GST Composition Scheme Registration – Step by Step guide with Screenshots. GST Registration Procedure is started from 1st July 2017. Everything you want to know about GST Composition Scheme Online Registration. All you need to know about GST Composition Scheme Registration, Please check details from below…

Composition Scheme is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.0 crore*.

Update as per Notification dated 29.12.2017

The late fees for failure to furnish returns in GSTR-4 by the due date have been waived off to the extent of the amount in excess Rs. 50 per day for every day the failure continues.

In case of the filing of Nil Returns in GSTR-4,The late fees for failure to furnish return by the due date, have been waived off to the extent of the amount in excess of Rs. 20 per day for every day the failure continues.

Advertisement

Content in this Article

*As per 23rd GST Council Meeting held on 10th Nov 2017

The main threshold for composition schemewas recommended for an increase to Rs. 1.5 crore (from earlier 1crore). But this is yet to be notified.

GST Composition Scheme Registration

Businessmen with annual turnover of more than Rs. 20 lakhs and up to Rs. 1 crore* lakhs can take advantage of composite schemes coming in GST. Under the composite scheme, the tax rate is low. Under this scheme, the traders will have to pay only 2 per cent tax.

The advantage of this scheme can be bought by Retailer, Wholesaler, Restaurant Businessman, MSME, Manufacturing. If the turnover of these traders is more than Rs 20 lakh and up to Rs 1 crore*. In GST, you have to pay tax at an annual rate of 2 per cent.

Video Guide forGST Composition Scheme Registration

Check Out to Watch Video on Youtube

How do I opt for the Composition Scheme?

What are the steps involved in applying to Opt for the Composition Scheme on the GST Portal?

To opt for the composition scheme on the GST Portal, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

In case of New Registration:

2. Log into the GST Portal by entering your login Credentials.

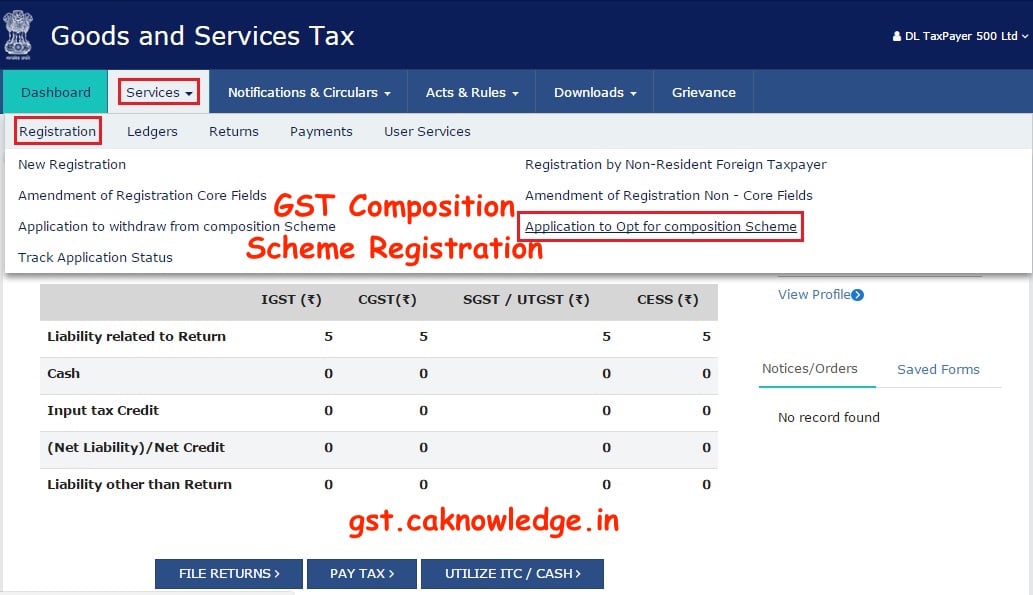

3. Once you have logged in, select ‘Application to Opt for Composition Scheme’ from the Registration Menu.

4. You will be directed to a new screen – Application to Opt for Composition Scheme. Your GSTIN, Legal Name of Business, Trade Name (if any), and Address of Principal Place of Business will be displayed.

5. Below that, your Nature of business and Jurisdiction will be listed.

6. Below these details, there is a Composition Declaration that you must check to pledge to abide by the conditions and restrictions for Taxpayers who are under the Composition Scheme.

7. Before submission, you must also check the box for Verification (below the Composition Declaration) that states that all the information given is true and that nothing has been concealed from the authority.

8. Finally, before submission, select the Authorized Signatory from the dropdown menu and enter the Place.9. Once you select the Authorized Signatory and enter the Place, the options to submit the form will get activated. Select the desired mode – DSC, E-sign, or EVC – and click the corresponding submission option. For the purpose of this manual, we will submit the application using DSC.

