GST Registration Procedure in Karnataka State (KARVAT), Get details guide or step by step GST Registration procedure for all the Taxpayers belongs from Karnataka state. GST Migration process is already over and now only new GST Registrations are open. Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds Twenty lakh rupees. Check More details for GST Registration in Karnataka State from below…

Please Note – Threshold Limit for GST Registration in Karnataka State is Rs 20,00,000 (Twenty Lakh)

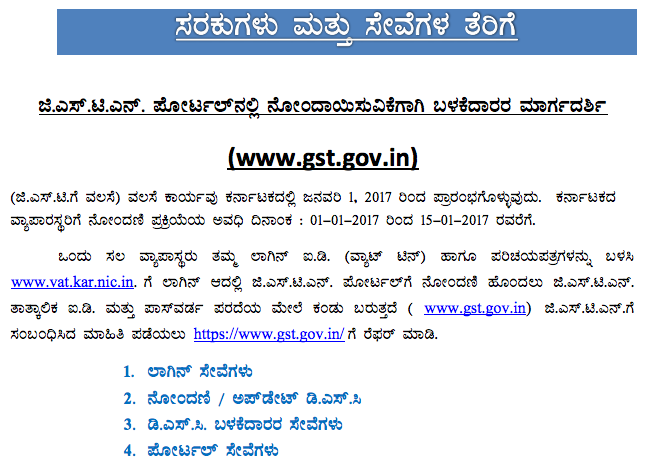

GST Registration for Existing Karnataka VAT Dealers is already over. GST Migration Procedure for Existing VAT Dealers of Karnataka State is already over, But if you have provisional ID then you may login by following link (Login by Existing Taxpayers for GST Registration). Check Steps to Register at New GST Portal by Karnataka VAT, CST & Excise Dealers for New GST Registration. As you are aware that Goods and Service Tax is to be implemented from 1st July 2017 and we understand that as a Taxpayer you would like to continue your business operations under GST regime. GST Registration Procedure for Karnataka Taxpayers are open at GST Portal. GSTN will seek the details under the provisions of proposed model goods and Service Tax Act (GST Act).

Check Procedure for GST Registration in Karnataka State for all taxpayers whose turnover exceeds Rs Twenty Lakhs. On and from the appointed day, every person registered under any of the existing laws and having a valid Permanent Account Number shall be issued a certificate of registration on provisional basis, subject to such conditions and in such form and manner as may be prescribed, which unless replaced by a final certificate of registration under sub-section (2), shall be liable to be cancelled if the conditions so prescribed are not complied with. Check More details for GST Registration from below…

GST Registration in Karnataka State

New GST Registration in Karnataka]

The Registration Application for Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD)/ SEZ Developer/ SEZ Unit is same.

Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable, within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed:

Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business.

Step by Step guide for GST Registration in Karnataka State

- Step 1 : Taxpayer need to visit on GST Registration Portal By Using Following link https://www.gst.gov.in/

- Step 2 : Now Please Click on “Click the Services > Registration > New Registration option.

- Step 3 : The Application form is divided into two parts as Part A and Part B.

- Step 4 : In Part A – The New Registration page is displayed. Select the New Registration option.

- Step 5 : In the I am a drop down list, select the Taxpayer as the type of taxpayer to be registered, also selects the state for which registration is required and district.

- Step 6 : Enter your Business Legal Name as per PAN Database, Select your State as “Karnataka” and then Select District in “Karnataka State”

- Step 7 : Enter your Email Address and valid Indian mobile number of the Primary Authorized Signatory.

- Step 8 : In the Type the characters you see in the image below field, enter the captcha text and Click on “Proceed Button”

- Step 9 : The OTP Verification page is displayed. In the Mobile OTP field, enter the OTP you received on your mobile number. OTP is valid only for 10 minutes. In the Email OTP field, enter the OTP you received on your email address. OTP is valid only for 10 minutes and Click the PROCEED button.

- Step 10 : The system generated Temporary Reference Number (TRN) is displayed on your screen…

Part B of GST Registration

- Step 11 : Now login again by using “Temporary Reference Number” and Captcha Code…

- Step 12 : The My Saved Application page is displayed. Under the Action column, click the Edit icon (icon in blue square with white pen).

- Step 13 : The Registration Application form with various tabs is displayed.

- Step 14 : On the top of the page, there are ten tabs as Business Details, Promoter/ Partners, Authorized Signatory, Authorized Representative, Principal Place of Business, Additional Places of Business, Goods and Services, Bank Accounts, State Specific Information and Verification. Click each tab to enter the details.

- Step 15 : Fill The Details of Principal place of business

- Step 16 : Enter Commodity Details and Save & Continue

- NOTE : In case you do not know the HSN Code: In the Search HSN Chapter by Name or Code field, type the matching character and from the displayed HSN Chapter list, scroll and select the appropriate HSN code.

- Step 17 : Fill the Details of Bank account and upload document

- Step 18 : Verification tab: This tab page displays the details of the verification for authentication of the details submitted in the form.

