How to submit Response for Outstanding Tax Demand.Many Times We Receive Outstanding Demand Notice but we Don’t Know how to Answer or Response for that Outstanding Tax Demand Notice. After Providing Income Tax Slab Rates for AY 2020-21 and List of All incomes Exempt from Income Tax, Today we Provide How to Submit Response for Outstanding Tax Demand. we provide full Online Procedure for response of Outstanding Demand Notice with Screenshots. Now you can Scroll Down Below And check complete details for “Procedure forHow to submit Response for Outstanding Tax Demand”

How to submit Response for Outstanding Tax Demand

Introduction-Once the e-Filed returns areprocessedand outstanding tax demand available ine-Filingportal, assessee isfacilitatedto submit the response against outstanding tax demand raised by CPC/AST.

Process

Thedetailedprocess to submit the Response to OutstandingTaxDemand is as below

- Logon on toincometaxindiaefiling.gov.inwith your User ID, Password andDate of Birth/Incorporation.

- Go to e-File andgt; Response to Outstanding Tax Demand

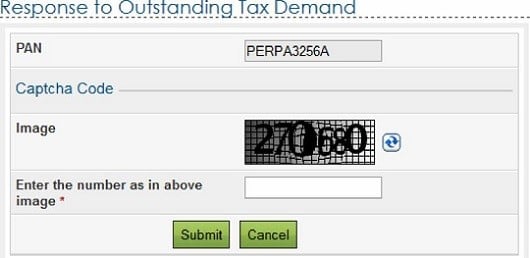

- Enter PAN andCaptchacode and click onSubmit button.

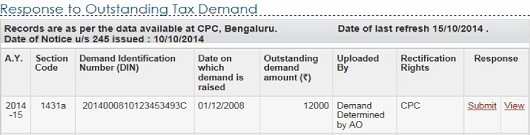

- On success full validation if there is any Outstanding Tax Demand, the “Response to Outstanding Tax Demand” available with the following details

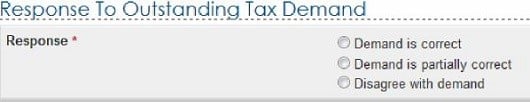

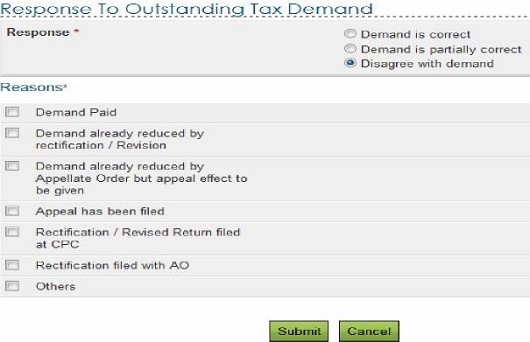

- Assessee must click on ‘Submitlink under Response column for the respective AY in order to submit the response. Assessee has to select one of the options from theradio button.

- 6. If assessee selects “Demand is correct”,then a pop up is displayed as “If you confirm “Demand is correct’ then you cannot ‘Disagree with the demand’. Click on Submit. A success message is displayed and no furtheractionis required.

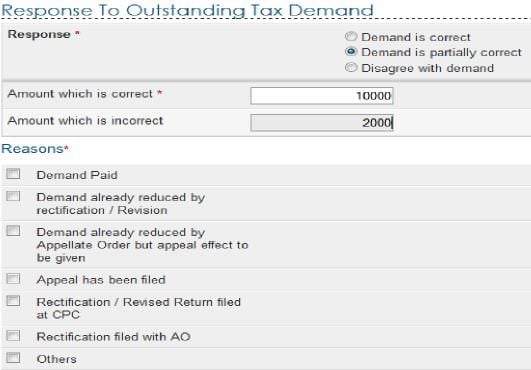

- If assessee selects “Demand is partially correct´,then two amount fields will be available.

Advertisement

♠ Amount which is correct-Enter the amount which is incorrect.

If the amount entered here is equal to the demand amount, then one pop is displayed “Since the amount entered is equal to outstanding demand amount, please select the option “Demand is correct”

Note: If amount entered is equal to Outstanding demand amount than user shall not be allowed to submit with this option.

Amount which is incorrect:Amount isautofilled which is the difference between theoutstanding amountand Amount which is correct.

- If amount entered is not equal to outstanding demand amount than user should mandatorily fill one ormorereasons listed below-

♠DemandPaid–

- Demand paid andchallanhas CIN

- Demand paid and challan has no CIN

- Demand already reduced by rectification/revision

- Demand already reduced byAppellateOrder but appeal effect to be given

- Appeal has been filed

- Stay petition filed with

- Stay granted by

- Instalment granted by

- Rectification / Revised Return filed at CPC

- Rectification filed with AO

- Others

- Based on the reason selected, the assessee needs to provide additional information as per the belowtable.

