incometaxefiling: ITR Filing for AY 2020-21 is started from April 2020, here we provide complete guidance for E-File Income Tax Return Online 2020-21. incometaxindiaefiling.gov.in is official website for filing Income tax returns in India, Please check complete Guide for How to File Income Tax Return Online for AY 2020-21 at incometaxindiaefiling.gov.in portal. File ITR Online for AY 2020-21. By Using This Guide Every Student are Able to E-File Income Tax Return Without Using Any Income Tax or CA Software.

Every One Know Cost of CA Software or Income Tax Return Software is very high and we don’t able to maintain these softwares. So Today We Provide A Full Guide and Procedure for E-Filing Income Tax Return Online. Recently We Provide How to Pay TDS Online Full Guide and Procedure, and All Due Dates of Income Tax.

Recommended Articles

- Latest Income Tax Return (ITR) Forms

- How to Pay TDS Online Full Guide and Procedure

- Income Tax Due Dates

- Latest Income Tax Slab Rates

- Download Form 3CA 3CB 3CD In Word Excel & Java Format

- Deduction For Donation Under Section 80G

incometaxefiling – E-File Income Tax Return Online

Income Tax efiling can be easily done on the online portal of Income Tax Department by following these 6 simple steps without incurring any cost. In order to help save time and efforts, Income Tax Department of India now allows tax payers to e-file there returns online.

Types of e-Filing

There are three ways to file Income Tax Returns electronically:

- Option 1: e-File without Digital Signature Certificate. In this case an ITR-V Form is generated. The Form should be printed, signed and submitted to CPC, Bangalore using Ordinary Post or Speed Post ONLY within 120 days from the date of e-Filing. There is no further action needed, if ITR-V Form is submitted.

- Option 2: e-File the Income Tax Return through an e-Return Intermediary (ERI) with or without Digital Signature Certificate (DSC).

- Option 3: Use Digital Signature Certificate (DSC) / EVC to e-File. There is no further action needed, if filed with a DSC / EVC.

Note – The Digital Signature Certificate (DSC) used in e-Filing the Income Tax Return/Forms should be registered on e-Filing application.

Pre-requisite for registration in e-Filing application

A user must register at www.incometaxindiaefiling.gov.in

Pre-requisites to register

- PAN (Permanent Account Number)

- TAN (Tax Deduction Account Number)

- Membership with ICAI – For Chartered Accountant

Registration process

- Provide PAN / TAN, Password details, Personal details as per PAN / TAN, Contact details and Digital signature (if available and applicable)

- Submit request

- On success, Activation link is sent to user through e-mail and a mobile PIN to mobile number. Click on the activation link and provide Mobile PIN to activate e-Filing account.

- Once registered, LOGIN using User ID (PAN/TAN), Password, Date of Birth/ Incorporation and Captcha code.

Prepare and Submit ITR1/ITR 4S Online:

The taxpayer has the option of submitting ITR 1 / ITR 4S by way of Uploading XML OR by Online submission

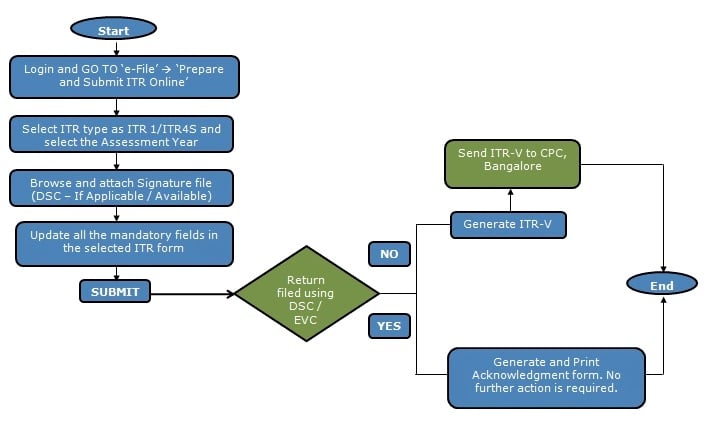

Steps to e-File Online ITR (ITR 1 and ITR 4S):

- www.incometaxindiaefiling.gov.in e-Filing Home Page

- Login using e-Filing user credentials

- Navigate to “e-File” Tab –> Click on “Prepare and Submit Online ITR”

- Select “ITR Form Name” from the drop down (ITR-1 or ITR-4S)

- Select “Assessment Year” –> Select the Radio button “Prefill Address with” to auto populate the address –> Select the Radio button if DSC is applicable –> Click on “Submit”

- Enter the mandatory details in the online form –> Click on “Submit”

Note:

- To e-File using DSC, it should be registered in the e-Filing application.

