Accounting entries in Tally prime 2023: After successfully establishing and understanding tally prime. A business person can start recording his transactions as accounting entries daily. A user can record all transactions and pass accounting entries using Journal Vouchers in TallyPrime. However, there are specialised accounting voucher types for different types of transactions like payments, receipts, sales, purchase, contra, debit note, credit note, and to make easy to do data entry. This article will discuss how to pass accounting entries in tally prime 2023 and other details related to it.

All the Steps to create all vouchers are similar, and only a few specifics vary from a voucher type to another. To know how to make accounting vouchers before passing accounting entries, click here.

Pass Data Entries/ Record Transaction

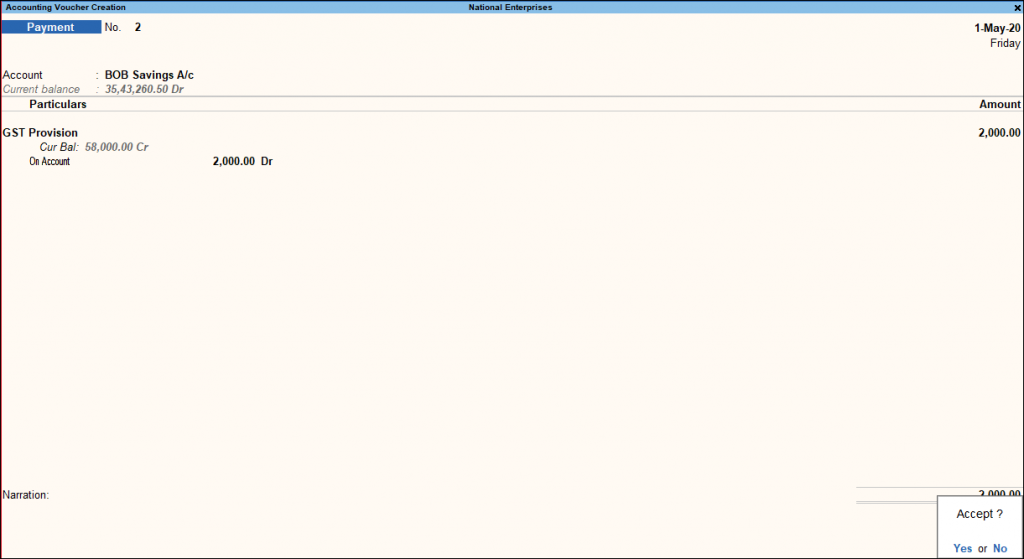

You can record a transaction with the following steps. For example, A payment transaction for expenses can be pass in the following way:

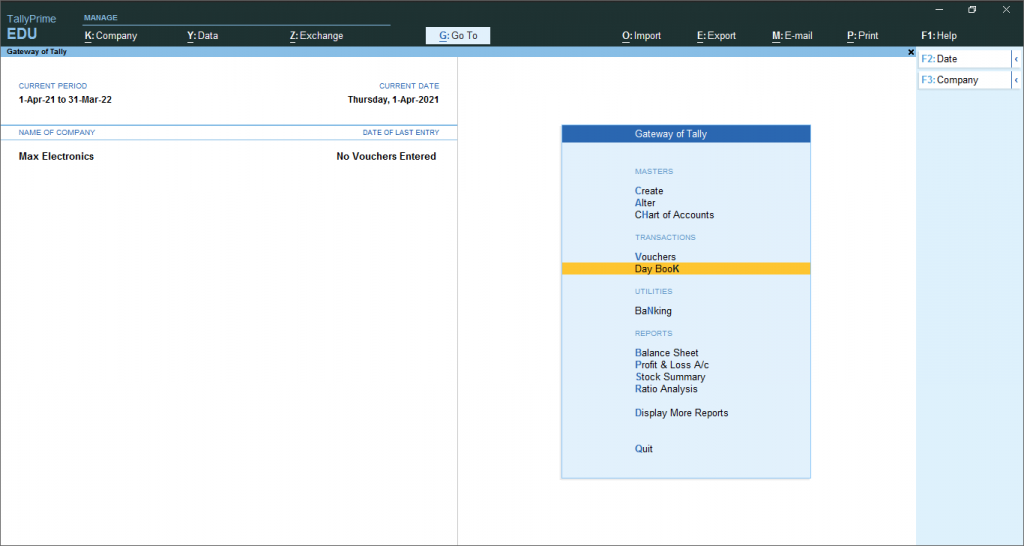

- Go to Gateway of Tally > Vouchers > press F5 (Payment), or other according to your entry type.

- Alternatively, Alt+G (Go to) > Create Voucher > press F5 (Payment).

- If you want to change the voucher date, press F2 (Date). While you press F2 to change the dates of a accounting entry it shows the date for the subsequent day of the current date. However, you can enter any date you want.

- Select the mode of payment. In the Accounts section, go to Cash ledger, which is already available or the Bank ledger.

- Select the ledger for which the payment is been made and specify the amount. For example, office rent.

- Under Particulars, select the expense ledger for which you are making this payment.

- However, If an expense ledger is not available, press Alt+C to create Ledger; in Ledger Creation (Secondary) screen, give the ledger name as per your expense head and choose the Indirect Expense group in the Under field.

- Provide Narration, if any, and accept the voucher. As always, you can use Ctrl+A to accept.

Alter & Delete Accounting Entries

To alter or change anything in an accounting entry, follow the next steps:

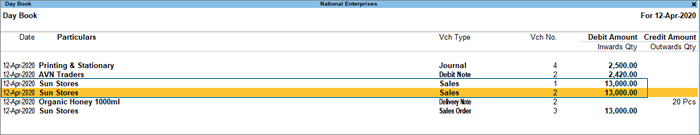

- Go to gateaway of tally> Day Book >Press Enter or Alternatively, press Alt+G (Go To) > type or select Day Book > press Enter.

- All entries shown> Select entry> Enter to see or Alter the entry.

- You can also use shortcut method, by typing DD and then Press Alt+ F2.

You can quickly delete an accounting entry that is in no more prolonged need for the business. To delete more entries at one time, follow these steps-

- Go to Gateway of tally > Daybook (press enter) >Alt+F2 (select period)

- Select entries with shift+arrow key >press Alt+D > press yes for delete

- select all entries with ctrl+space bar > which entry you don’t want to delete select that entry and press space bar for unselecting now press Alt+D > press yes for delete

Duplicate Accounting Entry

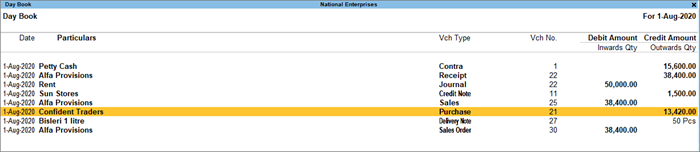

Duplicating an entry is an easy and shortcut method used by accountants to speed up their work. In data entry, you can easily copy accounting entries through shortcut ways.

You can duplicate a voucher in the Day Book to easily account for a recurring transaction. To do so, follow the following steps:

- To repeat an accounting entry just simply passed a purchase entry for August. Now you can easily repeat this transaction each month. Just select the existing entry and press Alt+2 (Period).

- You can see that all the details of the selected accounting entries are duplicated.

- You can update the required details, such as Voucher Date, Supplier Invoice No., and Invoice Date, and save the transaction.

- One can also sleect the duplicate otion given below at the bottom of screen. Click on the entry you want to duplicate and click duplicate option.

- Similarly, you can duplicate the vouchers for the upcoming months.

Recommended Articles