Form 26AS 2020: The Annual Tax Statement OR Tax Passbook

Form 26AS also known as Annual Tax Statement under section 203AA OF Income-tax Act, 1961 …

Form 26AS also known as Annual Tax Statement under section 203AA OF Income-tax Act, 1961 …

Atmanirbhar Bharat Abhiyan: Hon’ble Prime Minister during his address to the Nation on 12th May, …

From October 1, 2020, our Government has introduced a new provision for collecting TCS for …

My this article talks about the meaning of Nidhi company, its requirements, how does it …

Accrual Concept – Accrual means recognition of revenue and costs as they are earned or incurred …

The concept of Strategic Debt Restructuring (“SDR“) has been introduced by the Reserve Bank of …

Don’t worry – No TDS on Post Office Recurring Deposit Scheme, No TDS on Post …

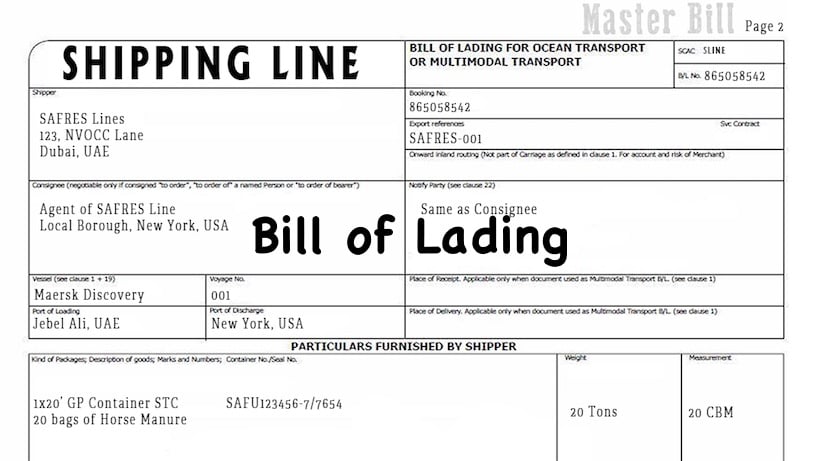

Bill of Lading Meaning/Definition. A bill of lading is a document issued by a carrier …

Advantages and Disadvantages of One Person Company, Check Advantages of OPC, and also Check Disadvantages …

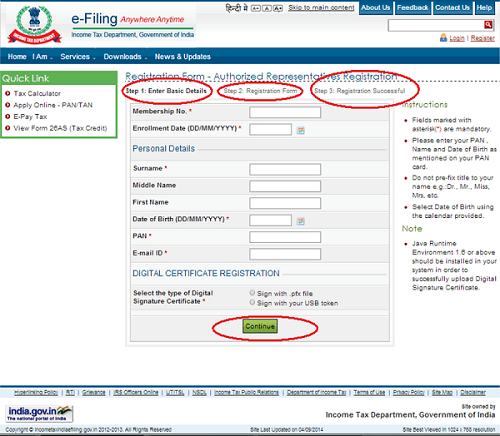

Procedure For E-Filling Of Tax Audit Report. Details for E-Filing of Tax Audit Report From …

The digital economy creates many new economic opportunities. Digitalization is transforming value chains in different …

In the past, a common conversation was that technology, the way it is moving forward, …

There has never been a better time to start investing. Education opportunities are everywhere, both …

Applicability of Tax Audit 2020: Tax Audit under section 44AB is an effective tool for …

