Input Tax Credit under GST Law, How to Claim ITC Under GST Law. Input tax credit (ITC) means credit of Central Tax, State Tax, Union Territory Tax, Integrated Tax and Compensation Cess paid on supply of goods or services by a supplier that can be used by a recipient for payment of its output tax liability. Integrated Tax paid on import of goods or services and tax paid by the recipient on reverse charge basis is also available as input tax credit. For example steel scrap supplier ‘A’ charges Rs. 18000 as Integrated Tax from recipient ‘B’. Subsequently recipient ‘B’ utilizes scrap in making steel ingots and supplies the same at Rs. 120000, on which Integrated Tax of Rs. 21600 is payable. ‘B’ can discharge the lax liability of Rs. 21600, by using available ITC of Rs. 18000 and payment of balance of Rs. 3600 in cash .

Manner of utilization of ITC

Input Tax Credit (ITC) of CGST and SGST/UTGST is available throughout the supply chain, but cross utilization of credit of CGST and SGST/UTGST is not possible, i.e. CGST credit cannot be utilized for payment of SGST/UTGST and SGST/UTGST credit cannot be utilized for payment of CGST.

However, cross utilization is allowed between CGST/SGST/UTGST and IGST, i.e. credit of IGST can be utilized for the payment of CGST/SGST/UTGST and vice versa.

Other Parts of this articles

Advertisement

Content in this Article

- Documents required and conditions for claiming ITC in GST Regime

- Procedure for distribution of input tax credit by Input Service Distributor

Input Tax Credit (ITC Under GST)

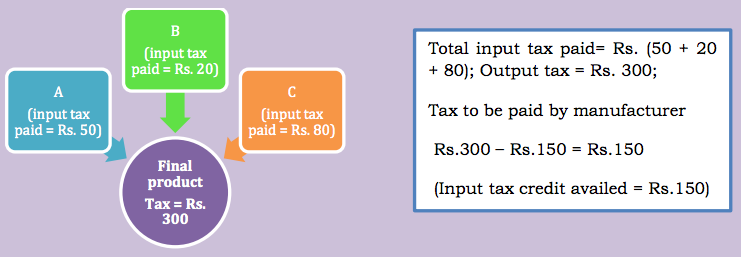

Input tax credit is a provision of reducing the tax already paid on inputs, to avoid the cascading effect if taxes. This can be understood with the help of the following diagram:

Input Tax Credit (ITC) is considered as a cornerstone of GST. In the current tax regime, there is a nonavailability of credit at various points of supply chain, which leads to a cascading effect of tax and increases the cost of goods and services. This flaw has been removed under GST and a seamless flow of credit throughout the value chain will be provided thus reducing the cascading effect of tax.

Under GST, Input tax, means the Central tax (CGST), State tax (SGST), Integrated tax (IGST) or Union territory tax (UTGST) charged on supply of goods or services or both made to a registered person and includes taxes paid on input goods, input services or both. To avail the benefit of ITC, it is required that the person availing such benefit is registered under GST. An unregistered person is not eligible to take the benefit of ITC.

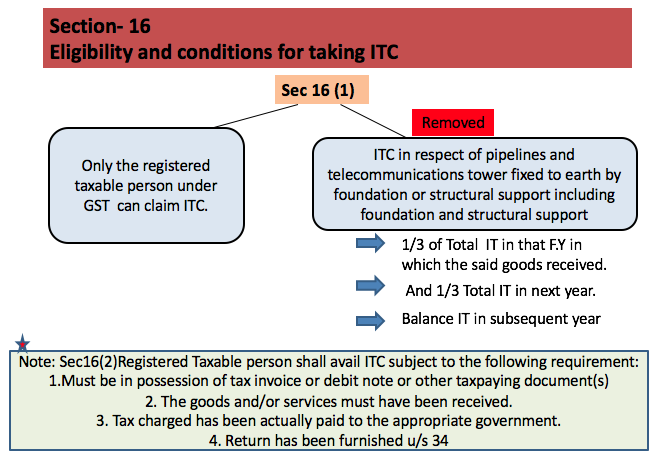

Section 16 of the CGST Act, 2017, states the condition and eligibility to obtain ITC. Following four conditions are required to be fulfilled by a registered taxable person:

- he should be in possession of tax invoice or debit note or such other tax paying documents as may be prescribed;

- he should have received the goods or services or both;

- the supplier should have actually paid the tax charged in respect of the supply to the government; and

- he should have furnished the return under section 39.

