GST Practitioner Registration Procedure – Step by Step guide with Screenshots. Check Complete Guide for GST Practitioner Registration like – How do I apply for enrolment as a GST Practitioner?, GST Practitioner Online Registration Procedure etc…Now scroll down below n check out more details from below.

How do I apply for enrolment as a GST Practitioner?

Video Guide for GST Practitioner Registration

Check Out to Watch Video

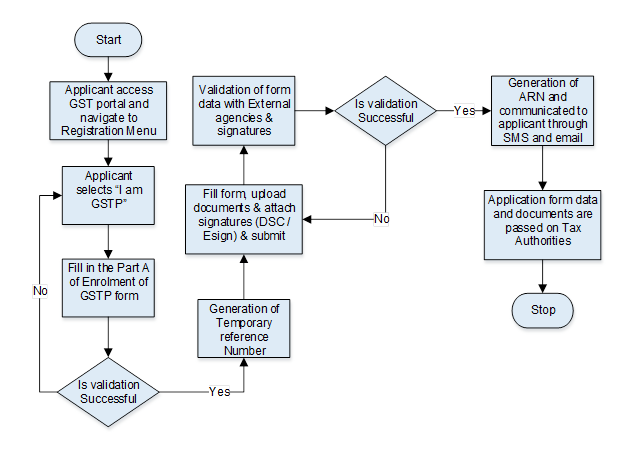

What are the steps involved in applying for Registration as a GST Practitioner (GSTP) on the GST Portal?

The Applicant is required to log in to GST common portal www.gst.gov.in. Thereafter he has to proceed to Services – Registration and then click on ‘New Registration’. Hereafter the Applicant will be referred to the ‘New Reg

Click on New Registration

Advertisement

Content in this Article

- In the ‘I am a’ dropdown, select GST Practitioner

- Select the State and District from the dropdown

- Enter Name, PAN, Email Address and Mobile Number

- Enter the captcha code

- Click on ‘Proceed’

- After validation, you will be redirected to OTP verification page

After this the Applicant will enter the 2 different OTPs received on e-mail and mobile number. This will generate a TRN (Temporary Reference Number). There after enter TRN and Captcha. Proceeding further, enters the OTP received on the registered mobile number. Subsequently, enter all the details required by this part and upload documents in .pdf and .jpeg format. Click on ‘Submit’ in the Verification page.

GST Practitioner Registration via online Mode

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

2. Click the REGISTER NOW link.

Alternatively, you can also click Services andgt; Registration andgt; New Registration option.

Part A:

3. The New Registration page is displayed. Select the New Registration option.

4. In the I am a drop down list, select the GST Practitioner as the type of taxpayer to be registered.

5. In the State/UT and District drop down list, select the state for which registration is required and district.

6. In the Name of the GST Practitioner (As mentioned in PAN) field, enter the legal name as mentioned in the PAN database.

7. In the Permanent Account Number (PAN) field, enter PAN number.

Note: In case you don’t have PAN, you can apply for PAN. To do so, click the here link.

8. Legal Name of the GST Practitioner and PAN will be validated against the CBDT database.

9. In the Email Address field, enter the email address of the Primary Authorized Signatory.

10. In the Mobile Number field, enter the valid Indian mobile number of the Primary Authorized Signatory.

Note: Different One Time Password (OTP) will be sent on your email address and mobile number you just mentioned for authentication.

11. In the Type the characters you see in the image below field, enter the captcha text.

12. Click the PROCEED button.

After successful validation, you will be directed to the OTP Verification page.

13. In the Mobile OTP field, enter the OTP you received on your mobile number entered in PART-A of the form. OTP is valid only for 10 minutes.

14. In the Email OTP field, enter the OTP you received on your email address entered in PART-A of the form. OTP is valid only for 10 minutes.

Note: OTP sent to mobile number and email address are separate. In case OTP is invalid, try again by clicking the Check Out to resend the OTPlink. You will receive the OTP on your registered mobile number or email ID again. Enter both the newly received OTPs again.

15. Click the PROCEED button.

16. The system generated 15-digit Temporary Reference Number (TRN) is displayed.

Note: You will receive the TRN acknowledgment information on your e-mail address

as well as your mobile number. Note that below the TRN the expiry date of the TRN will also be mentioned. Click the PROCEED button.