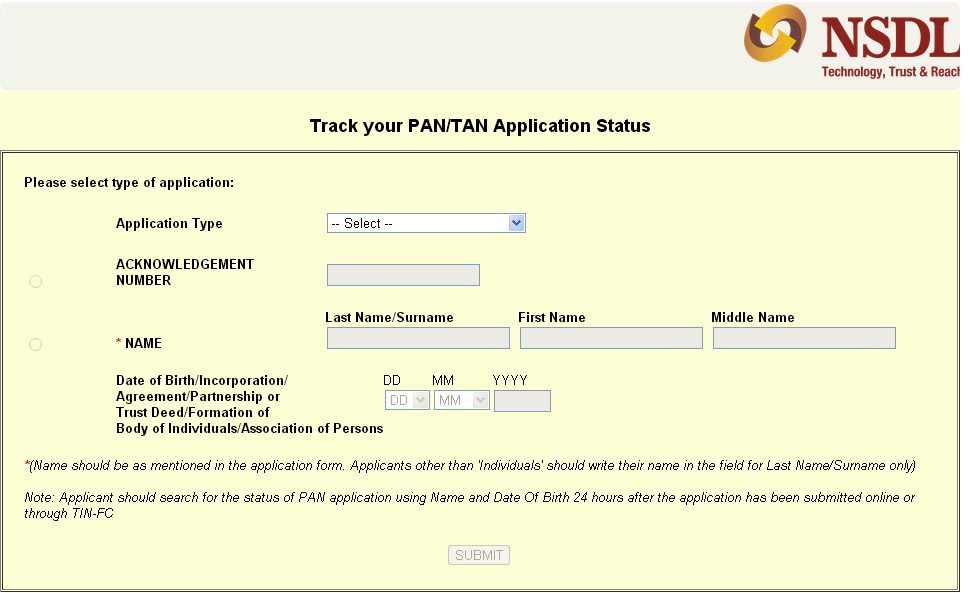

PAN card i.e Permanent Account Number Card is an important document. Whether you need to …

PAN card i.e Permanent Account Number is an Alphanumeric Code of 10 digits issued by …

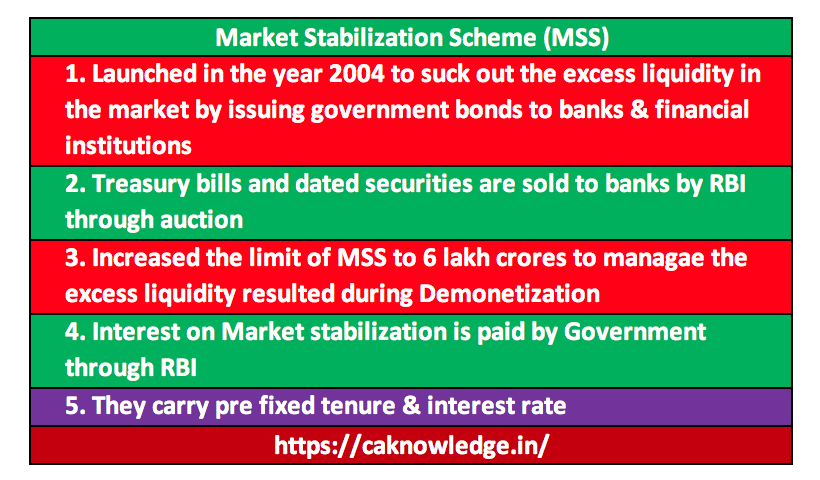

Market Stabilization Scheme (MSS): This is a scheme under which Reserve Bank of India (RBI) withdraws …

Elements needed to measure SROI While the approach varies depending on the program that is …

This article will guide you to know about how does the courier companies charge the …

Applicability of Cost Audit & Cost Records Maintenance. Check Cost Audit Applicability. Companies rules 2014 (Cost …

