Deduction For Donation Under Section 80G, How to Claim Deduction For Donation U/s 80G. Section 80G provides deduction to all assessee’s for donations to specified organizations or institutions or funds. However, any donation of any sum exceeding Rs. 2,000 shall not be allowed as deduction under the section unless such sum is paid by any mode other than cash.

Further, where an assessee has claimed and has been allowed any deduction under this section in respect of any amount of donation, the same amount will not again qualify for deduction under any other provision of the Act for the same or any other assessment year. Donations in kind is not eligible as per the Supreme Court Ruling (Vijaipat Singhania v. CIT).

Recently We are Provided Deduction For Medical Insurance Premium Section 80d, and Procedure For E-Filling of Tax Audit Report, Taxability of House Rent Allowance (HRA) Etc. Deduction in respect of donations to certain funds, charitable institutions, etc. [Section 80G]

Recommended Articles

Advertisement

Content in this Article

- Deduction For Medical Insurance Premium U/Sec 80d

- Procedure For E-Filling of Tax Audit Report

- Income Tax Due Dates

- Income Tax Slab Rates

- Depreciation Rate Chart As Per Income Tax

Deduction Under Section 80G

Deduction For Donation Under Section 80G

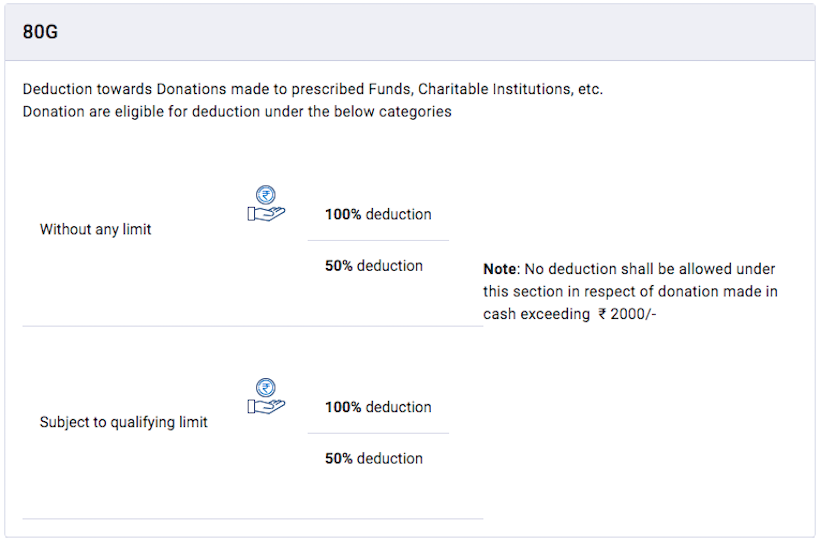

The quantum of deduction under this section is the aggregate of deduction permissible under clauses (A), (B), (C) and (D) mentioned below. Together for (C) and (D) below, there is a qualifying limit which is 10% of adjusted Gross Total Income.

Adjusted Gross total income means the “Gross Total Income” as reduced by:

- I. Long-term Capital gains, if any which have been included in the “Gross Total Income”.

- II. All deductions permissible under Sections 80C to 80U excepting deduction under Section 80G.

- III. Exempted Income.

- IV. Income of NRIs and Foreign Companies under Sections 115A, 115AB, 115AC, 115ACA or 115AD.

(1) Available to: All assessees.

(2) Nature of Expenditure: Donation during the PY (Previous Year) in money, not in kind.

(3) Amount of Deduction: Donations made to following are eligible for

(A) 100% deduction without any qualifying limit.