| Reason Selected | Additional Details Required |

| Demand paid and challan has CIN | BSR Code |

| Date ofpayment | |

| Serial Number | |

| Amount | |

| Remarks | |

| Demand paid and challan has no CIN | Date of payment |

| Amount | |

| Remarks | |

| Upload Copy of Challan | |

| Demand already reduced by rectification / Revision | Date of Order |

| Demand after rectification/ revision | |

| Details of AO | |

| Upload Rectification / Giving appeal effect order passed by AO | |

| Demand already reduced by Appellate Order but appeal effect to be given | Date of Order |

| Order passed by | |

| ReferenceNumberof Order | |

| Demand after Appeal effect | |

| Appeal has been filed:Stay petition has been filed | Date of filing of appeal |

| Stay petition filed with | |

| Appeal has been filed:Stay has been granted | Date of filing of appeal |

| Stay granted by | |

| Upload copy of Stay | |

| Appeal has been filed: Instalment has been granted | Date of filing of appeal |

| Instalment granted by | |

| Upload copy of stay/installment order | |

| Rectification / Revised Return filed at CPC | Filing Type |

| e-Filed Acknowledgement No. | |

| Remarks | |

| Upload Challan Copy | |

| Upload TDSCertificate | |

| Upload Letter requesting rectification copy | |

| UploadIndemnity Bond | |

| Rectification filed with AO | Date ofapplication |

| Remarks | |

| Others | Others |

- Note: Total Attachments size should be up to 50 MB.

9. f assessee selects “Disagree with the Demand” “,then assessee must furnishthe detailsfor disagreement along with reasons. Reasons are same as provided under“Demand is partially correct”.

Fill the necessary details and click on “Submit” button.

- After assesse submits the response the success screen must be displayed along with the Transaction ID.

Now you can Receive an Success Message

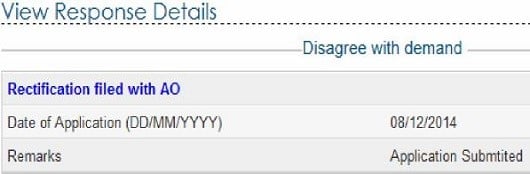

- Assessee can click on‘View’link under Response column to view the response submitted. The following details are displayed:

- Transaction ID – Ahyper link

- Date of Response

- Response Type

- Click on

Transaction ID to know the details of response submitted

Note:

- Demand position gets updated every day

- Interest demand u/s 220(2) is linked to the principal demand of the same assessment This indicates that principal demand is already adjusted/ paid and interest demand is the only outstanding value. Hence does not require any confirmation.

- If demand is shown to be uploaded by AO in the above table, rectification right is with AssessingOfficer, pleasecontactyour jurisdictional Assessing Officer for the same.

- For the demand against which there is “No Submit response option” available such demand is already confirmed by the Assessing Officer. Kindly contact your Jurisdictional Assessing officer.

Recommended Articles

- Income Tax Due Dates

- TDS Rate Chart

- PAN Name By PAN No

- incometaxefiling

- How to Pay TDS Online

- Form 3CA 3CB 3CD In Word Excel and Java Format

- Income Tax Slab Rates

- List of All Incomes Exempt from Income Tax

Dear Raju, While responding to outstanding tax demand under option rectification/revision filed at CPC, in addition to putting e-filing acknowledgement number, I have to upload 4 things.

1. Challan copy

2. TDS certificate

3. Letter requesting rectification copy

4. Indemnity Bond

I have the TDS certificate and challan numbers for tax remitted. Kindly advise on what is meant by “Letter requesting rectification copy” ?

Dear Sir,

On filing my returns for AY 2015-16, I received a communication from CPC, Bengaluru under section 245 that my return has been processed and has resulted in some refund.

But, it shall be adjusted against ‘out standing demands of Rs1120 and Rs 800’ for the AY 2010-11 and 2011-12 under section 154 and 143(1a) respectively uploaded by jurisdictional AO which is ITO W-4, Panchkula.

I never received any notice / intimation either from ITO or CPC , Begaluru in this regard nor do I know how these outstanding amount have been arrived at.

As suggested by you I checked up Form 26AS for these years but there is no outstanding amount indicated therein.

I also submitted request at Income Tax Website for supplying intimation under the relevant sections for these AYs but they also indicated that there is no such information

I shall be thankful to you if you can guide me to enable me get the required information.

Should not be there any time limit to raise demands for previous years and hold processing of returns/refunds for the current year on account of such outstanding demands which have not even been intimated.

I have a refund of Amount for AY 15-16.

I got an intimation u/s 245, that the refund will be adjusted against my outstanding demand for AY 13-14.

I already raised the rectification request for AY 13-14 for salary mismatch on 02/Sep/2015. The status for the same is showing submitted.

Now the intimation U/S 245 receives on 03/Sep/2015, says that the refund will be adjusted against my outstanding demand for AY 13-14.

As I already filed the rectification request and there should be not be any demand after processing, i dont want it to adjust as the tax has allready been paid fully.

In Outstanding tax Demand, I opted for Disggree with Demand Option.

But there I have to provide the challan copy, Form 16, rectification letter copy and the indimenty bond.

I can submit Challan copy and Form 16(2 are there). But i dont have any idea of the letter and the bond.

Can you please help me into this.