Procedure for Request of Re-issue of Income tax Refund Online. Income Tax Refund cheque issued by CPC Bangalore Returned undelivered or not been credited due to wrong account info, expired cheque, etc? Many Times Income Tax Refund is not Received and everyone not know how to Request for Re-issue of Income tax Refund. After Providing top Reasons for Income Tax Refund Failure and Latest Income Tax Slab Rates, Today we provide a Procedure for the Request of Re-issue of Income-tax Refund.

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing ”freely“

Procedure for Request of Re-issue of Income tax Refund

Now days Assessee who file theirIncome tax Return onlinegets their refund cheque issued by CPC Bangalore. Refunds are issued by two modes:-

- By crediting the refund amount in Assessee’sbank account if the Assessee has correctly mentioned his bank details inIncome tax Return Filed by him.

- By sending Income Tax Refund Cheque if Assessee failed to submit or correctly mention his bankaccount details in Income tax Return filed by him.

In case of Physical cheques there may be chances that after filing of Income tax Return Assessee has moved to new address and his Income tax Refund cheque issued by CPC Bangalore returned back for non-delivery. There may also be a chance that although address is not changed but Assessee could not receive the refund order as no one was there on the day when cheque was delivered orRefund cheque returned undelivered by the postal department as the house was locked.

Advertisement

Content in this Article

Further in case Assessee has applied for ECS but has entered wrong account details or account of which details been entered is closed and ECS to such account been failed.

In such cases one question arises what Assessee should do to request reissue of Refund cheque or how torequest Creditof that account in his bank account and how to intimate the change in address?

Procedure to apply for refund – reissue for refund related to AY 2009-10 and succeeding years

- Logon on tohttps://incometaxindiaefiling.gov.in/ with youruser IDand Password.

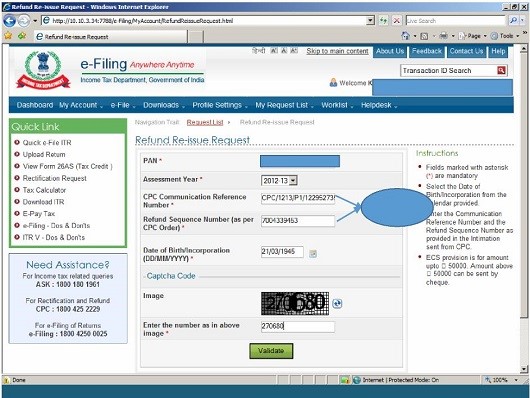

- Go toMY Account→Refund Reissue Request

- Screen below appears, you need to enter the necessary details and click on submit button.

REFUND REISSUE SCREEN

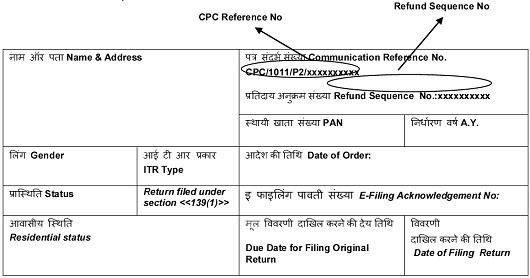

- Please refer to the pictorial representation shown below; indicating the CPC reference number and refund sequence number as can be seen in theOrder u/s 143(1)/154, Income Tax Act, 1961.

Intimation Pictorial Representation:

- Assessee has two options to apply Refund Reissue- ECS or Paper.

- ECS Mode:Select mode of Refund reissue, Bank Account Details – Can be changed, if required, category and click submit.

- Paper Mode:If assessee applies refund reissue through Paper mode. This option envisages the assessee to get refund through cheque to the address selected by the assessee.

- Refund Reissue related to AY 2008-09 to be applied through response letter to CPC.

Paper return which were processed at CPC, refund reissue can be applied only through sending response directly to CPC.

- please note that from AY 2013-14 onwards, Assessee need enter IFSC code instead of MICR code for

- Find below the table with reasons for refund failure at CPC and the resolution thereof.

Procedure to apply for refund – reissue for refund related toA.Y. 2008-09

Assessee needs to download theaddress/bank-detailsmodification form(Response Sheet)from the website of Income Tax department, fill the same and after that he needs to send the same by ORDINARY or SPEED POST along with cancelled cheque and other supporting documentsto:

“Income Tax Department – CPC, Post Bag No – 1, Electronic City Post Office, Bangalore – 560100, Karnataka”

To Download theneed to take Response Sheet Assessee Following steps:-

- Visithttps://incometaxindiaefiling.gov.in/portal/index.do

- Enter login details.

- after login go to sub menu ‘Response Sheet for Refund Failure Status’ under the main menu ‘My Account’ (Please note I have not found the link in Menu which was there earlier)

- Download the response sheet.

It is to be noted if there is any change in address of the Assessee needs to get the same updated with PAN master database by filingForm No. 49Afor correction in PAN Data.

RecommendedArticles

- Check Income Tax Refund Status Online

- Top Reasons for Income Tax Refund Failure

- TDS Rate Chart

- incometaxefiling

- How to Pay TDS Online Full Guide and Procedure

- Download Form 3CA 3CB 3CD In Word Excel and Java Format

- Income Tax Slab Rates

- List of All Incomes Exempt from Income Tax

- PAN Name By PAN No,Know Your PAN, Online Verify For PAN

- How to submit Response for Outstanding Tax Demand

I am not received income tax refund for the year 201o-11 pan NO AERPC 5055Q please help me get the refund