- National Defense fund

- The Prime Minister’s National Relief Fund

- The Prime Minister’s Armenia Earthquake Relief Fund

- The National Foundation for Communal Harmony

- The National Defence Fund set up by the Central Government

- The Africa (Public Contributions – India) Fund

- A University or any educational institution of national eminence as may be approved by the prescribed authority in this behalf

- The Maharashtra Chief Minister’s Relief Fund during the period beginning on the 1st day of October, 1993 and ending on the 6th day of October, 1993 or to the Chief Minister’s Earthquake Relief Fund, Maharashtra

- The Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of earthquake in Gujarat

- The Chief Minister’s Relief Fund

- The Lieutenant Governor’s Relief Fund in respect of any State or Union territory

- Zila Saksharta Samiti.

- The National Blood Transfusion Council

- Any State Blood Transfusion Council.

- The National Illness Assistance Fund

- The Army Central Welfare Fund

- The Indian Naval Benevolent Fund

- The Air Force Central Welfare Fund established by the armed forces of the Union for the welfare of the past and present members of such forces or their dependants

- The National Sports Fund to be set up by the Central Government

- The National Cultural Fund set up by the Central Government

- The Fund for Technology Development and Application set up by the Central Government

- Any fund set up by a State Government to provide medical relief to the poor

- The National Trust for Welfare of Persons suffering with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities.

- National Children’s Fund

(B) 50% deduction without any qualifying limit.

- Jawaharlal Nehru Memorial Fund

- Prime Minister’s Drought Relief Fund

- Indira Gandhi Memorial Trust

- The Rajiv Gandhi Foundation.

(C) 100% deduction with qualifying limit. (i.e. 10% of adjusted GTI).

(i) Any sum to Government or any approved local authority, institution or association to be utilized for promoting family planning.

(ii) Any sum paid by the assessee, being a company, in the previous year as donation to Indian Olympic Association or to any other association established in India and notified by the Central Government for:

- I. Development of infrastructure for sports and games or

- I. Sponsorship of sports and games in India.

(D) 50% deduction with qualifying limit. (i.e. 10% of adjusted GTI).

- (i) Donation to Government or any approved Local Authority, Institution or Association to be utilized for any Charitable purpose other than promoting family planning.

- (ii) Any other Fund or Institution, which satisfies the conditions of Section 80G(5).

- (iii) Notified Temple, Mosque, Gurudwara, Church or any other place notified by the Central Government to be of historic, as chorological or artistic importance, for renovation or repair of such place.

- (iv) Any corporation established by the Central or State Government specified under Section 10(26BB) for promoting interests of the members of a minority community.

- (v) Any authority constituted in India by or under any law for satisfying the need for housing accommodation or for the purpose of planning development or improvement of cities, towns and villages or for both.

IMPORTANT NOTE:-

1. Qualifying Limit:

Where the aggregate of the donations made to funds/institutions covered under (C) and (D) exceeds 10% of the Adjusted Gross Total Income, the amount in excess of 10% of the Adjusted GTI will be ignored while computing the aggregate of the sums in respect of which deduction is to be allowed.

2. Adjusted Gross Total Income:

| Gross total Income | XXXX |

| Less:LTCG | XXXX |

| STCG taxable under Section 111A | XXXX |

| Deduction u/s 80C to 80U (except u/s 80G) | XXXX |

| Adjusted Gross Total Income | XXXX |

Recommended Articles

There is no PAN allotted to ARMY CENTRAL WELFARE FUND. What I should write in the Return of Income for Claiming donation U/s. 80G.

Dear author,

Donations to Saisansthan falls under 80G but as per the below link article it is covered under 35AC clause Income tax act. I am confused whether the donations come under 50% or 100% tax exemptions. Can you kindly help?

http://www.incometaxindia.gov.in/Communications/Notification/104510000000044147.htm

Regards,

Vijay

Hi Mr. Vijay,

It is not for Shirdi sansthan. its for one more trust based in faridabad.

“Shirdi Sai Baba Temple Society, Sai Dham, Tigaon Road, Sector 86, Faridabad-121002”,

Donation to UAS, GKVK – Is donation to this institution covered under donation to University or educational institution of national eminence?