Filing & Payment Requirements for TDS on Property 26QB

Filing & Payment Requirements for TDS on Property 26QB, Filing and Payment Requirements of Form 26QB. You …

Filing & Payment Requirements for TDS on Property 26QB, Filing and Payment Requirements of Form 26QB. You …

Filing Income Tax Return in Case of Loss Section 139(3). Hi Friends Here we are …

TDS on sale of Immovable Property – TDS Section 194IA. Check Details for TDS Section …

Instructions to e-File Form 15CA and 15CB, Check Complete procedure for efiling Form 15CA and …

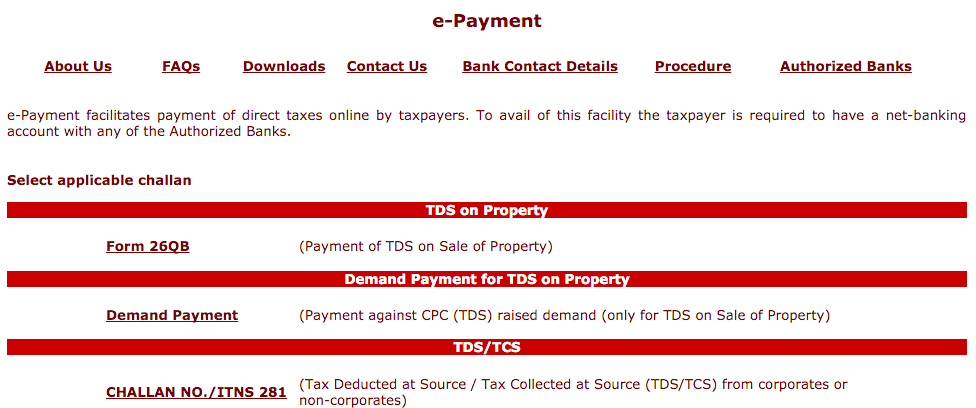

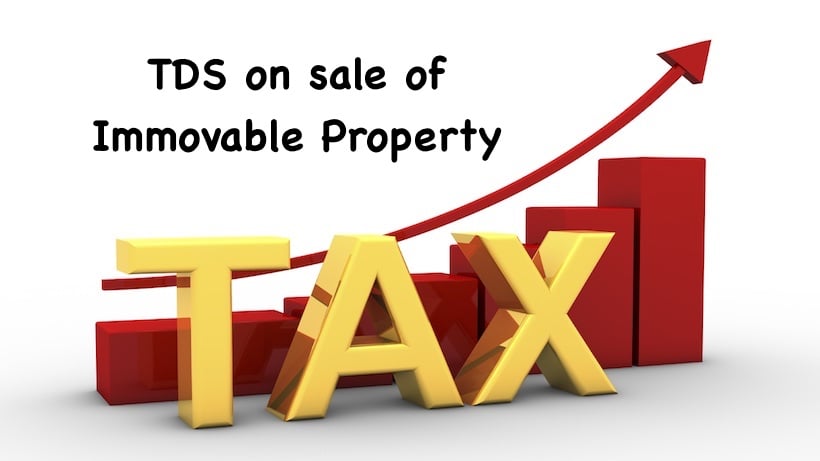

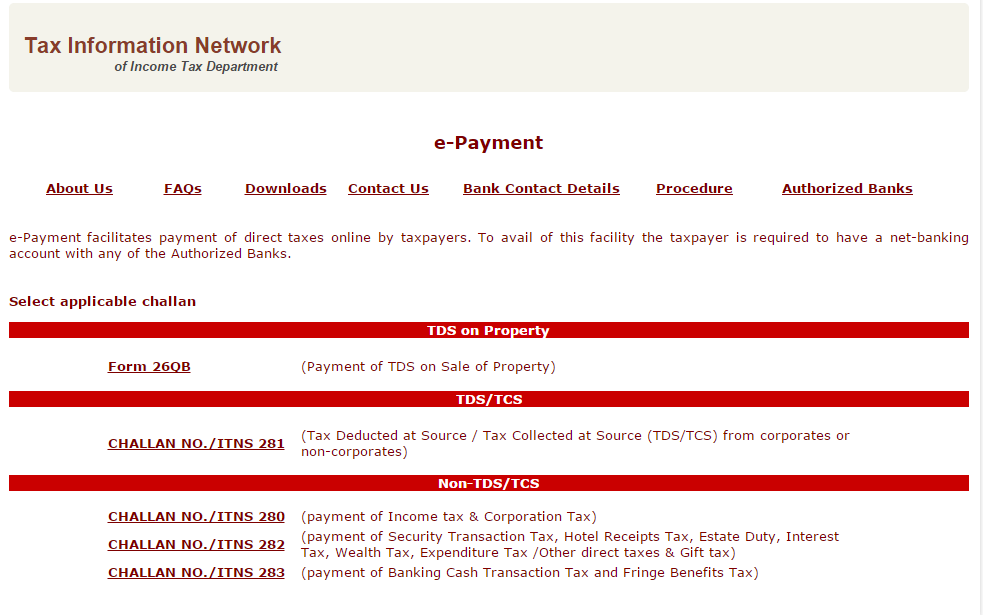

Complete Details for E-payment of Direct Taxes. Find Everything You Want to Know about E-payment …

How to Pay TDS Online Full Guide and Procedure. Everything you want to know about …

Queries (FAQ) Related to Income Tax Refund. Hi Friends There are Many queries related to …