Alternatively, you can also click Services andgt; Registration andgt; New Registration option

and select the Temporary Reference Number (TRN) radio button to login using the TRN.

PART-B

1. In the Temporary Reference Number (TRN) field, enter the TRN generated.

2. In the Type the characters you see in the image below field, enter the captcha text.

3. Click the PROCEED button. The Verify OTP page is displayed. You will receive same Mobile OTP and Email OTP. These OTPs are different from the OTPs you received in previous step.

4. In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note: OTP sent to mobile number and email address are same.

In case OTP is invalid, try again by clicking the Check Out to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter the newly received OTP again.

5. The My Saved Application page is displayed. Under the Action column, click the Edit icon (icon in blue square with white pen).

Note:

- Notice the expiry date shown below in the screenshot. If the applicant doesn’t submit the application within 15 days, TRN and the entire information filled against that TRN will be purged after 15 days.

- The status of the registration application is ‘Draft’ unless the application is submitted. Once the application is submitted, the status is changed to ‘Pending for

Validation

1. PART-B of the form has four sections that must be filled sequentially. The first section is General Details. Enter all the details and click SAVE AND CONTINUE at the bottom of the screen.

- a) Under Enrolling Authority, select the radio button Centre or State/UT

- b) Under enrolment sought as, please select an option from the dropdown given.

- c) Enter the name of your University/Institute where you received your academic credentials.

- d) Select your year of passing from the dropdown menu.

- e) Enter the name of the Qualifying Degree for enrolment as a GST Practitioner

- f) Under Proof of Qualifying Degree for enrolment as a GST Practitioner, select the document type from the dropdown given.

- g) Upload the document in PDF or JPEG format only (file size must be less than 1 MB.

- h) Once you have filled in all the sections, click on SAVE AND CONTINUE to move to the next section.

2. The second section is Applicant Details.

- a) Select your date of birth.

- b) Enter your first, middle, and last name (first name is mandatory).

- c) Select your gender.

- d) If you wish to use E-Sign or EVC, enter your Aadhaar Number.

- e) Enter all the details and upload your photograph.

- f) Upload your photograph in JPEG format (file size should not exceed 100 KB)

- g) Once you have entered all the details and uploaded the photograph, click SAVE AND CONTINUE to move on to the next section.

3. The third section is Professional Address.

- a) Enter the address with the correct PIN Code. State and District will be auto populated from PART-A of the form.

- b) Select the appropriate proof of professional address from the dropdown menu.

- c) Upload the selected proof of professional address in JPEG or PDF format with a file size not exceeding 1 MB.

- d) Once all the details are entered and the document is successfully uploaded, click SAVE AND CONTINUE to go to the final section.

4. The fourth and last section is the Verification page.

- a) Check the check-box with the verification statement.

- b) Enter the place.

- c) You may now choose to submit the form using DSC, E-Sign or EVC. (Note: For E-Sign and EVC you must update your Aadhaar number in the Applicant Details section)

In Case of DSC:

a) Click the SUBMIT WITH DSC button.

b) Click the PROCEED button.

Note:

- Make sure your DSC dongle is inserted in your laptop/ desktop.

- Make sure emSigner (from eMudra) is running on your laptop/ desktop with administrator permissions.

To check if the emSigner is running on your laptop/ desktop, perform the following

steps:

1. Click the item tray.

2. Double click the emSigner icon.

3. Click the Hide Service button to minimize the dialog box.

g) Select the certificate and click the SIGN button.

Note: To view the details of your DSC, click the View Certificate button.

You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

You can track the status of your application using the Services andgt; Registration andgt; Track Application Status command.

In Case of E-Signature:

e) Click the SUBMIT WITH E-SIGNATURE button.

f) Select the checkbox for declaration..

Note: OTP will be sent to your e-mail address and mobile phone number registered with Aadhaar.

g) Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar.

h) Click the CONTINUE button.

