ITC under GST: Uninterrupted and seamless chain of input tax credit (hereinafter referred to as, “ITC”) is one of the key features of Goods and Services Tax. ITC is a mechanism to avoid cascading of taxes. Cascading of taxes, in simple language, is ‘tax on tax’. Under the present system of taxation, credit of taxes being levied by Central Government is not available as set-off for payment of taxes levied by State Governments, and vice versa. One of the most important features of the GST system is that the entire supply chain would be subject to GST to be levied by Central and State Government concurrently. As the tax charged by the Central or the State Governments would be part of the same tax regime, the credit of tax paid at every stage would be available as set-off for payment of tax at every subsequent stage..

Input Tax Credit under GST – Conditions To Claim

- Possession of a tax invoice or debit note or document evidencing payment

- Receipt of goods and/or services

- goods delivered by supplier to other person on the direction of registered person against a document of transfer of title of goods

- Furnishing of a return

- Where goods are received in lots or installments ITC will be allowed to be availed when the last lot or installment is received.

- Failure to the supplier towards supply of goods and/or services within 180 days from the date of invoice, ITC already claimed will be added to output tax liability and interest to paid on such tax involved. On payment to supplier, ITC will be again allowed to be claimed

- No ITC will be allowed if depreciation have been claimed on tax

component of a capital good ⇒If invoice or debit note is received after - the due date of filing return for September of next financial year “or”

- filing annual return

- whichever Is later

- No ITC will be allowed

- Common credit of ITC used commonly for

- Effecting exempt and taxable supplies

- Business and non-business activity

ITC under GST

Let us understand how ‘cascading’ of taxes takes place in the present regime. Central excise duty charged on inputs used for manufacturing of final product can be availed as credit for payment of central excise duty on the final product. For example, to manufacture a pen, the manufacturer requires, plastic granules, refill tube, metal clip, etc. All these ‘inputs’ are chargeable to central excise duty. Once a ‘pen’ is manufactured by using these inputs, the pen is also chargeable to central excise duty. Let us assume that the cost of all the above mentioned inputs is say, Rs.10/- on which central excise duty @10% is paid, means Re.1. The cost of the manufactured pen is say Rs.20/-, the central excise duty payable on the pen @10% will be Rs.2/- . Now the manufacturer of the pen can use the duty paid on inputs, i.e. Re.1/- for payment of duty on the pen. So he will use Re.1 paid on inputs and he will pay Re.1/- through cash (1+1=2), the price of the pen becomes Rs. 22/-. In effect, he actually pays duty on the ‘value added’ over and above the cost of the inputs. This mechanism eliminatescascading of taxes.

However, when the pen is sold by the manufacturer to a trader, he is required to levy VAT on such sale. But under the present system, the manufacturer cannot use the credit of central excise duty paid on the pen for payment of VAT, as the two levies are being levied by Central and State government respectively with no statutory linkage between the two. Hence, he is required to pay VAT on the entire value of the pen, i.e. Rs.22/-, which actually includes the central excise duty to the tune of Rs.2/-. This is cascading of taxes or tax on tax, as now VAT is not only paid on the value of pen i.e. Rs.20/- but also on tax i.e. Rs.2/-.

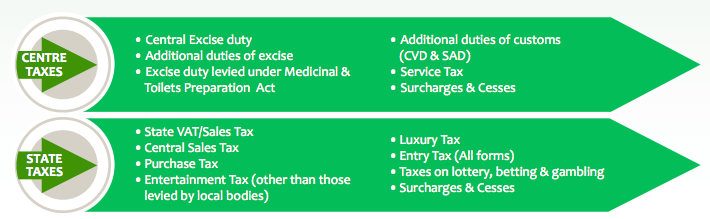

Goods and Services Tax (GST) would mitigate such cascading of taxes. Under this new system, most of the indirect taxes levied by Central and the State Governments on supply of goods or services or both, would be combined together under a single levy. The major taxes/levies which are going to be clubbed together or subsumed in the GST regime are as under:GST comprises of the following levies:

- a. Central Goods and Services Tax (CGST) [also known as Central Tax] on intra-state or intra-union territory without legislature supply of goods or services or both.

- b. State Goods and Services Tax (SGST) [also known as State Tax] on intra-state supply of goods or services or both.

- c. Union Territory Goods and Services Tax (UTGST) [also known as Union territory Tax] on intra-union territory supply of goods or services or both.

- d. Integrated Goods and Services Tax (IGST) [also known as Integrated Tax] on inter-state supply of goods or services or both. In case of import of goods also, the present levy of Countervailing Duty (CVD) and Special Additional Duty (SAD) would be replaced by integrated tax.

Advertisement

The protocol to avail and utilise the credit of these taxes is as follows:

| Credit of | To be utilised first for payment of | May be utilised further for payment of |

| CGST | CGST | IGST |

| SGST/UTGST | SGST/UTGST | IGST |

| IGST | IGST | CGST, then SGST/UTGST |

Credit of CGST cannot be used for payment of SGST/UTGST and credit of SGST/UTGST cannot be utilised for payment of CGST.

Some of the technical aspects of the scheme of Input Tax Credit are as under:

A. Any registered person can avail credit of tax paid on the inward supply of goods or services or both, which is used or intended to be used in the course or furtherance of business.

B. The pre-requisites for availing credit by registered person are:

- a. He is in possession of tax invoice or any other specified tax paying document.

- b. He has received the goods or services. “Bill to ship” scenarios also included.

- c. Tax is actually paid by the supplier.

- d. He has furnished the return.

- e. If the inputs are received in lots, he will be eligible to avail the credit only when the last lot of the inputs is received.

