GST Invoice Format 2022: An invoice is a commercial instrument issued by a supplier of goods/services to a recipient. It identifies both the parties involved, and lists, describes the goods sold/services supplied, quantifies the items sold, shows the date of shipment and mode of transport, prices and discounts, if any, and the delivery and payment terms (in case of supply of goods). Just add your details in the header section and start issuing invoices to your clients. Check more details for “Invoice Format Under GST, Rules for Time and Manner of issuing Invoice”

Invoice is a document which records the terms of an underlying arrangement between parties. An invoice does not bring into existence an agreement but merely records the terms of a preexisting agreement. GST requires that an invoice – tax invoice or bill of supply – to be issued on the occurrence of certain event or within a prescribed time. Therefore, an invoice, among others is required to be issued for every other form of supply such as sale, transfer, barter, exchange, license, rental, lease or disposal. The section uses the phrase registered person as a person who is required to issue an invoice whereas a taxable person is one who alone is entitled to input tax credit. know more

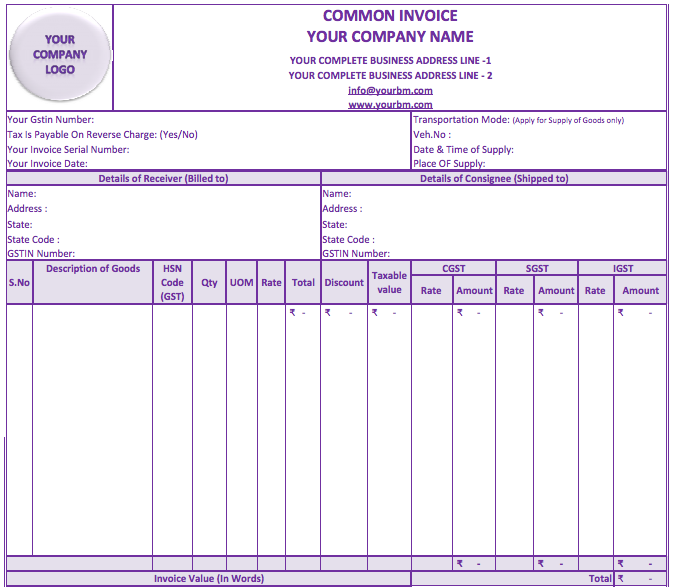

Invoice Format Under GST

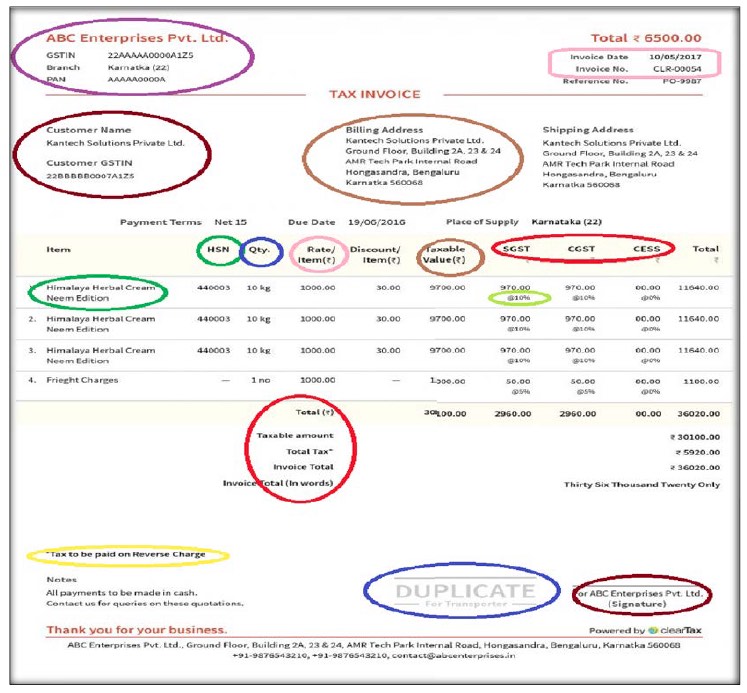

The format is drafted in view to ease of uploading of invoice to obtain “Invoice Reference Number” from GSTN (GST portal) as per “FORM GST INV -1” and while furnishing serial number of the invoice electronically through the Common Portal in FORM GSTR-1.