(where the goods against an invoice are received in lots or instalments, the registered person shall be entitled to take credit upon receipt of the last lot or instalment)

Availability of ITC to recipient has been made dependent on payment of tax by supplier, other than supplies where tax is payable on reverse charge basis. Thus, even if the receiver has paid the amount of tax to the supplier and the goods and/or services so procured are eligible for ITC, no credit would be available, till the time tax so collected by the supplier is deposited to the Government. Also, if a recipient fails to pay the amount of supply along with tax payable thereon within a period of 180 days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon.

Input Tax Credit under GST Law

Definition of Capital Goods , Input and Input Services under revised GST Law

Capital Goods -Sec. 2(19)

“Capital good” means goods , the value of which is capitalized in the books of accounts of person claiming the credit which are used or intended to be used in the course or furtherance of business.

Sec. 2(52) “input” means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business;

Sec.2 (53) “input service” means any service used or intended to be used by a supplier in the course or furtherance of business;

Sec. 2(55) “Input Tax” in relation to taxable person , means the IGST , including that on import of goods , CGST and SGST charged on supply of goods and services to him, and include the tax payable under section 8(3) but does not include the tax paid under Section -9

Sec. 2( 56) “Input Tax Credit” mean credit of input tax as defined in sub section 55. Yes, there are drastic changes in the definition of “input” and “Input Services” under GST law than the earlier law .

Yes, there are drastic changes in the definition of “input” and “Input Services” under GST law than the earlier law .

Now, we will discuss the Input tax provision under the Revised GST Law

1.Eligibility and conditions for taking ITCSection 16

Section 16(2)

Payment of invoice for supply of services is to be made within 180 days : ITC availed is to be added to output tax liability of recipient along with interest thereon, when value of services and tax is not paid within 180 days from date of invoice. However, the credit can be reclaimed again when such payment made to supplier, but no credit of interest will be given and hence will be the cost.

Goods received in Lots: ITC entitled on last lot or installment.

ITC made dependent upon payment of tax by supplier:Availability of ITC to recipient has been made dependent on payment of tax by supplier. Thus, even if the receiver has paid the amount of tax to the supplier and the goods and/or services so procured are eligible for ITC, no credit would be available, till the time tax so collected by the supplier is deposited to the Government.

Goods received by third person: It shall be deemed that the registered person has received the goods where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise..

Sec 16(3) ITC shall not be allowed if depreciation is claimed on tax componentof cost of capital goods.

Sec 16(4) Time limit for availment of credit:ITC shall not be allowed after furnishing of return for September month following the end of financial year to which such invoice or furnishing of relevant annual return (December 31 is the due date for filing annual return), whichever is earlier.

In the absence of any provisions as to eligibility to avail ITC when there is delay in applying for registration under GST, it appears that such credit on inputs would be lapsed and would be available only after the date of registration granted under the GST Law.

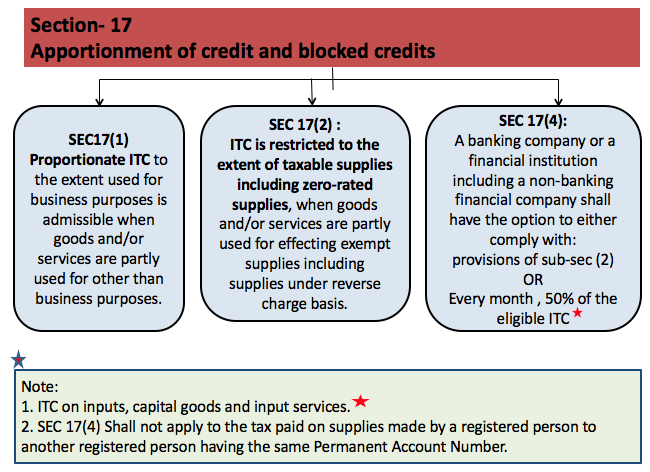

2.Availability of credit in special circumstances[Sec. 17]

SEC 17(5) Negative list of goods and/or services on which ITC shall not be admissible:

Motor vehicles and other conveyances:except when used for further supply of such vehicles or conveyances, transportation of passengers and goods, imparting training on driving , flying, navigating such vehicles or conveyances.