- Note : After filling the enrolment application, you need to digitally sign the application using Digital Signature Certificate (DSC)/ E-Signature or EVC. Digitally signing using DSC is mandatory in case of LLP and Companies

- Click the SUBMIT button to save the updated information and documents.

- Step 19 : Click Proceed (Note : Make sure your DSC dongle is inserted in your laptop/ desktop)

- Step 20 : Click Sign from the Pop-up window

- Step 21 : Note: To view the details of your DSC, click the View Certificate button.

- Step 22 : On successful submission it will show message on screen

NOTE : The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

Document Required for GST Registration in Karnataka

(A) Information Required for GST Registration By Karnataka VAT Dealers

Before enrolling with the GST Common Portal, you must ensure to have the following information:

- Provisional ID received from State/ Central Authorities

- Password received from the State/ Central Authorities

- Valid E-mail Address

- Valid Mobile Number

- Bank Account Number

- Bank IFSC

(B) Document Required for GST Registration in Karnataka

To complete the GST enrolment process please keep the following document ready:

Detailed information on proofs required to be attached on the basis of Constitution of Business selected by Applicant.

| Constitution of Business | Proof of Constitution | Size | Type |

| Proprietorship; | Nil (No Attachment required) | 1 MB | JPEG, PDF |

| Partnership; | Partnership Deed;Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Hindu Undivided Family | Nil (No Attachment required) | 1 MB | JPEG, PDF |

| Private Limited Company; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Public Limited Company; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Society/ Club/ Trust/ AOP; | Trust Deed;Registration Certificate;

Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Government Department; | Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Public Sector Undertaking; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Unlimited Company; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Limited Liability Partnership; | Certificate of Incorporation | 1 MB | JPEG, PDF |

| Local Authority; | Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Statutory Body; | Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

| Foreign Company | Certificate for Establishment | 1 MB | JPEG, PDF |

| Foreign Limited Liability Partnership | Certificate for Establishment | 1 MB | JPEG, PDF |

| Others | Registration Certificate;Any Proof substantiating Constitution | 1 MB | JPEG, PDF |

In case you are unable to upload any document, check the Internet connectivity, file size and format of the document you are trying to upload

GST Registration Requirement

- If anyone selling goods or provide services within state and have expected turnover more than 20 lakh rupees in a year. ( For Example – Providing the goods and services in Jaipur and between 01.07.2017 to 31.03.2018 your turnover cross more than 20 lakh rupees then its required the GST Number.

- If Supplier selling goods and service outside state & even have turnover less than 20 lakh rupees in a year. ( For example – providing the goods and service in Karnataka, Jaipur, Delhi, Mumbai, Bangalore and have turnover less than 20 lakh in 16-17 but still you have to required the GST Registration due to inter state supply.

- If you are doing ecommerce business online or any service based business online then its required the GST Registration.

- If you are deal as trader or manufacturer and your suppliers are registered under the GSTIN already then they charge the GST on your purchase & if you need the input credit or refund then you have to required the GSTIN Number.

Click to following link to know more details for GST Registration Last Date & Source of Above News

Dear Users, your Provisional Login Id and Password for GST are available in your login of ETD Portal. Kindly start enrolling yourself.Please enable pop-up in your browser

Kind attention to all valid TIN holders under Karnataka VAT/CST/Luxury Tax Acts

How to get Provisional ID & Password and Steps involved in Enrollment process:-

- * GSTN Provisional ID and Temporary password.(All the Existing Registered dealers of Karnataka will receive an E-Mail with GSTN Provisional ID and Temporary password.* Dealers can also know the GSTN Provisional ID and Temporary password after Login in http://www.ctax.kar.nic.in/When the above details are ready, Go to GSTN Portal https://www.gst.gov.in/ for enrollment process for First time login, Click New User Login

Please keep in mind:-

- The dealers should not share their provisional USER ID and temporary PASSWORD with anyone for their safety. The sole responsibility of the safety and secrecy of USER ID and PASSWORD would lie with the Dealer.

- The enrolment under GST is free of cost.

GST Registration for Existing Tax Payers

Hi Friends We Provide Complete Registration Procedure for Existing Tax Payers in Separate Article with all Screenshots, Please Check Full Registration Procedure for registration by Existing Dealers on GST Portal by the State VAT Dealers on following article….

In case of any queries, the taxpayer can contact on the Helpdesk Number (0034-4688999/ 0175- 2225192) or email id ([email protected]).

