How to Study CMA Final Corporate Laws and Compliance in 2021

Corporate Laws and Compliance: In this changed situation of epidemics having lockdowns at every level, …

Corporate Laws and Compliance: In this changed situation of epidemics having lockdowns at every level, …

TDS under Section 194A. The topic relating to any TDS section is very much famous …

TDS on payment to contractors Under Section 194C: Any person responsible for paying to any …

Procedure to incorporate LLP (Limited Liability Partnership Firm), Step by Step Guide for Formation of …

How to choose a best broker for demat & trading account?, Find details for How to …

E – Assessment Scheme: Union Budget 2019 proposed Faceless Assessment Scheme. The scheme is finally …

Double Taxation Avoidance Agreements. What is Double Taxation Avoidance Agreement (DTAA). Find Complete Details for Double …

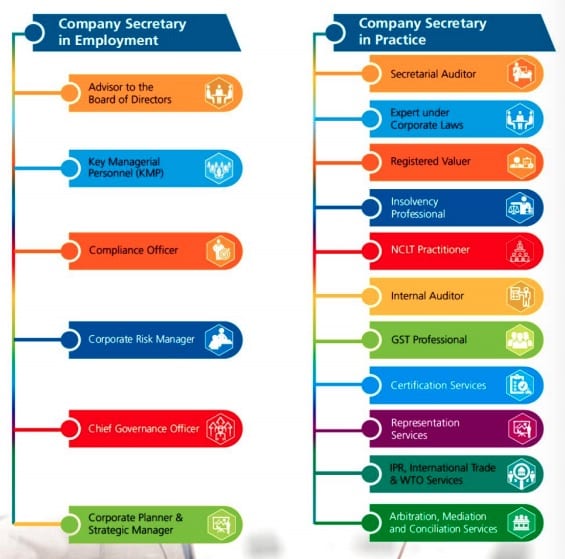

Company Secretary Profession: A qualified Company Secretary can become a Key Managerial Personnel in a …

Social return on investment (SROI) is a method for measuring values that are not traditionally …

Which is the Best Health Insurance for Parents, As we grow old , two things surely …

Section 43B Deductions Based Actual Payments, As per section 43B of income tax there are certain …

Documents Required for PAN Card Application 2021: PAN was introduced to facilitates linking of various …

Section 194J – TDS on Professional Services or Technical services. TDS is required to be …

How to prepare for CMA Examination in less time: Preparing for professional examinations like CMA …

Prevention of Money Laundering Act, 2002. Money Laundering can be understood as a process employed …

Registration of Section 8 Company – Charitable Companies. Section 8 Company is similar to a …

Types of stamps & Concepts of stamp duty, How to pay the Stamp Duty?. In …

ITR 4S Sugum Form is the return form for those taxpayers who has opted for …

Loans to Directors: Upon the enactment of the Companies Act, 2013 (“the Act”), 98 sections were …

ITR-1 SAHAJ is a return form of income tax return for filling the compliances with …

Analysis of Cost Accounting Standard on Pollution Control Cost, CAS on pollution control cost, This standard …

CA Foundation, CA Inter, CA Final: Pre examination Preparation: It is that time of the …

Artificial Intelligence: Finally, a dream has come true where humans will be replaced by machines …

The 2008 financial crisis, numerous advancements in technology and cross border trading have led to …

What is rebate under section 87A and who can claim it?. An individual who is …

Government has enacted the Research and Development Cess Act of 1986 to provide for levy …

Quality Review Board: First QRB was constituted by central government adhering to notification issued on …

Supply Chain is typically seen as a cost center. Digitization allows for a paradigm shift …

Self Evaluation Techniques After Examination For CA, CS, CMA. Post Examination: Self Evaluation. There is …

Why should I pay tax? Know Various Reasons. The citizens of India are required to pay …