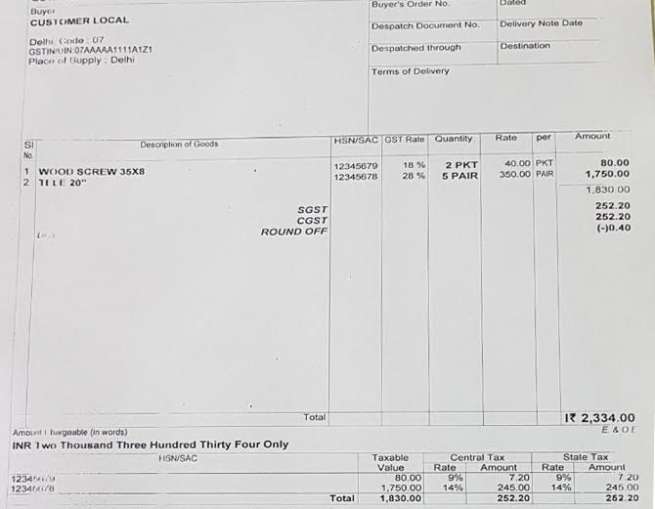

GST Impact: B2B invoice includes SGST and CGST – First Bill Screenshot

Goods and service tax (GST) has been implemented. Now GST has replaced VAT and excise in the bill. Businesses will be required to show both SGST and CGST in both the tax bills in the B2B bill. The way the bills are made for businessmen in GST has changed.

Advertisement

Content in this Article

GST Invoice Formats 2022

- GST invoice Software in Excel

- GST Tax Invoice

- Download Simple GST Invoice Format in Excel

- GST Invoice Format (New) in Excel

- Download GST Invoice Format in Excel

- GST Invoice Format for Services in Excel

- GST Invoice Template in Excel

- GST Invoice Format for Goodsin Excel

- Download Simple GST Invoice Format in Excel

- Download GST Invoice Formatin PDF

- GST Invoice for Domestic and Export in Excel

- GST Invoice Format for Composition Scheme Dealers

Other GST Invoice Formats

All Formats are available in Excel Format

SGST and CGST included in invoice

caknowledge.in is showing a copy of a similar B2B bill that has been cut on July 1 in the new tax regime of GST. State GST and Central GST will be shown separately to the traders in the GST bill. Tax has been levied on the basis of new rates of GST in the bill. Later the share of Central and State GST has been shown.

GSTN number shown in invoice

The details of the purchaser and the supplier were given to the traders on the bill. Also the GSTN number is shown in place of TIN. Purchaser has shown his PAN card number on the bill too.

Bills format will be made by traders themselves

All GST taxpayers, ie traders and businessmen, can make their invoice formats according to their own. According to GST law, there is a certain field in the invoice. Now there should be an alternative to GST in place of VAT in the bill.

Up to Rs 200 bills will not be required to be billed

Small retailers do a large number of transactions. They do not need to make a bill for the transaction of up to Rs 200 in GST but if the customer demands a bill then the retailer has to make the bill. The retailer will not need to give details of each transaction to the government. He will have to make an invoice of all day transactions, which will be submitted to the trader government.

Copy of bill not to be kept at the time of transportation

It is mandatory to have a copy of the invoice for the transporter in normal position. However, the GSTN will be given an Invoice Reference Number to the Trader. If taxpayers generate these reference numbers, then there will be no need to keep a copy of the invoice bill at the time of transportation. This will not threaten to lose, disappear, break the paper bill.

