IndAS 1: Presentation of Financial Statement,In India Presentation of Financial Statement is always governed by Companies Act instead of Accounting Standard.Earlier there is Schedule VI, now Schedule III is there for Presentation of Financial Statement as per Accounting Standard. Now you can scroll down below n check more details regarding “IndAS 1: Presentation of Financial Statement”

IndAS 1: Presentation of Financial Statement

Till date, no format has been prescribed for Presentation of Financial Statement as per Indian Accounting Standard.

There is an exposure draft on it which is not yet approved.

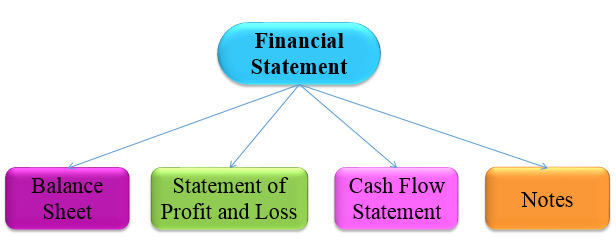

Financial Statement comprises of:-

Advertisement

Content in this Article

- (a)Balance Sheet as at the end of the period;

- (b)Statement of Profit and Loss for the period;

- (c)Cash Flow Statement for the period; and

- (d)Notes.

Balance Sheet

Balance sheet include Statement of change in equity which is presented as a part of the Balance Sheet.

Statement of Profit and Loss

- Statement of Profit and Loss include other comprehensive income which is presented as part of a single statement of profit and loss.

- There is no concept of extraordinary item in Ind AS.

Notes

- Notes comprises of summary of significant accounting policies and other explanatory information.

Other Comprehensive Income

Other comprehensive income comprises items of income and expense (including reclassification adjustments) that are not recognised in profit or loss as required by other Ind ASs.

The components of other comprehensive income include:

(a) changes in revaluation surplus (see Ind AS 16 Property, Plant and Equipmentand Ind AS 38 Intangible Assets);

(b) actuarial gains and losses on defined benefit plans (see Ind AS 19 Employee Benefits);

(c) gains and losses arising from translating the financial statements of a foreign operation (see Ind AS 21 The Effects of Changes in Foreign Exchange Rates);

(d) gains and losses on remeasuring available-for-sale financial assets (see Ind AS 39 Financial Instruments: Recognition and Measurement);

(e) the effective portion of gains and losses on hedging instruments in a cashflow hedge (see Ind AS 39 Financial Instruments: Recognition and Measurement).

Reclassification adjustments are amounts reclassified to profit or loss in the current period that were recognised in other comprehensive income in the current or previous periods.

Must Read –

- Indian Accounting Standard (IndAS 2) – Inventories

- IndAS 115 Revenue from Contracts with Customers

- Ind AS 40 Investment Property

- IND AS 36 Impairment of Assets

- What is IASB, FASB, IFRS, Ind AS and US GAAP?

Format of Financial Statement As Per IndAs

Download Draft Format of Financial Statement As Per IndAs

Note: It is a draft format of Financial statement.

Compliance with Ind ASs

- Financial statements complying with Ind ASs shall make an explicit and unreserved statement of such compliance in the notes.

- Financial statements shall not be described as complying with Ind ASs unless they comply with all the requirements of applicable Ind ASs.

Comparision

| Particulars | IND AS | AS | IFRS |

| Statement of change in equity | Yes | Yes | Yes |

| Statement of change in equity as Seperate statement or Part of notes | Part of notes | Part of notes | Seperate statement |

| Other comprehensive income | Yes | No | Yes |

| Single / Two statement approach for Statement of Profit and Loss | Single | Single | Any one |

| Extraordinary items | No | Yes | No |

| Expense presentation in Statement of Profit and Loss | Nature wise | Nature wise | Either by nature or function wise |