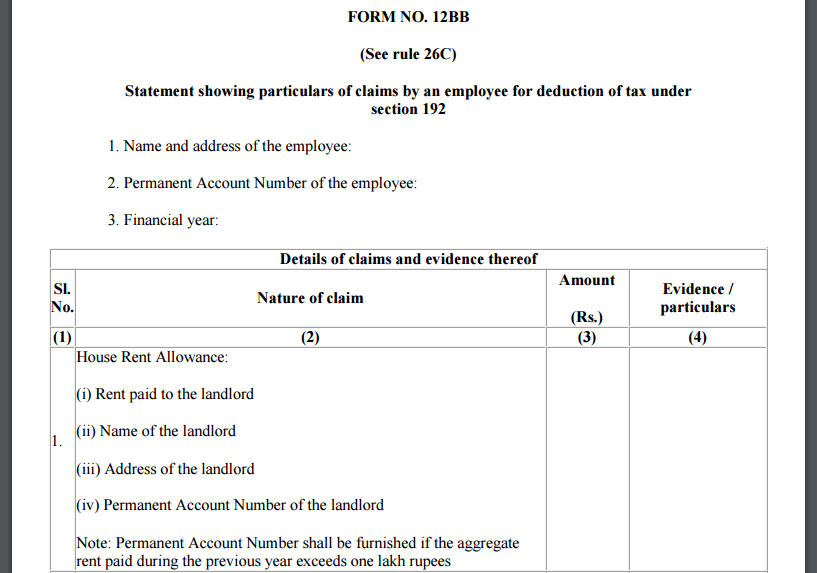

Form 12BB of Income Tax: Central board of direct taxation (CBDT) has recently issued a new …

Impact of Credit Growth on Economy – Standard political speculation holds that a country’s monetary strength …

Inserting Section 115BAC, The New Tax Rate May Become The Hard Weapon In The Hands …

TAN Registration: TAN or Tax Deduction and Collection Account Number is a 10 digit alpha …

Corporate Social Responsibility Complete details. Corporate Social Responsibility Definition Social responsibility is the duty of organizations and …

Independent directors in Indian companies, Independent directors company wise analysis, Over the last four decades, corporate …

Nine Study Habits of Successful Students – CA, CS & CMA. Successful students have good …

How to convert Private Limited company into OPC ??. My this article is about the …

Section 44 ADA: Presumptive Tax Scheme for Professionals. Difference Between Section 44AD & 44ADA, Presumptive Income Computation …

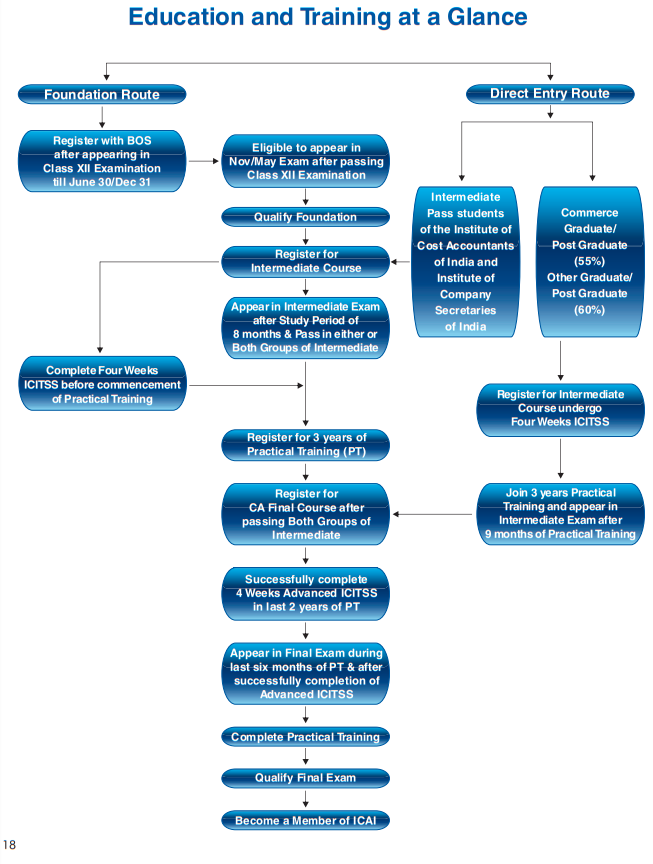

How to Become Chartered Accountant (CA). Check out step by step guide for how to …