More Details

| Sr.No | Download Link | Description |

|---|---|---|

| 1. | GST INV – 1 | Application for Electronic Reference Number of an Invoice |

| 2 | Sample Format | GST Invoice Format, Export Invoice Under GST Sample Format |

GST Invoice In respect of goods:

A tax invoice can be issued at or before the time of removal of the goods for making the supply, where the supply can be made only on moving the goods (either by the supplier or by the recipient, or any other person).

- However, where the supply to the recipient does not involve movement of the goods, the tax invoice would be due at the time of delivery or making the goods available to the recipient. It is not necessary that every supply requires movement of goods on the basis that all goods are movable in nature.

- The time of removal would matter only in cases where the removal of goods and the movement of goods is by virtue of the supply.

- Consider the case of sale on approval basis. Goods would be removed at a certain time, and may be delivered to the location of the recipient. However, it is not known at the time of removal, whether the transaction results in a supply. Therefore, the time of confirmation by the recipient that he wishes to retain the goods would be the due date for issuing the tax invoice.

- The Government is also empowered to notify certain categories of supplies in respect of which it can prescribe a separate time limit for issuance of tax invoice.

GST InvoiceForms and Formats

| INV – 1 Format | Sample Format in PDF |

| GST Invoice in Excel | Simple GST Invoice in Excel |

| GST Invoices and Vouchers Formats in Excel | GST Invoice Template in Excel |

GST Invoice Format for services:

A tax invoice for supplying services should be issued within 30 days from the date of supply of the taxable service.

However, the Government is empowered to notify certain categories of services wherein any other document relatable to the supply would be treated as the tax invoice, or for which no tax invoice is required to be issued at all.

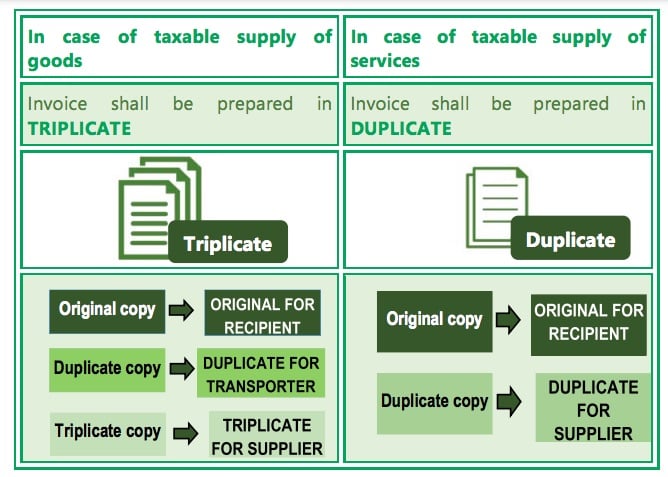

Manner of issuing Invoice

(1) The invoice shall be prepared in triplicate, in case of supply of goods, in the following manner:–

- (a) the original copy being marked as ORIGINAL FOR RECIPIENT;

- (b) the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- (c) the triplicate copy being marked as TRIPLICATE FOR SUPPLIER.

Provided that the duplicate copy is not required to be carried by the transporter if the supplier has obtained an Invoice Reference Number under sub-rule (4).

(2) The invoice shall be prepared in duplicate, in case of supply of services, in the following manner:-

- (a) the original copy being marked as ORIGINAL FOR RECEIPIENT; and

- (b) the duplicate copy being marked as DUPLICATE FOR SUPPLIER.

(3) The serial number of invoices issued during a tax period shall be furnished electronically through the Common Portal in FORM GSTR-1.

(4) A registered taxable person may obtain an Invoice Reference Number from the Common Portal by uploading, on the said Portal, a tax invoice issued by him in FORM GST INV-1, and produce the same for verification by the proper officer as required under section 61 in lieu of the tax invoice.

(5) The Invoice Reference Number shall be valid for a period of 30 days from the date of uploading.