The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

In Case of Electronic Verification Code:

a) Click the SUBMIT WITH EVC button.

b) Enter the OTP sent to email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

Note: OTP will be sent to your mobile phone number registered with Aadhaar.

c) Verify OTP screen is displayed. Enter the OTP received on your mobile phone number registered with Aadhaar.

d) Click the CONTINUE button.

The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

Note: After submission, you cannot make any changes to your application.

Recommended Articles

what is the next step of after the gstp form filling

what is the next step of after the gstp form filling

Sir

,,

I have applied for GST practitioner registration on 30/07/2017 & received the ARN number on the same day

but as its already passed so many days & i am still getting the status pending for processing,

REPLY ME

Sir

,,

I have applied for GST practitioner registration on 30/07/2017 & received the ARN number on the same day

but as its already passed so many days & i am still getting the status pending for processing,

REPLY ME

SIR I GOT MY GSTP USERNAME AND PASSWORD. BUT STILL I DON’T FIND THE PRACTITIONER LOGIN SCREEN ON GST PORTAL. PLEASE SEND ME THE LOGIN LINK FOR GST PRACTITIONER AT HARIKESH292@GMAIL.COM.

I have same problem. When i go to login page on GST portal is shows an error “Invalid username or password”. Please solve my problem sir.

SIR I GOT MY GSTP USERNAME AND PASSWORD. BUT STILL I DON’T FIND THE PRACTITIONER LOGIN SCREEN ON GST PORTAL. PLEASE SEND ME THE LOGIN LINK FOR GST PRACTITIONER AT HARIKESH292@GMAIL.COM.

Sir,

I have applied for GST practitioner registration on 13/07/2017 & received the ARN number on the same day but as its already passed so many days & i am still getting the status pending for processing, what to do?

please help

many well known names are also facing similar problems,when contacted through helpdesk,they cite same words “pending for processing”

better wait

Sir,

I have applied for GST practitioner registration on 13/07/2017 & received the ARN number on the same day but as its already passed so many days & i am still getting the status pending for processing, what to do?

please help

Sir,

I have applied for GST practitioner registration on 13/07/2017 & received the ARN number on the same day but as its already passed so many days & i am still getting the status pending for processing, what to do?

please help

Thanks for ur valuable reply sir

Thanks for ur valuable reply sir

Hi sir

I have a doubt about profitional address? What is the meaning of profitional. sir I am a b.com graduated person I would like to be registered in gst practitioner so how will I get that

Please help me

Professional address means where your work place or office will be located. Give the details if its your own, rented. Upload the proof. See the list of uploads

Hii sir

I am a graduated person passed by last year 2017.I didn’t work anywhere so I would like to be register as gst practioner so what would be fill in the profitional address coloum

I didn’t have any professional address

give your residence address if you have a room to set as your office

Hi sir

I have a doubt about profitional address? What is the meaning of profitional. sir I am a b.com graduated person I would like to be registered in gst practitioner so how will I get that

Please help me

Due to oversight, I have selected Enrollment authority Centre instead of State. Please advice me, how I can edit the information of Enrollment Authority.

Leave it no problem

Due to oversight, I have selected Enrollment authority Centre instead of State. Please advice me, how I can edit the information of Enrollment Authority.

Dear Sir,

My TRN No expired on 05.08.2017 what i must to do to get GST Practitioner Registration number.

Thanks,

ALWAR.S

Dear Sir,

My TRN No expired on 05.08.2017 what i must to do to get GST Practitioner Registration number.

Thanks,

ALWAR.S

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. XXXXXXX

2. Aadhaar Number: : Name

plz suggest me if posssible i m also mentioning my mail id

deepali021@gmail.com

thanks in advance

check if aadhar data with spellings are similar to other documents

mobile and email are registered with aadhar

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. XXXXXXX

2. Aadhaar Number: : Name

plz suggest me if posssible i m also mentioning my mail id

deepali021@gmail.com

thanks in advance

PLEASE LET ME KNOW THE DIFFERENCE BETWEEN SELECTING “CENTRE” OR “STATE” FOR ENROLING AUTHORITY.

Don’t worry ,select state if you have state assembly otherwise leave it by default. Authorities will put you at right place

PLEASE LET ME KNOW THE DIFFERENCE BETWEEN SELECTING “CENTRE” OR “STATE” FOR ENROLING AUTHORITY.