Supply of Goods and/or services relating to

- Food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery except where inward supply of particular category is used for making outward taxable supply of same category.

- Membership of a club, health and fitness centre.

- Rent-a-cab, life insurance and health insurance except wher

- a) it is obligatory for an employer under any law in force

- b) inward supply of particular category is used for making outward taxable supply of same category.

- Travel benefits extended to employees on vacation such as leave or home travel concession .

Construction Service /Works contract services when supplied for construction of immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service.

“construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said IP.

- Goods and/or services on which tax is paid under composition scheme.

- Goods and/or services used for personal consumption.

- Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.

- Goods and/or services received by a non-resident taxable person except on goods imported by him

Note : “Plant and Machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes- (i) land, building or any other civil structures; (ii) telecommunication towers; and (iii) Pipelines laid outside the factory premises.

Availability of credit in special circumstances:

Circumstance 1 – Newly Registered Person

- When a person becomes liable to register he should apply for registration within thirty days from the date he becomes liable to register

- Consider he is liable to pay tax w.e.f. 1st August 2017 but he is granted such registration on 15th August 2017

- He is entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held on 31st July 2017

Circumstance 2 – Voluntary Registration

- When a person applies registration U/S 25(3) (Voluntary Registration)

- Let’s assume he applies on 5th June 2017 and obtained registration on 22nd June 2017

- He is entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on 21st June 2017

Circumstance 3 – Crosses the Compounding Threshold

- Hypothetically, a Registered Person who was paying tax U/S 10(Composition Scheme) becomes liable to pay tax under regular scheme w.e.f. 31st July 2017.

- He shall take credit for ITC on the inputs held as stock, inputs contained in semi finished/finished goods in stock, even on capital goods (which shall be reduced by 5% points per quarter of a year or part thereof) held on 30th July 2017.

Circumstance 4 – Exempted Goods became Taxable

- If a person dealing in exempted goods or services or both becomes taxable supply

- He shall take credit for ITC on the inputs held as stock, inputs contained in semi finished/ finished goods in stock (relatable to such exempt supply), even on capital goods (used for such exempt supply)(which shall be reduced by 5% points per quarter of a year or part thereof) held on 31st March 2018.

Manner and conditions for claiming credit in above circumstances

- Within 30 days from the date of becoming eligible to avail of ITC on above 4 circumstances

- The registered person shall make declaration in FORM GST ITC – 01 and furnish details

- If the aggregate claim exceeds Rs.2 lakhs, then a Certificate from a chartered accountant should be obtained

- Tax invoice date must not be older than one year to claim ITC

- ITC of 3rd and 4th circumstances shall be verified with the corresponding details furnished by the corresponding supplier in FORM GSTR-1 or FORM GSTR-4 respectively

Circumstance 5 – Change in Constitution

- If there is UNUTILIZED ITC during the course of sale, merger, demerger, amalgamation, lease or transfer of the business with a specific provision for transfer of liabilities

- Registered Person shall furnish the details in FORM GST ITC – 02 along with a Certificate from a Chartered Accountant to transfer the SAME into the Electronic Credit Ledger of the concerned party due to change in the constitution.

Circumstance 6 – Regular to Composition Scheme or Taxable to Exempt

- Situation 1: When a Registered Person who was taxable under regular scheme opts to pay tax U/S.10 (composition scheme) w.e.f. 1st July 2017

- Situation 2: When the taxable goods/services under regular scheme supplied by a Registered Person become wholly exempt w.e.f. 1st July 2017

- In both situations, he should first nullify his electronic credit or cash ledger by paying an amount equivalent to the credit of ITC on the inputs held as stock, inputs contained in semi finished / finished goods in stock, even on capital goods (which shall be reduced by 5% points per quarter of a year or part thereof) held on 30th June 2017

- if after payment of such amount, any balance of ITC in his electronic credit ledger shall lapse.

Circumstance 7 – Sale of Capital Goods

If capital goods or plant and machinery is disposed after utilizing ITC in the first place, Registered Person shall pay an amount equivalent to

- Input Tax Credit taken on Capital Goods (Reduced by 5% points every quarter or part thereof) OR

- The tax on the transaction value of such Capital Goods (Whichever is higher)

- Note: But if refractory bricks, moulds and dies, jigs and fixtures are supplied as scrap, then tax may be paid on the transaction value as per Section 15

- To summarize, the credit of input tax can be taken as and when the person applies for the registration but the entitlement of credit of inputs would be from the day liability to tax arises.