Photographs wherever specified in the Application Form

- Proprietary Concern – Proprietor

- Partnership Firm / LLP – Managing/ Authorized Partners (personal details of all partners is to be submitted but photos of only ten partners including that of Managing Partner is to be submitted)

- HUF – Karta Company – Managing Director or the Authorised Person

- Trust – Managing Trustee

- Association of Person or Body of Individual – Members of Managing Committee (personal details of all members is to be submitted but photos of only ten members including that of Chairman is to be submitted)

- Local Body – CEO or his equivalent

- Statutory Body – CEO or his equivalent

- Others – Person in Charge

Photograph upload should only in JPEG format and size should not exceed 100 kb

Recommended Articles

- GST Registration in Uttar Pradesh

- GST Registration in Gujarat

- GST Registration in MP

- GST Registration in Rajasthan

- FAQs on GST Registration

- GST Definition, Objectives

- GST Forms

- GST Rates

- GST India: Intro

- GST Login

- GST Returns

- GST Invoice Format

If you have any query regarding “GST Registration in Karnataka State” then please tell us via below comment box….

hi sir im filling form but problum is letter of authrisation which kind of document i will upload in this coloum

Hai can any one let me know what might the charges for a Proprietor ship concern to register under GST

We had registered under Vat & provisional registraion certificate is issued with ID. But as our turnover is less than Rs.20 lakhs, we would like to apply for cancell the regn. We are unable to access the correct sitew & form (GST29) online, Pl. inform the proceedure.

dear sir

my provisonl id and password is not display in vat web site so contact lvo-240 Hassan-573201 that time know pan number mistake and then update pan number lvo-240 hassan ,lvo-240 told new user id and password is coming, till date not reciveed .please update to provisonal id and password urgently tin no is 29420873169

Sir,

We have received the items on 03.07.2017 from Maharastra with Invoice dated 29.06.2017 agst C form.

How to account it & issue the c form.

Sir,

plz let me know how to add Product HSN code for already Migrated Dealers.

Hi We registered our company with karnataka VAT on 13th of June and we are yet to received the provisonal ID and password. I tried checking on GST portal with our pan no it shows no records found. What is the best way to get my GSTIN number.

i have made invoice on 30.06.2017 but dispatch on 01.07.2017. but at the time of E-sugam asking GST collected value,please confirm me can we dispatch the shipment today.

Dear sir

i hv registred the GST no for which VAT registration had and i should know the i hv 2 companys in propertior ship i hv only one PAN No. my question is A company regsitered with GST and what about B company is having a SErvice Tax?

Sir I already enrolled but not migrated because I don’t have bank account and now am yet to start d business and now I have to search for business place wat can I do for reg

Dear sir i Have an Provisional Id But gts migration is incompleted Because its showing VALIDATION ERROR What Can I do For Further Please Help me

Dear Sir

Kindly help to Register at GST for new entity,

already having head office at mumbai of Clearing & Forwarding Service, they want to open branch at bangalore, procedure and required documents please.

We are trying to login using temporary id and password but gettting stuck repeatedly at security question page where it says “try after some time”.What may be the issue?

Hi Some times due to server issue you can face this issue, please also try to clear your browser history and try again…

DEAR SIR I AM EXIST TAX PAYER MY TIN NO IS 29420873169 AND PROVISONAL ID IS 29AJCPD4005B1Z0 BUT I AM NOT GETTING USER ID AND PASSWORD PLEASE SIR I AM NOT GETT IT SO PLEASE PROVIDE FOR GST ENROLMENT AND FOR FUTURE BUSINES WAITING FOR I AM VERY DIPRESHESD PLSNSIE

Hi,

Any possibility where in, migration from KVAT to GST is possible.

Please can anyone tel me how to get new registration under GST

Hi

New registration is not started at this time, currently only migration process is started, GST new registration is expected to be started from 1st July 2017

Even till 03/05/2017 Karnataka GST Act is not passed, how the govt. official force the dealer under KVAT act to enroll or to migrate to not existing system, the act is not passed at all?

please extend the last date to migarate

i registrad to gst but fail to migrate becaause digital signature is not there

the migraion date is over ??

now i have signature

what to dooo????

please help me..

You are enrolled for GSTN but not migrated. Migrate before March 15, 2017.

3 days left for migration. Please explain what it mean?? and guide how to migrate

sir

i have entered all the details and saved in the GST portal and saved in my account after that i have registered my dsc in GST portal then submit the application with using the DSC. After that i got mail your PAN No. is missmatch. But my PAN NO. is correct and also same no. produce to vat department of Karnataka. but how it mismatch Pan No. how to solve the problem.

Please any body give the suggestion and mail me for the solve the problem

What is DSC and why it has to be plugged in to desktop/laptop

Hi

I have not recd the GST provisional ID and password so far from the dept.

When I contacted the dept I was told that the above details will be sent to me.

Till dt however I have not recd the same.

What is to be done

sir

i have entered all the details and saved in the gst portal and saved in myaccount

i was not able to attach the dsc because my dsc was expired and i have to create a new one

what if it is done after 15-1-2017 since it is a sunday today……..

DSC from Sify Safescrypt is not displaying in emsigner. How to add my DSC in GST portal

Is DSC COMPULSORY FOR PROPRIETORY CONCERN?TO ENROLL IN THE GST REGISTRATION

no

Dear sir ,

I am unable to get my Gst provisional id & password please tell me the procedure regarding to get I’d & password

Thank You