- If the Income Tax Return is digitally signed or electronically verified, on generation of “Acknowledgement” the Return Filing process is complete. The return will be further processed and the Assessee will be notified accordingly. Please check your emails on these notifications

- If the return is not e-Filed with a DSC (digitally signed) or EVC (electronically verified), an ITR-V Form will be generated. This is an Acknowledgement cum Verification form. A duly verified ITR-V form should be signed and submitted to CPC, Post Bag No. 1, Electronic City Post Office, Bangalore – 560100 by Ordinary Post or Speed Post (without Acknowledgment) ONLY, within 120 days from the date of e-Filing.

- On receipt of the ITR-V at CPC, the return will be further processed and the Assessee will be notified accordingly.

Register Digital Signature Certificate (DSC):

The below steps to register DSC in e-Filing

- www.incometaxindiaefiling.gov.in e-Filing Home Page

- Login with e-Filing user id and credentials

- Navigate to “Profile Setting” Tab –> Click on “Register Digital Signature Certificate”

- Download “ITD e-Filing DSC Management Utility” from the link provided in e-Filing website Extract the downloaded DSC Utility –> Open the Executable Jar File (DSC Utility)

- “Register/Reset Password using DSC” – tab

- Enter e-Filing User ID, Enter PAN of the DSC, Select the type of DSC

- DSC using .pfx file

- Select the Type of DSC .pfx file

- Browse and attach the Keystore file (.pfx File)

- Enter the password for your private key

- Click on “Generate Signature file”

- DSC using USB token

- Select the Type of DSC (.pfx file or USB token) USB Token

- Select USB Token Certificate –> Click on “Generate Signature File”

- Browse and attach the signature file using the browse option –> “Submit”,

Modes of e-Verification:

The below are the options provided to electronically verify the returns

- Option 1: e-Verification using e-Filing OTP (only available if Total Income is less than or equal to Rupees 5 Lakhs and Refund or Tax payable upto 100 Rupees.

- Option 2: e-Verification using NetBanking login

- Option 3: e-Verification using Aadhaar OTP validation.

- Option 4: e-Verification using Bank ATM (SBI, AXIS bank, Canara bank, ICICI bank and IDBI)

- Option 5: e-Verification using Bank Account Number (Punjab National Bank, United Bank of India and

ICICI bank) - Option 6: e-Verification using Demat Account

Note: No Further actions required by the taxpayer post e-Verifying the Return

To upload Income Tax Form by Tax Professional:

Steps to e-file Audit Form(CA):

The taxpayer (Client) has to add a particular CA for upload of particular audit form. Post which the CA has to login into his account and download required Audit Form. After updating, the CA has to upload the Audit form using CA login.

Add CA functionality:

- www.incometaxindiaefiling.gov.in – e-Filing Home Page

- Login with efiling user credential.

- Navigate to “My Account” –> Manage CA/ERI –> My Chartered Accountant –> “Add CA” –> Enter “Membership Number”, “Name of the CA”, select “Form Name” ,“Assessment Year” –> click “Submit” to add CA.

E-file Audit Form:

- www.incometaxindiaefiling.gov.in – e-Filing Home Page

- Login with CA credential.

- Navigate to “e-File” –> “Upload Form”

- Enter “PAN/TAN” of the Taxpayer, “PAN of the CA”, Form Name, “Assessment Year”, Filing Type, “Attach the XML” , “Attach Signature File” and click on submit.

A request will be sent to Taxpayer of such upload done by the CA. The taxpayer can view the same under “Work List” option after login with taxpayer’s login credentials.

Approve Audit Form:

- www.incometaxindiaefiling.gov.in – e-Filing Home Page

- Login with user Credential.

- Navigate to “Worklist” –> “For your Action” –> “Click on “Click Here” for view Uploaded Form Details

- Click on “View Form” –> select “Approve/Reject” –> enter “Rejection comment” –> click on “Submit”

Once assesse approves the audit form it will be considered for processing. In case of rejection, CA has to upload the audit form again after making necessary changes.

Submit Online Form:

- www.incometaxindiaefiling.gov.in – e-Filing Home Page

- Login with e-Filing User credential.

- Navigate to “e-file” –> “Prepare submit Online Form (Other than ITR)” –> Select the “Form Name” and “Assessment Year”

- Click on “Continue” to proceed further

Recommended Articles

- Deduction For Medical Insurance Premium U/Sec 80d

- Procedure For E-Filling of Tax Audit Report

- Calculation and Taxability of House Rent Allowance (HRA)

- Depreciation Rate Chart As Per Companies Act 2013

- List of Taxes which Common Man pay in India

- List of Exempted Incomes

If you have any query regarding “incometaxefiling – E-File Income Tax Return Online” Then Please post your query via below comment box….

Sir,

Acualli i had filed my ITR IV 2016-17, but didn’rt take print of that form how could I take print of that

very nicely understood… thank you sir….

Thanks s k nayak

Ahaa, its nice conversation concerning this piefe of writing at this place

at this web site, I have read all that, so at this time

me also commenting aat this place.

nice job,keep it up

Thanks kirankumar