Penalty For Late Filing of E-Forms Under Companies Act, 2013. Here we are providing complete …

PAN Card Status, Know Your PAN, Verify PAN online. Track PAN Card Status Online, Verify …

Form 3CD Latest Changes in Tax Audit Report – Clause Wise Discussion. Form 3CD Clause …

Section 143(3) – Scrutiny Assessment under Income Tax Act. This article is about the scrutiny assessment …

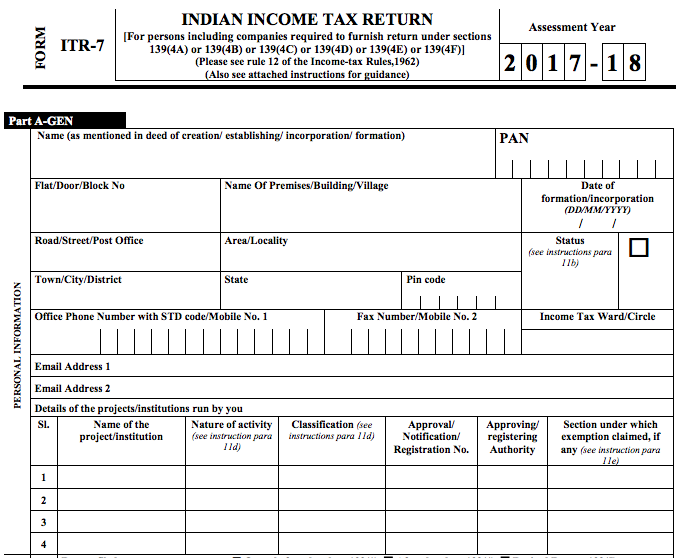

Instructions for Filing ITR 7 For AY 2017-18. These instructions are guidelines for filling the particulars …

Indirect Tax System in India – List of Taxes Under Indirect tax. India has a three-tier …

Union Budget 2017- Ache Din for Digital Economy. Contains all amendments made by finance bill …

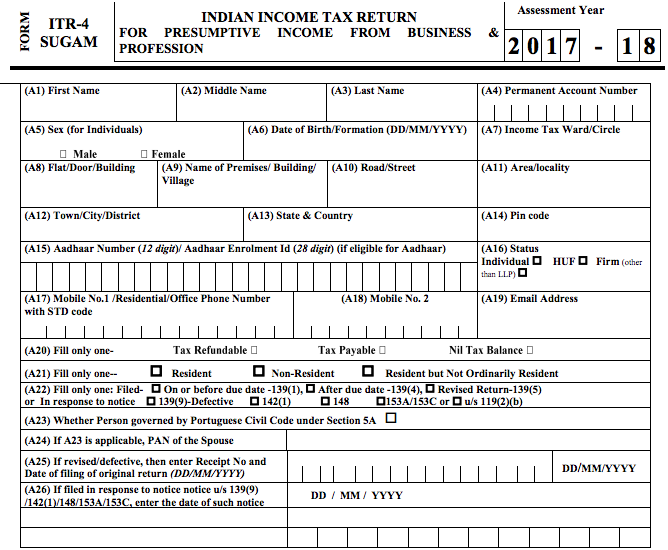

Instructions for Filing ITR 4S (SUGAM) For AY 2017-18: These instructions are guidelines for filling the …