- f. He should pay the supplier, the value of the goods or services along with the tax within 180 days from the date of issue of invoice, failing which the amount of credit availed by the recipient would be added to his output tax liability, with interest [rule 2(1) and (2) of ITC Rules]. However, once the amount is paid, the recipient will be entitled to avail the credit again. In case part payment has been made, proportionate credit would be allowed.

C. Documents on the basis of which credit can be availed are:

- a. Invoice issued by a supplier of goods or services or both

- b. Invoice issued by recipient alongwith proof of payment of tax

- c. A debit note issued by supplier

- d. Bill of entry or similar document prescribed under Customs Act

- e. Revised invoice

- f. Document issued by Input Service Distributor

D. No ITC beyond September of the following FY to which invoice pertains or date of filing of annual return, whichever is earlier

E. The Input Service Distributor (ISD) may distribute the credit available for distribution in the same month in which, it is availed. The credit of CGST, SGST, UTGST and IGST shall be distributed as per the provisions of Rule 4(1) (d) of ITC Rules. ISD shall issue invoice in accordance with the provisions made under Rule 9(1) of Invoice Rules.

F. ITC is not available in some cases as mentioned in section17(5) of CGST Act, 2017. Some of them are as follows:

- a. motor vehicles and other conveyances except under specified circumstances.

- b. goods and/or services provided in relation to:

- i. Food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, except under specified circumstances;

- ii. Membership of a club, health and fitness center;

- iii. Rent-a-cab, life insurance, health insurance except where it is obligatory for an employer under any law;

- iv. Travel benefits extended to employees on vacation such as leave or home travel concession;

c. Works contract services when supplied for construction of immovable property, other than plant and machinery, except where it is an input service for further supply of works contract;

d. Goods or services received by a taxable person for construction of immovable property on his own account, other than plant and machinery, even when used in course or furtherance of business;

e. Goods and/or services on which tax has been paid under composition scheme;

f. Goods and/or services used for private or personal consumption, to the extent they are so consumed;

g. Goods lost, stolen, destroyed, written off, gifted, or free samples;

h. Any tax paid due to short payment on account of fraud, suppression, mis-declaration, seizure, detention.

G. Special circumstances under which ITC is available:

- a. A person who has applied for registration within 30 days of becoming liable for registration is entitled to ITC of input tax in respect of goods held in stock (inputs as such and inputs contained in semi-finished or finished goods) on the day immediately preceding the date from which he becomes liable to pay tax.

- b. A person who has taken voluntary registration under section 23(3) of the CGST Act, 2017 is entitled to ITC of input tax in respect of goods held in stock (inputs as such and inputs contained in semi-finished or finished goods) on the day, immediately preceding the date of registration.

- c. A person switching over to normal scheme from composition scheme under section 10 is entitled to ITC in respect of goods held in stock (inputs as suchand inputs contained in semi-finished or finished goods) and capital goods on the day immediately preceding the date from which he becomes liable to pay tax as normal taxpayer.

- d. Where an exempt supply of goods or services or both become taxable, the person making such supplies shall be entitled to take ITC in respect of goods held in stock (inputs as such and inputs contained in semi-finished or finished goods) relatable to exempt supplies. He shall also be entitled to take credit on capital goods used exclusively for such exempt supply, subject to reductions for the earlier usage as prescribed in the rules.

- e. ITC, in all the above cases, is to be availed within 1 year from the date of issue of invoice by the supplier.

- f. In case of change of constitution of a registered person on account of sale, merger, demerger etc, the unutilised ITC shall be allowed to be transferred to the transferee.

- g. A person switching over from composition scheme under section 10 to normal scheme or where a taxable supply become exempt, the ITC availed in respect of goods held in stock (inputs as such and inputs contained in semi-finished or finished goods) as well as capital goods will have to be paid.

- h. In case of supply of capital goods or plant and machinery, on which ITC is taken, an amount equivalent to ITC availed minus the reduction as prescribed in rules (5% for every quarter or part thereof) shall have to be paid. In case the tax on transaction value of the supply is more, the same would have to be paid.

Recommended Articles

- Shifting of Existing Input Tax

- GST ITC Rules 2017

- GST ITC Formats

- Input Tax Credit

- Procedure for distribution

- FAQ on Input Tax Credit

- Filing of GST Returns

- GST Registration

- GST Rates

- GST Forms

- HSN Code List

- GST Login

- GST Registration last date

PLEASE Explain the GST 28% ON MOLASSES PURCHASES WHERE AS FOR CAPTIVE CONSUMPTION NO GST

HOW THE STANDALONE DISTILLERIES WHICH ARE PURCHASING MOLASSES FROM SUGAR FACTORY HAVE TO COMPETE WITH THE DISTILLERY ATTACHED WITH SUGAR FACTORY

PLEASE Explain the GST 28% ON MOLASSES PURCHASES WHERE AS FOR CAPTIVE CONSUMPTION NO GST

HOW THE STANDALONE DISTILLERIES WHICH ARE PURCHASING MOLASSES FROM SUGAR FACTORY HAVE TO COMPETE WITH THE DISTILLERY ATTACHED WITH SUGAR FACTORY

please explain we are sale in home theatres with tax of 14.5% and take input tax from purchase bills. so coming GST on 01 July 2017 after implement of GSt input validity in 180 days after input not taken sale after six month full tax 28% not taken input on purchases

please explain we are sale in home theatres with tax of 14.5% and take input tax from purchase bills. so coming GST on 01 July 2017 after implement of GSt input validity in 180 days after input not taken sale after six month full tax 28% not taken input on purchases