I have applied GST PCT and submitted it successfully.After that I receiver ARN number on 15 July . But in last my application is rejected by tax officer without any reason.

I have applied GST PCT and submitted it successfully.After that I receiver ARN number on 15 July . But in last my application is rejected by tax officer without any reason.

I have applied GST PCT and submitted it successfully.After that I receiver ARN number on 15 July . But in last my application is rejected by tax officer without any reason.

Mine is submitted successfully but it is pending for processing. How long does it take for processing?

how many days have completed after receiving ARN number.

Mine is submitted successfully but it is pending for processing. How long does it take for processing?

how many days have completed after receiving ARN number.

I have applied GST PCT and submitted it successfully.After that due to validation error uanble to do anything and TRN also expired. pl tell me what to do?

I have applied GST PCT and submitted it successfully.After that due to validation error uanble to do anything and TRN also expired. pl tell me what to do?

Great Congrats, Mr Mehfooz Ahmed, i thought you are the fist person who gets ARN No after my view and,

what about others those who are getting same error & same problem, Mr Mehfooz Ahmed pleas let us know how to solve this problem, if you got any solutions pleas let me know and you can text me on the mail (altafchikkeri.hubli@gmail.com)

thanx Altaf saheb

i wish success for all

Great Congrats, Mr Mehfooz Ahmed, i thought you are the fist person who gets ARN No after my view and,

what about others those who are getting same error & same problem, Mr Mehfooz Ahmed pleas let us know how to solve this problem, if you got any solutions pleas let me know and you can text me on the mail (altafchikkeri.hubli@gmail.com)

thanx Altaf saheb

i wish success for all

Great Congrats, Mr Mehfooz Ahmed, i thought you are the fist person who gets ARN No after my view and,

what about others those who are getting same error & same problem, Mr Mehfooz Ahmed pleas let us know how to solve this problem, if you got any solutions pleas let me know and you can text me on the mail (altafchikkeri.hubli@gmail.com)

thanx Altaf saheb

i wish success for all

There are problems related to aadhar, first check if your mobile no. and email is enrolled in aadhar database.

Pan card and other documents aadhar bear the same date as on your aadhar, with correctness of spellings

There are problems related to aadhar, first check if your mobile no. and email is enrolled in aadhar database.

Pan card and other documents aadhar bear the same date as on your aadhar, with correctness of spellings

after applying for gst practitioner on 26 jun,today i received my ARN no.after successfull validation of all documents

after applying for gst practitioner on 26 jun,today i received my ARN no.after successfull validation of all documents

after applying for gst practitioner on 26 jun,today i received my ARN no.after successfull validation of all documents

THAT WAS PROBLEM ……… 🙂

BUT NOW YOU CANT TRY AGAIN ………… THERE IS NO ERROR

THAT WAS PROBLEM ……… 🙂

BUT NOW YOU CANT TRY AGAIN ………… THERE IS NO ERROR

MY PCT01 application was not acknowledged due to validation error.While PAN displays name SUNDARAM GOPALAN /aadhar displays GOPALAN. Change in AADhar may consume more time.PLease inform the way out to submit the ////application and getting it acknoledged

MY PCT01 application was not acknowledged due to validation error.While PAN displays name SUNDARAM GOPALAN /aadhar displays GOPALAN. Change in AADhar may consume more time.PLease inform the way out to submit the ////application and getting it acknoledged

can the time extend after the expiry of 15 days after getting TRN for gst practitioner.if i open gst practitioner with TRN it is showing time is expired. if i go for new registration for gst practitijoner ii is

showing already taken with same pan number.

can the time extend after the expiry of 15 days after getting TRN for gst practitioner.if i open gst practitioner with TRN it is showing time is expired. if i go for new registration for gst practitijoner ii is

showing already taken with same pan number.

Is anyone successfully registered for GST Practitioner ?

I also face same error while registration process.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

Is anyone successfully registered for GST Practitioner ?

I also face same error while registration process.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

Is anyone successfully registered for GST Practitioner ?