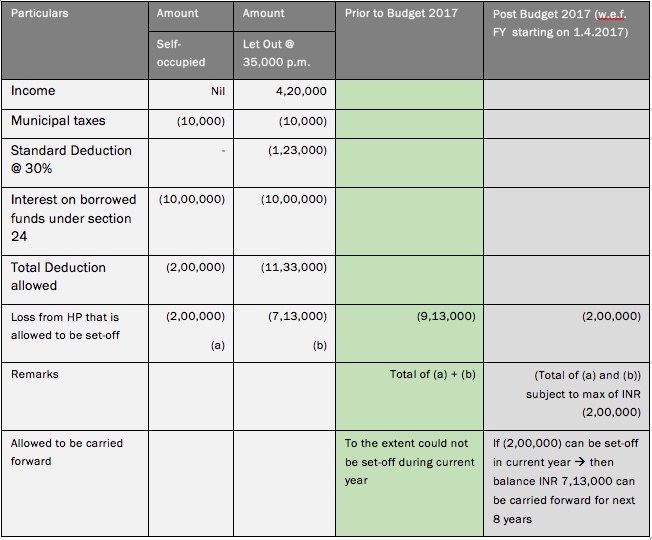

Section 71(3A) Restriction on set-off of loss from House property. Understand New rule as per …

TDS Rules and Regulations – All Details for Tax Deducted at Source. TDS is a …

Tax treatment of dividend received from a foreign company, Find Completed details for dividend received …

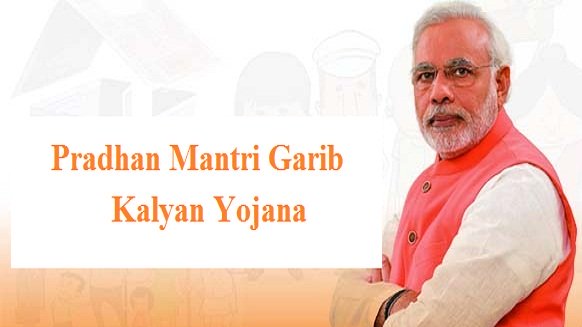

PMGKY Scheme, Pradhan Mantri Garib Kalyan Deposit Scheme (PMGKDS), 2016. Guidelines for Pradhan Mantri Garib Kalyan …

Which ITR to be Filed? – How to Choose ITR Form. When We file Income …

Form 15CA & Form 15CB – Everything you want to know about. Find Complete details for Form …

Section 115JB of Income Tax- Amended in Budget 2016, Budget 2016 has amended the existing Section …

EPF Withdrawal : TDS on EPF Withdrawal – New Rules 2016, TDS on Employees Provident …

Register as Person Competent to Verify in e-Filing, Find Complete procedure for Register as Person …

Save Tax by Creating HUF – Advantages and Limitations. Save Tax by Forming HUF – Taxability, …

Tax rebate on payments made using Debit And Credit Card, In order to encourage the people …

Capital Gains – Section 54 & Section 54F. Find Complete details for Capital Gain Section …

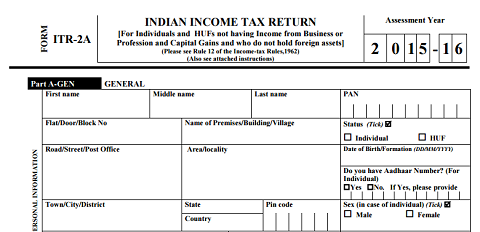

ITR 2A Download For AY 2016-17, Applicability of ITR 2A. This New ITR Introduced from AY 2016-17. Who …

Understanding the Procedure of Advance Rulings, Check Complete Details for Procedure of Advance Rulings. Chapter XIX-B, consisting …

Accounting for Credit Available in Respect of MAT, Check Detailed Analysis of Guidance Note on …