of shares.

Difference Between AS 20 and Ind AS 33

| Particulars | Ind AS 33 | AS 20 |

|---|---|---|

| Additional disclosures | Disclosure is required for instruments (including contingently issuable shares) that could potentially dilute basic earnings per share in the future but were not included in the calculation of diluted earnings per share because they are anti-dilutive for the periods presented. | Certain additional disclosures required under Ind AS not required here. |

| Mandatorily convertible instrument | Ordinary shares to be issued upon conversion of a mandatorily convertible instrument are included in the calculation of basic EPS from the date the contract is entered into. | No specific requirement as in Ind AS. |

| Shares issuable after a passage of time | Ordinary shares that are issuable solely after a passage of time are not treated as contingently issuable shares because passage of time is a certainty | No specific guidance. |

| Contingently returnable shares | Outstanding ordinary shares that are contingently returnable are not treated as outstanding and are ignored in the calculation of basic EPS until the shares are no longer subject to recall. | No guidance on contingently returnable shares. |

Disclosure

If EPS is presented, the following disclosures are required:

- The amounts used as the numerators in calculating basic and diluted EPS, and a reconciliation of those amounts to profit or loss attributable to the parent entity for the period

- the weighted average number of ordinary shares used as the denominator in calculating basic and diluted EPS, and a reconciliation of these denominators to each other

- instruments (including contingently issuable shares) that could potentially dilute basic EPS in the future, but were not included in the calculation of diluted EPS because they are antidilutive for the period(s) presented

- a description of those ordinary share transactions or potential ordinary share transactions (other than those arising from capitalisation, bonus issue, share split or reverse share split), that occur after the balance sheet date and that would have changed significantly the number of ordinary shares or potential ordinary shares outstanding at the end of the period if those transactions had occurred before the end of the reporting period. Examples include issues and redemptions of ordinary shares issued for cash, warrants and options, conversions, and exercises.

Recommended Articles