GST Refund Status, Track GST Refund Status via online Mode: First we know that what is GST – It is a destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer.

Any person claiming refund of any tax and interest, if any, paid on such tax or any other amount paid by him, may make an application in that regard to the proper officer of IGST/CGST/SGST/UTGST before the expiry of two years from the relevant date in prescribe form and manner – section 54(1) of CGST Act.

Procedure after submitting refund application

Where the application relates to a claim for refund from the electronic cash ledger, an acknowledgement in form GST RFD-02 shall be made available to the applicant through the Common Portal electronically, clearly indicating the date of filing of the claim – Rule 2(1) of Refund Rules.

The application for refund, other than claim for refund from electronic cash ledger, shall be forwarded to the proper officer who shall, within fifteen days of filing of the said application, scrutinize the application for its completeness and where the application is found to be complete in terms ofsub-rule (2), (3) and (4) of rule 1, an acknowledgement in form GST RFD-02 shall be made available to the applicant through the Common Portal electronically, clearly indicating the date of filing of the claim for refund. – Rule 2(2) of Refund Rules.

Advertisement

Content in this Article

Where any deficiencies are noticed, the proper officer shall communicate the deficiencies to the applicant in form GST RFD-03 through the Common Portal electronically, requiring him to file a refund application after rectification ofsuch deficiencies – Rule2(3) of Refund Rules

Where deficiencies have been communicated in form GST RFD-03under the SGST Rules, the same shall also deemed to have been communicated under this Rule along with deficiencies communicated under rule 2(3) – Rule 2(4) of Refund Rules [and vice versa]

How to Check GST Refund Status

From this page you may check your GST Refund Status or you can track your GST Refund for 2017-18. Here below we provide Detailed Procedure for How to check GST Refund Status via online mode or How to Track GST Refund Status via GST Portal….please check following steps..

How can I track the status of refund on the GST Portal after logging to the GST Portal?

1. To track your submitted refund application, login to the GST Portal.

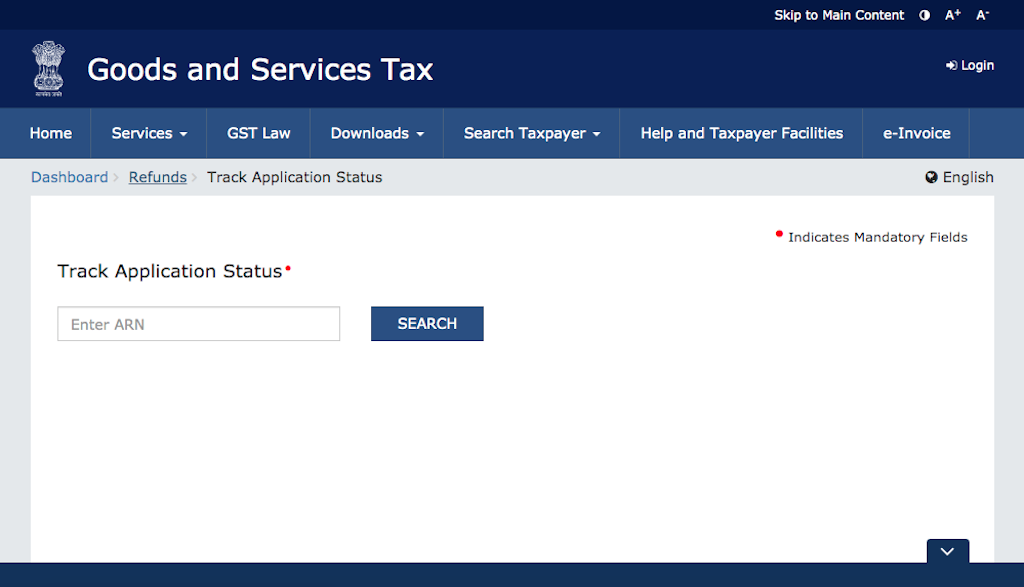

2. Navigate toServices andgt; Refunds andgt; Track Application Statuscommand.

3. Enter theARNand click theSEARCHbutton.

- Step 1: Visit on Income Tax InformatioN Official Website https://www.gst.gov.in/

- Step 2: After Visit on official Website please click on “Status of Tax Refund”

- Step 3: Now you may reach at official income tax refund status page, click here (not available at this time) for direct visit on Income tax refund status page

- Step 4: After Reach at official page of Income tax refund, Please enter you GSTIN Number and Select Assessment Year for which you want to check your refund status and Click on Submit Button

- Step 5: Now New page is Open and it will Show you Income tax Refund Status, if you are not able to see your Refund status then please contact to your assessing officer as soon possible.

Click Here for Online GST Refund Status

Must –GST Registration Status

GST Refund Formats

| Form No | Name of Form |

| GST RFD-01 | Application for Refund

|

| GST RFD-02 | Acknowledgement |

| GST RFD-03 | Deficiency Memo |

| GST RFD-04 | Provisional Refund Order |

| GST RFD-05 | Payment Advice |

| GST RFD-06 | Refund Sanction/ Rejection Order |

| GST RFD-06 | Interest on delayed refund order (same as refund order) |

| GST RFD-07 | Order for complete adjustment of sanctioned Refund/ order for withholding of refund |

| GST RFD-08 | Notice for rejection of application for refund |

| GST RFD-09 | Reply to the show cause notice |

| GST RFD-10 | Application for Refund by any specialize agency of UN or Multilateral Financial Institution and Organization, Consulate or Embassy of foreign countries, etc. |

Important Questions Related to GST Refund

Q 1. Is there any specified format for filing refund claim?

Ans. Every claim of refund has to be filed in Form GST RFD – 01. However, claim of refund of balance in electronic cash ledger can be claimed through furnishing of monthly/quarterly returns in Form GSTR 3, GSTR 4 or GSTR 7, as the case may be, of the relevant period.

Q 2. Is there any specified format for sanction of refund claim?

Ans. The claim of refund will be sanctioned by the proper officer in Form GST RFD-06 if the claim is found to be in order and payment advice will be issued in Form GST RFD-05. The refund amount will then be electronically credited to the applicants given bank account.

Q 3. What happens if there are deficiencies in the refund claim?

Ans. Deficiencies, if any, in the refund claim has to be pointed out within 15 days. A form GST RFD-03 will be issued by the proper officer to the applicant pointing out the deficiencies through the common portal electronically requiring him to file a refund application after rectification of such deficiencies.

Q 4. Can the refund claim be rejected without assigning any reasons?

Ans. No. When the proper officer is satisfied that the claim is not admissible he shall issue a notice in Form GST RFD-08 to the applicant requiring him to furnish a reply in GST RFD -09 within fifteen days and after consideration of the applicant‟s reply, he can accept or reject the refund claim and pass an order in Form GST RFD-06 only.

Q 5. Is there any time limit for sanctioning of refund?

Ans. Yes, refund has to be sanctioned within 60 days from the date of receipt of application complete in all respects. If refund is not sanctioned within the said period of 60 days, interest at the rate notified will have to be paid in accordance with section 56 of the CGST/SGST Act.

However, in case where provisional refund to the extent of 90% of the amount claimed is refundable in respect of zero-rated supplies made by certain categories of registered persons in terms of sub-section (6) of section 54 of the CGST/SGST Act, the provisional refund has to be given within 7 days from the date of acknowledgement of the claim of refund.

Must Read –