GST Model India – CGST, IGST, UTGST, SGST for India 2021. gst model of India. Goods and Service Tax, the forthcoming biggest reform in the taxation era of Indian Economy, on implementation facelifts the brand of India in world’s business friendly countries and boosts the economy by eliminating hindrance in the present indirect taxation structure. Till now, the varying taxation structure across the states within India created unhealthy competition among the states and hampered the overall growth with increased compliance cost to the business environment.

Goods and Services Tax would be a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India, to replace the various indirect taxes levied by the Central and State governments. France was the first country in the world to introduce GST system in 1954 and almost 160 countries across the world have already implemented the GST. Now check more details about “GST Model For India – Proposed, Central and State GST” from below…

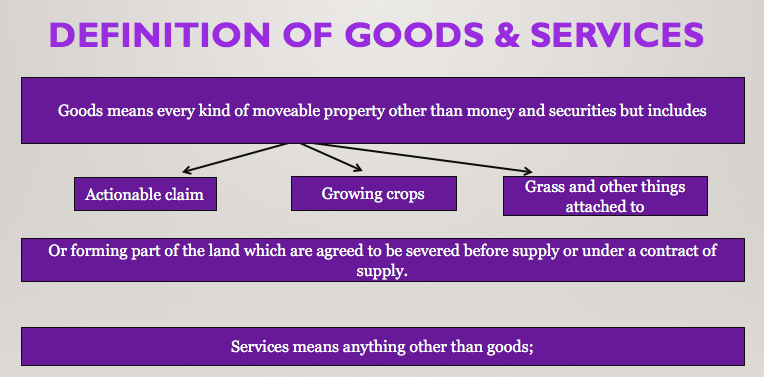

DEFINITION OF GOODS & SERVICES

GST Model India – Central and State GST

TAXES LIKELY TO BE SUBSUMED IN GST

CENTRAL TAXES

| STATE TAXES

|

GST – Present vs. Proposed

GST Models – World Wide

There are three well-known GST models in the world.

- GST at Union Government Level Only (Central GST)

- GST at State Government Level Only (State GST)

- GST at both, Union and State Government Levels (Concurrent GST)

Central GST

Under CGST, Both Central and State government combine their levels to bring into existence a single unified taxation system at the center level, with appropriate revenue sharing arrangement among them and leaving no room or very little for tax levy by state government..

- CGST on supply of goods or services or both will be charged for within the state transactions.

- Tax revenue is meant for Central Government and tax rates will be common all over India.

- The expected rate of CGST is around 9%.

State GST

Under SGST, only States alone levy GST and the Centre withdraws power to levy the tax completely on goods or services. This would significantly enhances the revenue generating power of states and the center offsets its revenue loss by reducing its fiscal transfer benefit to the states or by suitable revenue sharing arrangement if required. State GST increases the compliance cost to business houses as it will have to comply with tax laws of each state within same country and brings unhealthy competition among the states.

- Tax revenue is meant for State Government and tax rates will be decided by each State

- The expected rate of SGST is around 9%.

IGST

- IGST is charged on interstate movement of G&S.

- Tax revenue is shared by both Central Government and State Government.

- Tax rates will be common all over India.

- The expected rate of IGST is around 18%. Tax on imported goods will continue at a rate equal to IGST. Unlike in the present regime, the States where imported goods are consumed will now gain their share from this IGST paid on imported goods.

When CGST , SGST and IGST is levied ?

The GST to be levied by the Centre on intraState supply of goods and/or services is Central GST (CGST) and that by the States is State GST (SGST).

On inter-state supply of goods and services, Integrated GST (IGST) will be collected by Centre. IGST will also apply on imports.

Concurrent Dual GST

Under this model, both central and state Governments will levy GST concurrently. There will be Central GST to be administered by the Central Government and there will be State GST to be administered by State Governments. In this model, both goods and services would be subject to concurrent taxation by the Centre and the States. All types of goods and services will be brought under this proposed GST structure except few exceptions.

Proposed GST Model For India

Article 246, Seventh Schedule of constitution empowers Union Government and State Government to make the laws with respect to any of the matters enumerated in List I (Union List) and List II (State List) respectively. In case of List III (Concurrent List), Both Union and State Government can make the laws. However, the law enacted by central government shall prevail over the state government where the laws are conflicting on the subject matter of concurrent list (except that the state law may prevail in that state subject to Hon’ble President Assent).

The Unified GST at Union Government level (Central GST) is the ideal form of taxation structure from business perspective as it removes the cascading effect to a large extent and drastically reduces the compliance cost. However, the states may not agree for single and unified tax by central as it gives up the constitutional power granted to levy and collect the taxes. Even though, an attempt was made by the central government in the initial stage for implementation of single tax at central level but it was not acceptable to most of the states, Hence, a compromise is made on Concurrent Dual GST where both states and centre will impose and collect tax on a single transaction of sale and service in the form of State Goods and service tax “SGST” and Central Goods and service tax “CGST”

At present, the central has the constitutional power to tax goods only up to manufacturing stage and further has the power to tax services. States has the power to tax Goods up to the stage of sales but not have the power to tax services. Hence, constitutional amendment is required to give power to the central to tax goods up to the stage of sale and further to give power to states to tax services for implementation of concurrent dual GST.

Recommended Articles

Respected sir,

your informations are very very important and helpful.Sir, please start a G.S.T. and Income tax course by you.

I think find this somewhere useful and helpful to us.

GOOD AND IMP FOR US