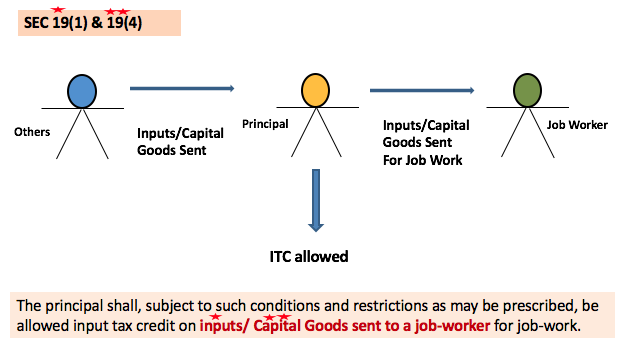

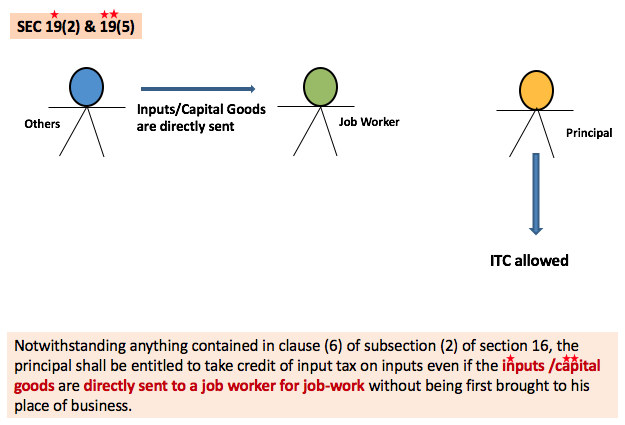

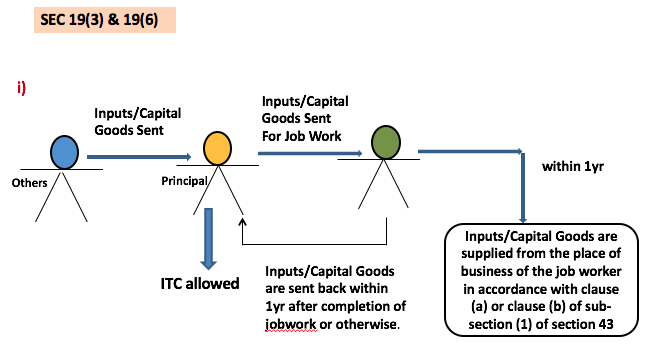

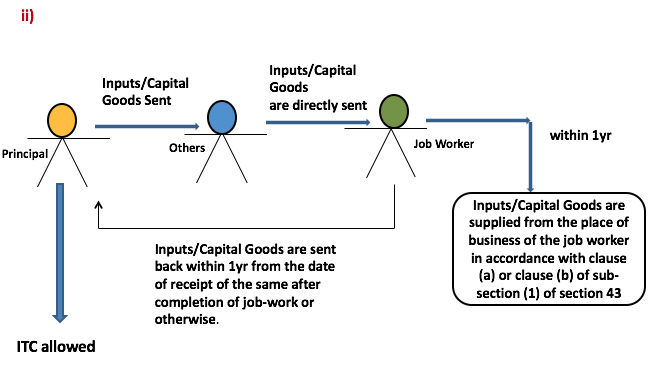

4. Taking Input Tax Credit in respect of inputs sent for JOB WORK [ Section 19]

Principal referred u/s 143 shall take ITC on Inputs/Capital Goods sent to job worker either Directly or through Principal’s Place of Business provided within TIME LIMITS the job worker supplies back to Principal’s Place of business else it is DEEMED AS SUPPLY of Input/ Capital goods in the hands of Principal.

Image 2

Image 3

Image 4

5. Taking input tax credit in respect of input sent for job work [ Section 20]

Where the inputs/capital goods sent for job work are not received back by the principal after completion of job work or otherwise or are not supplied from the place of business of the job worker in accordance with clause (a) or clause (b) of sub-section (1) of section 43 within 1 year of being sent out, it shall be deemed that such inputs had been supplied by the principal to the jobworker on the day when the said inputs were sent out:

Provided that where the inputs/capital goods are sent directly to a job worker, the period of 1 year shall be counted from the date of receipt of inputs by the job worker.

