Section 71(3A) Restriction on set-off of loss from House property. Understand New rule as per Budget 2017 on set off of loss from House property with Practical Example. Section 71 – The set-off of loss under the head “Income from house property” against any other head of income shall be restricted to two lakh rupees for any assessment year. However, the unabsorbed loss shall be allowed to be carried forward for set-off in subsequent years for next 8 years and the same can be set-off only against income from house property.

Date from which amendment is applicable – W.e.f. 1st April, 2018 and will apply in relation to assessment year 2018-19 and subsequent years

As per Budget 2017

Restriction on set-off of loss from House property Section 71 of the Act relates to set-off of loss from one head against income from another. In line with the international best practices it is proposed to insert sub-section (3A) in the said section to provide that set-off of loss under the head “Income from house property” against any other head of income shall be restricted to two lakh rupees for any assessment year. However, the unabsorbed loss shall be allowed to be carried forward for set-off in subsequent years in accordance with the existing provisions of the Act.

This amendment will take effect from 1st April, 2018 and will, accordingly apply in relation to assessment year 2018-19 and subsequent years.

- Anuraag Singhaal CA (2005) & CPA (USA)(2008)

- 11 Years of Work Experience with PwC (Big 4), Deloitte (Big 4), Reliance Industries Group

- Best-in-class Faculty for Direct Taxes (DT) CA Final

- For Batches & Sessions, contact at 9582039221 [/author]

Restriction on set-off of loss from House property : Section 71(3A)

Advertisement

Comprehensive Practical Illustration and Impact of this Amendment

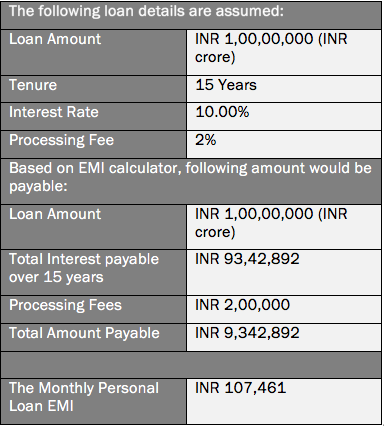

Allocation of Principal and Interest is provided in the below table: – this is done based on EMI calculator – ONLY INTEREST ELEMENT IS RELEVANT FOR

DISCUSSION –PL NOTE INTEREST COMPUTATION IS NOT RELEVANT – the below table is presented for complete analysis so that you can understand that how much interest would be paid over 15 years

| Year | Principal | Interest | Total Payment in Each Yr. | Principal Outst. |

| 2017 | 2,76,737 | 9,05,327 | 11,82,064 | 97,23,262 |

| 2018 | 3,32,151 | 9,57,377 | 12,89,528 | 93,91,112 |

| 2019 | 3,66,930 | 9,22,597 | 12,89,527 | 90,24,181 |

| 2020 | 4,05,352 | 8,84,175 | 12,89,527 | 86,18,829 |

| 2021 | 4,47,798 | 8,41,728 | 12,89,526 | 81,71,030 |

| 2022 | 4,94,689 | 7,94,837 | 12,89,526 | 76,76,341 |

| 2023 | 5,46,488 | 7,43,037 | 12,89,525 | 71,29,852 |

| 2024 | 6,03,713 | 6,85,812 | 12,89,525 | 6,526,138 |

| 2025 | 6,66,930 | 6,22,594 | 12,89,524 | 58,59,208 |

| 2026 | 7,36,767 | 5,52,760 | 12,89,527 | 51,22,441 |

| 2027 | 8,13,917 | 4,75,611 | 12,89,528 | 43,08,525 |

| 2028 | 8,99,143 | 3,90,382 | 12,89,525 | 34,09,382 |

| 2029 | 9,93,296 | 2,96,230 | 12,89,526 | 24,16,086 |

| 2030 | 1,097,307 | 1,92,221 | 12,89,528 | 13,18,780 |

| 2031 | 12,12,211 | 77,319 | 12,89,530 | 1,06,571 |

| 2032 | 1,06,571 | 888 | 1,07,459 | 0 |

- If a salaried class has availed loan for a let-out/ deemed let-out property on 1.4.2016 assuming that he will claim deduction for interest component for FY 2016-17 and subsequent years and also set-off the same with salary income / business income, in that case, he will be able to set-off loss in FY 2016-17.

- But post amendment proposed in Finance Budget 2017, there will be change in his tax computation from FY 2017-18 onwards since his tax liability would be increased due to restriction of set-off of loss from house property.

- In most of cases, specifically for salaried class, the loss from house property is generally get set-off in current financial year itself without any limitation on interest deduction for let-out/ deemed let-out property.

