GST Accounting of Transactions, GST Accounts & Records Rules. GST Accounting Entries, Every registered person shall keep and maintain, at his principal place of business (as mentioned in the certificate of registration), a true and correct account of the following: –

- Production or manufacture of goods;

- Inward supply of goods or services or both;

- Outward supply of goods and/or services or both

- Stock of goods;

- Input tax credit availed;

- Output tax payable and paid; and

- Such other particulars as may be prescribed in this behalf.

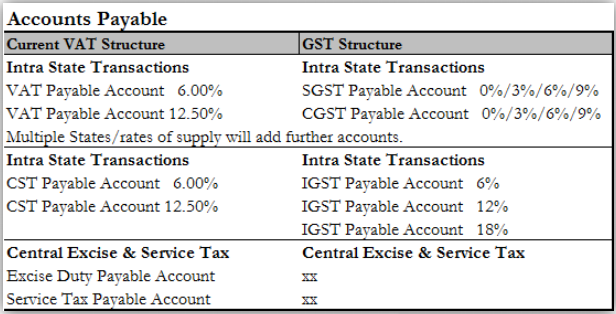

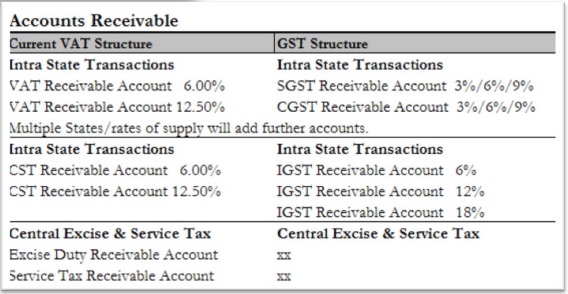

Accounting structure for Tax on input credits of goods and services.

Accounting structure for Tax liability on the outward movement of goods & Services.

- Invoice system need to have flexibility to capture transaction as per above structure.

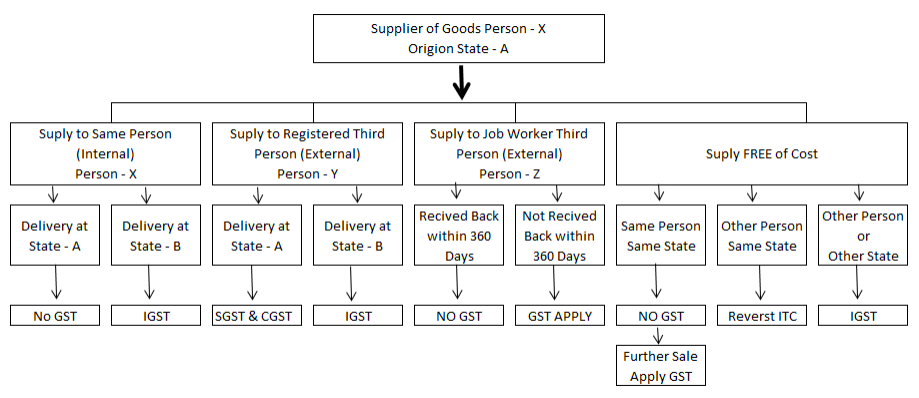

- Movement of goods is of importance in case of billing and delivery address is different

- Customer accounts to capture GSTIN and state code of each delivery location of customer and vendors.

- HSN Code / SAC codes to be mapped for each of the product received/supplied for seamless input credit and discharge of tax liability

Other Transaction which calls for attention by a registered person:

- GST is payable on advance received which is applied against supply made/to be made.

- Receipt voucher is to be generated for such advance received.

- If no supply is made against advance received, refund voucher is to be generated.

- If tax is payable on reverses charge basis, issue an invoice in respect of goods or services received by him from the supplier who is not registered on the date of receipt.

- Issue a payment voucher at the time of making payment to the supplier of point 4.

- Reversal of ITC in case of no payments against supplies received within 180 days from invoice date, credit can be taken again after making payments.

- Appropriate GST is applicable on all Debits Notes generated.

- For invoices issued to end user (B2C) consolidated entries can be done into return.

GST Accounting of Transactions

(ii) In case of multiple places of business (as specified in the certificate of registration), the accounts relating to each place of business shall be kept at the respective places of business concerned. Hence, all records are to be maintained at each place of business.

(iii) Registered assesse may keep and maintain such accounts and other particulars in the electronic form in such manner as may be prescribed.

Advertisement

(iv) The Commissioner is vested with powers to notify a class of taxable persons to maintain additional accounts or documents for specified purpose.

(v) In case the Commissioner considers that any class of taxable persons are not in a position to keep and maintain accounts in accordance with this section, he can, for reasons to be recorded in writing, permit such class of taxable persons to maintain accounts in any other manner.

(vi) Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit to the proper officer a copy of the audited statement of accounts together with the electronic reconciliation statement u/s 44(2).

(vii) Specific provisions in case of requirement to reverse input tax credit availed, as Provided for under Section 17(5)(h) – Where goods are lost, stolen, destroyed, written off, or disposed of as gifts or free samples, proportionate input tax credit should be reversed. However, where the taxable persons do not account for such transactions, the amount payable would be determined based on the demand provisions (Section 73/74) as the case may be) as if such goods had been supplied.

(viii) Persons who own/ operate any warehouse, godown, etc. for storage of goods and every transporter should maintain the records of the consigner, consignee and other relevant details of the goods, even if such persons are not registered under the Act – i.e., both registered and unregistered persons shall be required to maintain such records/ details.

(ix) The law requires every registered person to maintain accounts and records along with relevant details at each place of business and for each place of storage failing which the proper officer shall determine the amount of tax payable on the goods or services or both that are not accounted for, as if such goods or services had been supplied by such person. Further the provisions of section 73 or 74, as the case may be, shall apply, mutatis mutandis, for determination of such tax

(x) The provisions of Section 73 & 74 are in relation to demands and recovery of tax so determined by way of short payment or excess credit availed or utilised with or without wilful misstatement or fraudulent intention.

Recommended Articles