I also face same error while registration process.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

I got validation error on aadhar name . My due date was expired. I applied for correction in aadhar still not yet corrected. After correction in aadhar shall i upload again, since due date was expired shall i do for fresh registration. pl clarify and send a mail to me kraman68@gmail.com

I got validation error on aadhar name . My due date was expired. I applied for correction in aadhar still not yet corrected. After correction in aadhar shall i upload again, since due date was expired shall i do for fresh registration. pl clarify and send a mail to me kraman68@gmail.com

I ENROLLED as GST practitioner on 26/06/2017 but status still pending for verification. and expiry date shown 13/07/2017. Will this activated after 13/07/2017 automatic.

I ENROLLED as GST practitioner on 26/06/2017 but status still pending for verification. and expiry date shown 13/07/2017. Will this activated after 13/07/2017 automatic.

I also met with same fate like Aadhar and name for my application though Aadhar and pan are linked,it is unjustified rejection of receiving application

I also met with same fate like Aadhar and name for my application though Aadhar and pan are linked,it is unjustified rejection of receiving application

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

PLEASE MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT

MAIL id :- cmaasjain@gmail.com

Sir, i m also getting the same error regarding nat validate adhaar no. nd Name.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

plz suggest me if posssible i m also mentioning my mail id

mishrajesh394@gmail.com

thanks in advance

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

PLEASE MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT

MAIL id :- cmaasjain@gmail.com

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

PLEASE MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT

MAIL id :- cmaasjain@gmail.com

Sir, i m also getting the same error regarding nat validate adhaar no. nd Name.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

plz suggest me if posssible i m also mentioning my mail id

mishrajesh394@gmail.com

thanks in advance

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

PLEASE MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT

MAIL id :- Jeetu.only9@gmail.com

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

PLEASE MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT

MAIL id :- Jeetu.only9@gmail.com

This mail is in reference to the Application for Enrolment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: XXXXXXXXXX : Name

PLEASE MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT

MAIL id :- Jeetu.only9@gmail.com

SIR I CANT LOGIN WITH THE TRN NO. HOW CAN I LOGIN SIR. ONLY 91% IS COMPLETES

SIR I CANT LOGIN WITH THE TRN NO. HOW CAN I LOGIN SIR. ONLY 91% IS COMPLETES

PLEASE TELL ME ANSWER ITS TOO MUCH

What do you want to know

PLEASE TELL ME ANSWER ITS TOO MUCH

SIR I UPLOAD MY APPLICATION GETTING ERROR MASSAGE “The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 563487555362 : Name”

MY AADHAR NAME AND PAN NAME IS SAME. WHAT TO DO????? PLEASE REPLY THANKS IN ADVANCE

SIR I UPLOAD MY APPLICATION GETTING ERROR MASSAGE “The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 563487555362 : Name”

MY AADHAR NAME AND PAN NAME IS SAME. WHAT TO DO????? PLEASE REPLY THANKS IN ADVANCE

I have to register as GST practitioner. I just want to know that for professional address is it sufficient to submit Copy of Aadhar Card only. Is it ok. Thank you.

I have problem please tell me what to do

I have the same doubt please tell me what to do please

I have to register as GST practitioner. I just want to know that for professional address is it sufficient to submit Copy of Aadhar Card only. Is it ok. Thank you.

I have the same doubt please tell me what to do please

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

PLS MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT vinodkumawat44@gmail.com

facing same problem…..

you can try your name in 2 section… it is mentioned in this article….

2. The second section is Applicant Details.

b) Enter your first, middle, and last name (first name is mandatory).

check and tell me…….

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

PLS MAIL ME IF ANY IDEA OR SOLUTION OF THIS PROBLEM AT vinodkumawat44@gmail.com

i have submitted application for enrollment as GST Practictioner on 26-06-2017 TRN ref no 291700000058 , it showed Application sucessfully uploaded

But till date even after 8 days, ARN not received, it is showing message “pending for validation”,

i contacted help desk but no response from thier side

i donot know what the problem is and whehter registration is accepted or rejected

Me Too.. the same problem. And it is very surprise that the same information i posted in this portal on 1st July 2017. i saw my messages and it was presented. But today i seeing that my messages are deleted.

HI RAGHAVENDRA,,

What you do about this problem (you face this problem) plz. guide

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

Your issue is not only yours but with majority of the people you have applied as GST Practitioner.

