Your parents must be mighty proud of you for becoming a strong, independent individual. Here you are, not only fully capable of securing yourself but also capable of securing your family and their health. You are about to get your parents health insurance.

Brownie points for you on that one since parents need that kind of protection and support, especially when it comes to their health and medical needs. Moreover, having a safety net to prevent you and your parents from falling into the pits of financial losses is always a great decision.

Health Insurance Tax Benefits

Health insurance isn’t just security. It is an investment you make for yourself and your loved ones to ensure that all medical needs are taken care of without any hiccups. Not only does health insurance save you and your parents from losing hefty amounts on medical expenses, it also helps you save taxes!

Section 80D and Health Insurance

As per Section 80D of the Income Tax Act of 1961, you could save up to ₹1 Lakh through tax benefits. This tax benefit is applicable to health insurance premiums paid for yourself, your spouse, your children and your parents. Regardless of the type of health insurance policy, you can be eligible for tax deductions up to ₹1 Lakh.

Advertisement

Content in this Article

The Tax Deduction Breakdown

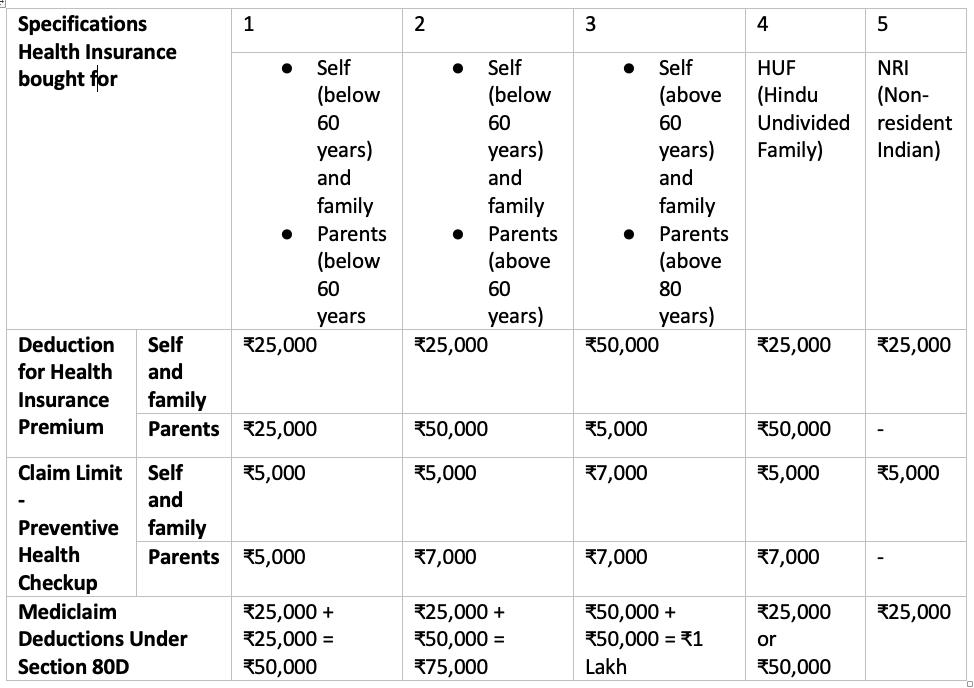

Here’s a table that could help you understand how tax deductions work when it comes to health insurance, under Section 80D of the Income Tax Act of 1961.

Let’s understand this with an example, shall we?

Let’s assume that you are under the age of 60 years and have health insurance for yourself and your family. In addition to that, you have a separate health plan for your parents who are above the age of 60 years. You pay ₹16,000 for one plan and another ₹17,000 for another. That brings your total premium to ₹33,000. This is under ₹75,000 which puts you within the bounds of Specification 2.

Additionally considering preventive health checkups as well, let’s say you pay approximately ₹47,000 on that front. Even then, you are well under the limits of ₹75,000. This means that you can claim the full amount as medical insurance income tax benefits under Section 80D of the Income Tax Act.

What Excludes You From Health Insurance Tax Benefits

As per the regulations stated under Section 80D, you will find the following factor barring you from getting health insurance tax benefits.

- You haven’t paid your health insurance premium amount during that particular financial year

- You paid your premium amount in cash

- You cannot produce the receipt of your premium payment

- If you are claiming tax benefits on a health insurance premium that has been paid by someone else on your behalf

- If the health insurance premium has been paid for anyone other than your parents, children and spouse

- If you have overstepped the deduction limit stated under Section 80D

Documents You Would Require to Claim Health Insurance Tax Benefits

If you’d like your fair share of up to ₹1 Lakh as tax benefits for health insurance, Section 80D of the Income Tax Act requires you to furnish certain documents crucial to the process. The list of those documents is given below.

- Receipt of the premium payment made within that financial year. An online invoice or receipt will do

- The receipt should coherently indicate the date of payment, mode of payment and the total amount received

- Record of medical bills, invoices, diagnostic reports, doctor’s prescriptions, etc.

- Insurance documents and claim details

Wrapping It Up…

If you have already bought health insurance for your parents or are considering the prospect of one, you now know that, much like certain investments, health insurance can be a great tax-saving tool for you. Not only do you gift your parents the comfort of a safety net against medical emergencies, but you also give yourself safety against expensive eventualities and the benefits of saving taxes.

So, here’s to protecting your parents’ health and your finances through health insurance. Salud!