10. You will get a prompt to confirm your action, click on PROCEED to move forward.

11. The system will retrieve the installed digital signatures available on your system using the emSigner and you will get a pop-up to select the desired DSC. Select the desired signature.

12. Once you select the desired digital signature (it will get highlighted in blue), click Sign. If your digital signature is authenticated, you will get a SUCCESS message.

13. The system will perform some validations and if they are successful your ARN for the work item will be generated and sent to you via e-mail and SMS within the next 15 minutes

Must Read–

- GST Registration Consent Letter

- GST Registration Schedule

- How to Register and Update Digital Signature

- GST Migration for Existing Central Excise

- GST Registration Formats

- Registration Under GST

- Documents Required for GST Registration

- FAQs on Registration under Goods and Service Tax

- GST Forms

- Registration of Existing Tax Payers

- HSN Code List

- GST Login @gst.gov.in

- GST Registration Certificate

- GST New Registration Procedure

rate of tax for nylon net under gst and its hsn code

rate of tax for nylon net under gst and its hsn code

rate of tax for nylon net under gst and its hsn code

How to opt out from composition scheme. No rules i found on portal.

How to opt out from composition scheme. No rules i found on portal.

How to opt out from composition scheme. No rules i found on portal.

I have opted composition scheme on 15/07/2017 by unknowingly mistake( by my accountant).when he told me Immediately conveyed him to come out from composition but gst portal was not working on composition levy till date not working. please advise me how to quite composition scheme and what is the procedure to come out from composition. i also already inform in local authority (sales tax dept.) in written. still gst portal is not working.

I have opted composition scheme on 15/07/2017 by unknowingly mistake( by my accountant).when he told me Immediately conveyed him to come out from composition but gst portal was not working on composition levy till date not working. please advise me how to quite composition scheme and what is the procedure to come out from composition. i also already inform in local authority (sales tax dept.) in written. still gst portal is not working.

when i click on application for composition scheme tab……..it says ACCESS DENIED/SESSION EXPIRE

How to opt for composition scheme in old registration that are registered before 5th July 2017

when i click on application for composition scheme tab……..it says ACCESS DENIED/SESSION EXPIRE

How to opt for composition scheme in old registration that are registered before 5th July 2017

i Want kNOW The composit Retrun

i Want kNOW The composit Retrun

Trading account alag alag rakhva nu 5%?12%;18%:28% k fakat sale & purchase account

Trading account alag alag rakhva nu 5%?12%;18%:28% k fakat sale & purchase account

Trading account alag alag rakhva nu 5%?12%;18%:28% k fakat sale & purchase account

Trading account alag alag rakhva nu 5%?12%;18%:28% k fakat sale & purchase account

Mare 70 lakh nu trun over se t

40 lakh tax free

30 tax paid se

. to mare 70 lakh no 1% bharva no k 30 lakh no?

Mare 70 lakh nu trun over se t

40 lakh tax free

30 tax paid se

. to mare 70 lakh no 1% bharva no k 30 lakh no?

Mare 70 lakh nu trun over se t

40 lakh tax free

30 tax paid se

. to mare 70 lakh no 1% bharva no k 30 lakh no?

Mare 70 lakh nu trun over se t

40 lakh tax free

30 tax paid se

. to mare 70 lakh no 1% bharva no k 30 lakh no?

Mare 70 lakh nu trun over se t

40 lakh tax free

30 tax paid se

. to mare 70 lakh no 1% bharva no k 30 lakh no?

I tried so many times, it is useless, foolishness, wastage of time

I tried so many times, it is useless, foolishness, wastage of time

I tried so many times, it is useless, foolishness, wastage of time

When I opt composition scheme, it always says access failed retry after sometime

When I opt composition scheme, it always says access failed retry after sometime

When I apply for Composite scheme,

I get the comments SUCCESS. System will varify and validate and acknowledgement will be sent with in 15 minutes. But it never comes. i tries at least 10 times. Yes, my annual turnover is less than 20 lacs.

When I apply for Composite scheme,

I get the comments SUCCESS. System will varify and validate and acknowledgement will be sent with in 15 minutes. But it never comes. i tries at least 10 times. Yes, my annual turnover is less than 20 lacs.

How to opt for composition scheme in old registration that are registered before 5th July 2017

How to opt for composition scheme in old registration that are registered before 5th July 2017

You can choose composition scheme from 5th July 2017,( announced in news.)

You can choose composition scheme from 5th July 2017,( announced in news.)

The application for composition is not shown in regitration tab then how can a person apply for such..

The application for Composition scheme is mentioned under the profile tab.

It is there but everytime i am trying to opt..access is denied

The application for composition is not shown in regitration tab then how can a person apply for such..

when i click on application for composition scheme tab……..it says ACCESS DENIED/SESSION EXPIRE

when i click on application for composition scheme tab……..it says ACCESS DENIED/SESSION EXPIRE