I assure you that you don’t have to worry about it. The system sends validation error within an hour if there’s any application mistake. However, such is not the case then, your application is correct and you need not have to worry about it.

It’s still under process. Kindly wait patiently.

and For any further Query Pls Contact

Mahendra Verna

Mob. No.+919727272176

Email – ca.mkverma@gmail.com

i have submitted application for enrollment as GST Practictioner on 26-06-2017 TRN ref no 291700000058 , it showed Application sucessfully uploaded

But till date even after 8 days, ARN not received, it is showing message “pending for validation”,

i contacted help desk but no response from thier side

i donot know what the problem is and whehter registration is accepted or rejected

Me Too.. the same problem. And it is very surprise that the same information i posted in this portal on 1st July 2017. i saw my messages and it was presented. But today i seeing that my messages are deleted.

Hello ALL,

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

Hello ALL,

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

Hello ALL,

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

Hello sir,

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

Hello sir,

I complete my first GST Registration Process after get TRN NO. i Completed second steps but after complete process this type massage show on my email id.

This mail is in reference to the Application for Enrollment as Goods and Services Tax Practitioner & GST PCT-01.

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxx.

Respected Sir,

i am submitted successful but i got mails that is under

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 212996730127 : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) 271700036213TRN.

Note: Kindly ensure that form is successfully submitted within 15 days from creation date.

THEN TELL ME WHAT I DO?

Dear Mahesh,

I am also getting the same error msg. If you get any solution please reply me to sujeetnandan@hotmail.com

ok ,

i will definitely tell you t

If you will register successfully tell me why this error come bcoz same problem facing by me

Respected Sir,

i am submitted successful but i got mails that is under

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: xxxxxxxxxxxx : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) xxxxxxxxxxxxxxxx.

Note: Kindly ensure that form is successfully submitted within 15 days from creation date.

THEN TELL ME WHAT I DO?

i am also facing the same problem ,if u get to know the solution mail me at malligarikapati90@gmail.com

I am facing the same problem.pl update on this.

Respected Sir,

i am submitted successful but i got mails that is under

The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 212996730127 : Name

Please resubmit the application after rectifying the errors.

You can access your dashboard by providing your Temporary Reference Number (TRN) 271700036213TRN.

Note: Kindly ensure that form is successfully submitted within 15 days from creation date.

THEN TELL ME WHAT I DO?

If i am not having proffesional address than what to fill in professional address feild???

If i am not having proffesional address than what to fill in professional address feild???

There is much technical error while uploading documents its many time shown 99% completed

There is much technical error while uploading documents its many time shown 99% completed

Is there any Examination to become a GST practitioner ??

Is there any Examination to become a GST practitioner ??

Hi

I Am also applying Practioner but when i am entered the basic details and give the procced its showing PAN DOES NOT EXIT so what to do pls help me

Hi

I Am also applying Practioner but when i am entered the basic details and give the procced its showing PAN DOES NOT EXIT so what to do pls help me

Hi

I Am also applying Practioner but when i am entered the basic details and give the procced its showing PAN DOES NOT EXIT so what to do pls help me

Which option to be selected in Enrolling Authority “Cenrte” or “State”

Which option to be selected in Enrolling Authority “Cenrte” or “State”

Is there any deadline to enroll GST Practioner. What to opt between Centre or State/UT. Pls reply. With Regards

Is there any deadline to enroll GST Practioner. What to opt between Centre or State/UT. Pls reply. With Regards

Is there any deadline to enroll GST Practioner. What to opt between Centre or State/UT. Pls reply. With Regards

I uploaded successfully all required details but still i did not received any reply from the department regarding ARN number or acknowledgement.

Now what next?

a big load on the portal

due to that many disturbances are there

you might have noticed software remain under repairing mode at night and you cant connect it

wait everything will be settled gradually.its enough you submit successfully

soon youll get arn

pls tell me i am getting this error massage “The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 563487555362 : Name”

Thanks in advance

I uploaded successfully all required details but still i did not received any reply from the department regarding ARN number or acknowledgement.

Now what next?

I uploaded successfully all required details but still i did not received any reply from the department regarding ARN number or acknowledgement.