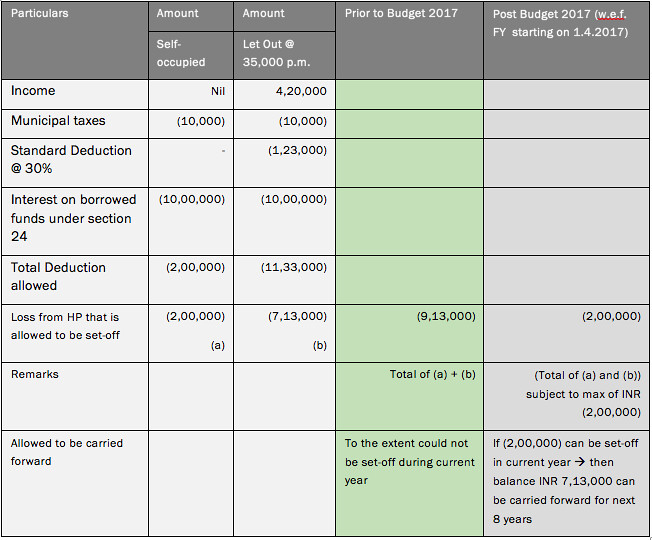

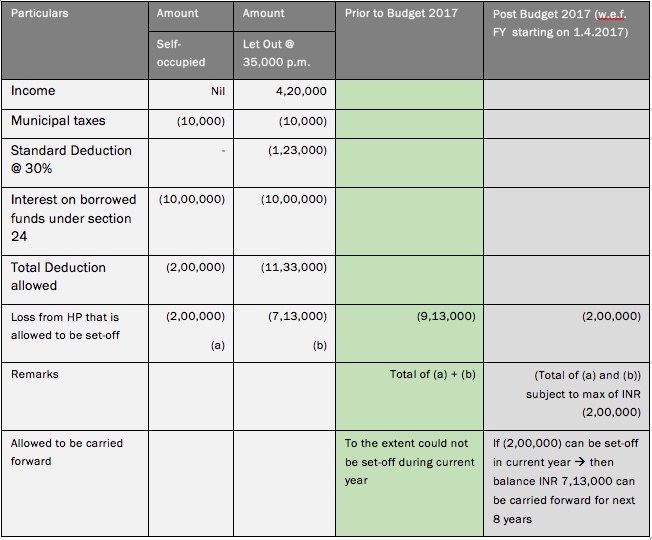

- Post amendment in Finance Budget 2017, following picture will emerge for Computation of Income / (Loss) under house property[1][1] Analysis based on hypothetical figures – assuming all tax conditions such as return filing within time and others are fulfilled and there is no subsequent change in law

- Following assumptions are made:

- Municipal taxes are assumed

- Rent is assumed to be INR 40,000 p.m. * 12 = INR 4,80,000 p.a.

- It is assumed to be increasing @ 5% every year.

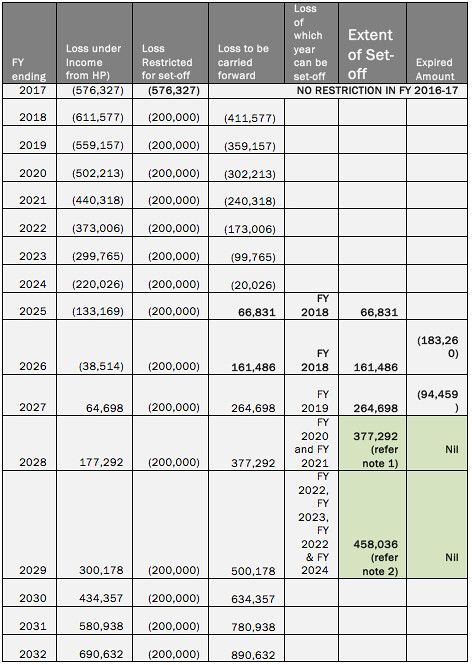

- Analysis of carry forward and Set-off of loss in income from House Property in various years

Note 1: Loss of FY 2020 and partial loss of FY 2021 is set-off

| Year | Loss |

| FY 2020 | 3,02,213 |

| FY 2021 | 75,079 |

| Total loss set-off in FY 2028 | 377,292 |

Note 2: Balance loss of 2021, Full loss of 2022, 2023 and 2024 is set-off

| Year | Loss |

| FY 2021 | 165,239 |

| FY 2022 | 173,006 |

| FY 2023 | 99,765 |

| FY 2024 | 20,026 |

| Total loss set-off in FY 2029 | 4,58,036 |

Conclusion – Based on specific facts, it is possible that in some cases loss from house property may be expired without set-off in subsequent years.

This amendment may have prolong and deep impact specifically on take home salary of salaried class person since income more than 50% would attract surcharge @ 10% and at the same time, loss of house property is restricted to INR 2,00,000

The impact discussed in above analysis will change with change in rate of interest.

You may Download Finance Bill 2017 From Below link….

Finance Bill 2017, Direct tax Changes in Budget 2017 – Download

Other Budget 2017 Updates

- Cash Expenses Limit Reduced from Rs 20000 to Rs 10000 u/s 40A(3)

- Base year Changed for computation of capital gains from 1981 to 2001

- Revised Fee for Delayed Filing of Income Tax Return – Budget 2017

- Disallowance of depreciation u/s 32 & capital expenditure u/s 35AD on cash payment

- TDS Rates U/s 194J Reduced from 10% to 2% by Finance Bill 2017

- Deemed profit u/s 44 AD reduced from 8% to 6% for digital transaction

- Income Tax Due Dates

- How to submit Response for Outstanding Tax Demand

- Additional Depreciation – Who can Avail?, availability, Rate of Add Dep

- Tax Audit Limit U/s 44AB Increased From 1 Crore to 2 Crore AY 2017-18

- Threshold limit Increased for maintenance of books of accounts

- Penalty on CA & professionals for furnishing incorrect information in statutory report

If you have any query or suggestion regarding “Restriction on set-off of loss from House property” then please tell us via below comment box….

This is the greates dis service by GoI and Tax analysts across the country. How many ever Home Loans you pay, you are now eligible to claim just 2 LPA as Home Loan Interest Deduction. Every article made it look like its going to be 2 LPA Interest Deduction on the Self-occupied home and 2 LPA deduction on 2nd Home / Let out Home Loan deduction. This is such a misleading of facts by the media and Arun Jet Li.

Please check calculation in your last table mainly for FY ending 2025 and 2026. Its give an impression that even brought forward house property losses can be set off against other income. FY ending 2026 onwards, net result is gain. You have still claimed 2,00,000 limit -should be out of brought forward losses. Is this legislation meant?