SEC 19(7) – Nothing contained in subsection (3) or sub-section (6) shall apply to moulds and dies, jigs and fixtures, or tools sent out to a job worker for job work.

Recommended Articles

- GST Registration Formats

- GST Refund Formats

- Returns Under GST

- GST Objectives

- What is IGST

- GST Rates

- GST Forms

- GST Registration

If you have any query regarding “Input Tax Credit under GST Law” then please tell us via below comment box….

I have wrongly taken ITC on my inward supply in which invoice has been raised not on my business but to me personally.In other words for my supplier it was a B2C transaction.What can i do?please help…

I have wrongly taken ITC on my inward supply in which invoice has been raised not on my business but to me personally.In other words for my supplier it was a B2C transaction.What can i do?please help…

can builder can apply for gst refund lying in ITC after receiveing o.c or how can claim his Refund.

can builder can apply for gst refund lying in ITC after receiveing o.c or how can claim his Refund.

How can my Company claim Input Cess on purchase of Motor Car?

How can my Company claim Input Cess on purchase of Motor Car?

I am fmcg distributor I purchased goods in Rs 100+12 GSt @12% my profit is Rs 5 =105 I have give at Rs 10 discount =95 +11.40 GST as there is no GSt payable company has reimburse RS 5 through credit note.

Please provide help on this regarding input excess retain.

I am fmcg distributor I purchased goods in Rs 100+12 GSt @12% my profit is Rs 5 =105 I have give at Rs 10 discount =95 +11.40 GST as there is no GSt payable company has reimburse RS 5 through credit note.

Please provide help on this regarding input excess retain.

can a trust which doesnot have any output GST can claim & Refund Input GST…… plzzzz reply ASAP

can a trust which doesnot have any output GST can claim & Refund Input GST…… plzzzz reply ASAP

Dear sir / madam,

Kindly solve my query, how to adjust, avail or claim ITC against purchase new machinery in Job Work business.

Best regards,

Dear sir / madam,

Kindly solve my query, how to adjust, avail or claim ITC against purchase new machinery in Job Work business.

Best regards,

Sir,Please send full details for input tax credit

Sir,Please send full details for input tax credit

can a hospital claim input tax credit for medicine supplied to inpatient and outpatient

can a hospital claim input tax credit for medicine supplied to inpatient and outpatient

Sir

I have a GST registered office in Delhi, want to purchase goods from Ahmedabad based supplier through MCX Exchange which will be kept in MCX designated vault in Ahmedabad & supplier will give invoice charging CGST & SGST as location of supplier & place of supply is same.

At the time of sale from my Delhi office, I shall charge IGST from the customer because the goods are supplied from MCX designated Ahmedabad vault to Ahmedabad customer(here location of supplier is Delhi & place of supply is Ahmedabad).

Please suggest if I shall get Input credit in this transaction.

Regards

Anubhav

Sir

I have a GST registered office in Delhi, want to purchase goods from Ahmedabad based supplier through MCX Exchange which will be kept in MCX designated vault in Ahmedabad & supplier will give invoice charging CGST & SGST as location of supplier & place of supply is same.

At the time of sale from my Delhi office, I shall charge IGST from the customer because the goods are supplied from MCX designated Ahmedabad vault to Ahmedabad customer(here location of supplier is Delhi & place of supply is Ahmedabad).

Please suggest if I shall get Input credit in this transaction.

Regards

Anubhav

If I am Constructing a Factory Buiding in Gujarat. As per GST provisions , no credit is admissible to my customer.

Their Head Office is at Mumbai. If we raise an invoice to Mumbai, HO, and they claim credit and pass it through ISD route. Is it possible legally. ?

If I am Constructing a Factory Buiding in Gujarat. As per GST provisions , no credit is admissible to my customer.

Their Head Office is at Mumbai. If we raise an invoice to Mumbai, HO, and they claim credit and pass it through ISD route. Is it possible legally. ?

q1: whether automaticalli can i avail the credit available in my last return automatically. are am i ti file any return to avail tjhe same:

q2: what about the intransit goods/ service credit?

q1: whether automaticalli can i avail the credit available in my last return automatically. are am i ti file any return to avail tjhe same:

q2: what about the intransit goods/ service credit?