Time of Issue of Invoice

- Time of Issue Invoice for Supply of Goods, where movement of goods happens , will be at the time of removal of goods.

- Time of Issue Invoice for Supply of Goods, where movement of goods not happens , will be at the time of delivery of goods.

- Time of Issue Invoice for Supply of Services, will be at the time/before/after provision of service but not more than 30 days from the date of supply of service.

- In case of continuous supply of services , the invoice shall be issued within a period of thirty days from the date when each event specified in the contract, which requires the recipient to make any payment to the supplier of services, is completed.

- Where the supplier of service is a banking company or a financial institution including a non-banking financial company , the period within which the invoice is to be issued shall be forty five days from the date of supply of service.

Recommended Articles

- GST Registration Formats

- GST Refund Formats

- GST Invoice Rules

- GST Payment Formats

- Returns Under GST

- GST Objective

- When will GST be applicable

- What is IGST

- GST Rates

- GST Forms

I am a Govt Contract for Services. Input Tax Credit Claimed OR & NOT.

I am a Govt Contract for Services. Input Tax Credit Claimed OR & NOT.

i need scan copy of IGST sale invoice and purchase invoice for understading purpose.kindly send me.

i need scan copy of IGST sale invoice and purchase invoice for understading purpose.kindly send me.

sir, If any supplier is supplying goods to SEZ unit under LUT is it mandatory that in the GST invoice he should mentioned the IGST/CGST/SGST Amount also along with %age.

sir, If any supplier is supplying goods to SEZ unit under LUT is it mandatory that in the GST invoice he should mentioned the IGST/CGST/SGST Amount also along with %age.

i am govt work tander cantrasion work do whan g st iffikat

i am govt work tander cantrasion work do whan g st iffikat

i have a work shop under GST we have paid GST TAX at the time of purchase but ,we want to know it will be show on our bill and collect the gst tax from consumer or not . or hsn code should be write or not

i have a work shop under GST we have paid GST TAX at the time of purchase but ,we want to know it will be show on our bill and collect the gst tax from consumer or not . or hsn code should be write or not

What is the valuation rule in GST. We are getting tools from our customers & making products using these tools & selling it to customers. Whether we have to workout transaction value for additional consideration & pay GST on Assassable value, which we were doing pre-GST. Please explain, its very urgent.

What is the valuation rule in GST. We are getting tools from our customers & making products using these tools & selling it to customers. Whether we have to workout transaction value for additional consideration & pay GST on Assassable value, which we were doing pre-GST. Please explain, its very urgent.

Manual tax invoice would be allowed in GST billinc ?

Manual tax invoice would be allowed in GST billinc ?

Sir we are in whole sale business in which goods were previously supplied on challan basis and then on challan Refrence we r making bill same will continue under gst

Sir we are in whole sale business in which goods were previously supplied on challan basis and then on challan Refrence we r making bill same will continue under gst

how would we movement exempeted goods from one state to another state

how would we movement exempeted goods from one state to another state

c form and road permit is required for import or not

c form and road permit is required for import or not

Sir, we are a manufacturer of chemical item of Alum. we paid CST or VAT under W.B. VAT ACT and also paid of service Tax for service received by transporter ( FREIGHT INWARD AND FREIGHT OUT WARD) for sales and purchase of goods. Now, we will pay the GST under GST ACT. for supply of goods but we want to know under GST Act any liability for Transporter payment ( freight inward and freight outward) for supply of goods or received of goods.

Sir, we are a manufacturer of chemical item of Alum. we paid CST or VAT under W.B. VAT ACT and also paid of service Tax for service received by transporter ( FREIGHT INWARD AND FREIGHT OUT WARD) for sales and purchase of goods. Now, we will pay the GST under GST ACT. for supply of goods but we want to know under GST Act any liability for Transporter payment ( freight inward and freight outward) for supply of goods or received of goods.