Now what next?

I had applied successfully on 26/06/2017, but still not received ACKNOWLEDGEMENT NUMBER. When i filed application it shows Submitted successfully, you will received ARN with in next 15 minutes on your email.

but still i have not received such ARN neither on Email nor on mobile.

Is any body has suggestion, what to do??

I have send mail to the department, but no reply from there side, Phone lines are also busy.

What to do?? If any one has any suggestion, please let me know.

Thanks in advance.

Same in my case also pending for validation since last 8 days. Message shown i will receive the acknowledgement within 15minutes but until now i haven’t receive anything through mail or sms.

I had applied successfully on 26/06/2017, but still not received ACKNOWLEDGEMENT NUMBER. When i filed application it shows Submitted successfully, you will received ARN with in next 15 minutes on your email.

but still i have not received such ARN neither on Email nor on mobile.

Is any body has suggestion, what to do??

I have send mail to the department, but no reply from there side, Phone lines are also busy.

What to do?? If any one has any suggestion, please let me know.

Thanks in advance.

I had filed my application successfully, but I did not received ARN either in my mobile or email.how we can obtain ARN then?

I had filed my application successfully, but I did not received ARN either in my mobile or email.how we can obtain ARN then?

pls tell me i am getting this error massage “The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 563487555362 : Name”

Thanks in advance

Mr. Dhadge..

pls tell me i am getting this error massage “The details mentioned in Form did not validate successfully due to the following errors,

1. Aadhaar Number: 930707624890 : Name”

Thanks in advance

I had filed my application successfully, but I did not received ARN either in my mobile or email.how we can obtain ARN then?

BILL OF SUPPLY OR TAX INVOICE WHICH IS APPLICABLE FOR EXPORT

BILL OF SUPPLY OR TAX INVOICE WHICH IS APPLICABLE FOR EXPORT

how to get login id and password afterword to check or change my applicaion form

how to get login id and password afterword to check or change my applicaion form

dear sir

everytime i upload the scan pdf file of my llb degree it encounter error while uploading the file

kingly guide me what to do.

rgds

it may be due to technical issues or network overload. I also encountered the same. Kindly upload after 1 or 2 hours. It will be ok for u.

It’s done now

But not received any acknowledgement or arn yet after its been one hour now

Rgds

dear sir

everytime i upload the scan pdf file of my llb degree it encounter error while uploading the file

kingly guide me what to do.

rgds

ARN NOT GENERATED AFTER SUBMITTED E-SIGNATURE VERIFY

ARN NOT GENERATED AFTER SUBMITTED E-SIGNATURE VERIFY

In part b what is the difference in selecting the central authority or state?

Same I also need to know what is the difference in selecting the central authority or state?

In part b what is the difference in selecting the central authority or state?

sir what to select in Enrolling Authority “Cenrte” or “State”

PLEASE LET ME KNOW THE DIFFERENCE BETWEEN SELECTING “CENTRE” OR “STATE” FOR ENROLING AUTHORITY.

Enrolling Authority refers to the Institute/University from which you have passed your Graduation or got your degree. E.g. if you are a CA you should choose Center for Enrolling Authority as ICAI is the Enrolling authority and separate Law has been passed by Center. Likewise if you are a graduate from some state you should choose state if you dont have any degree for center.

CA Mahendra Verma

Mob. – 9727272176

Email – ca.mkverma@gmail.com

I had already submitted and successfully uploaded and TRN is Generated, but status is showing that “Pending for Validation” exp date is 10-07-2017.

Till date no further status is changed. what does it mean?

sir what to select in Enrolling Authority “Cenrte” or “State”

Enrolling Authority refers to the Institute/University from which you have passed your Graduation or got your degree. E.g. if you are a CA you should choose Center for Enrolling Authority as ICAI is the Enrolling authority and separate Law has been passed by Center. Likewise if you are a graduate from some state you should choose state if you dont have any degree for center.

CA Mahendra Verma

Mob. – 9727272176

Email – ca.mkverma@gmail.com

MOST IPORTANT AND USEFUL INFORMATION

useful for new users and screenshot is best for me

MOST IPORTANT AND USEFUL INFORMATION