How can I view the Inward Supplies Return GSTR 2A? at www.gst.gov.in. Step by Step Guide for how taxpayer can check GSTR 2A form at GST Portal. As per law, a taxpayer is required to file a document with the administrative authority which is commonly known as a “return”. There are various types of returns under GST like the Monthly return, Return for Composition Scheme, TDS return, Return for Input Service Distributor, Annual return and final return. Under GST, everything will be online and will be updated regularly. now check more details for “Return GSTR 2A” from below

Return GSTR 2A > View of Inward Supplies Return

How can I view the Inward Supplies Return GSTR 2A?

GSTR2A will be generated in below scenarios,

- When the supplier uploads the B2B transaction details in GSTR-1& 5/ &

- ISD details will be auto-populated on submission of GSTR-6 by the counterparty / &

- TDS & TCS details will be auto-populated on filing of GSTR-7 & 8 respectively by the counter party.

GSTR2A is a Read view form only and you cannot take any action in GSTR2A.

GSTR-2A will be generated in the following manner.

When GSTR – 2 has not been submitted by the taxpayer, the details will be auto-populated to GSTR-2A of current tax period if –

- Counterparty adds Invoices / Credit notes / Debit Notes /Amendments in GSTR-1/5

- GSTR-6 is submitted for distribution of credit in the form of ISD credit

- GSTR-7 & 8 filed by the counterparty for TDS & TCS credit respectively.

To view the Inward Supplies Return GSTR2A, perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3. Click the Services > Returns > Returns Dashboard command.

4. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the return from the drop-down list.

5. Click the SEARCH button.

6. The File Returns page is displayed. In the GSTR 2A tile, click the VIEW button.

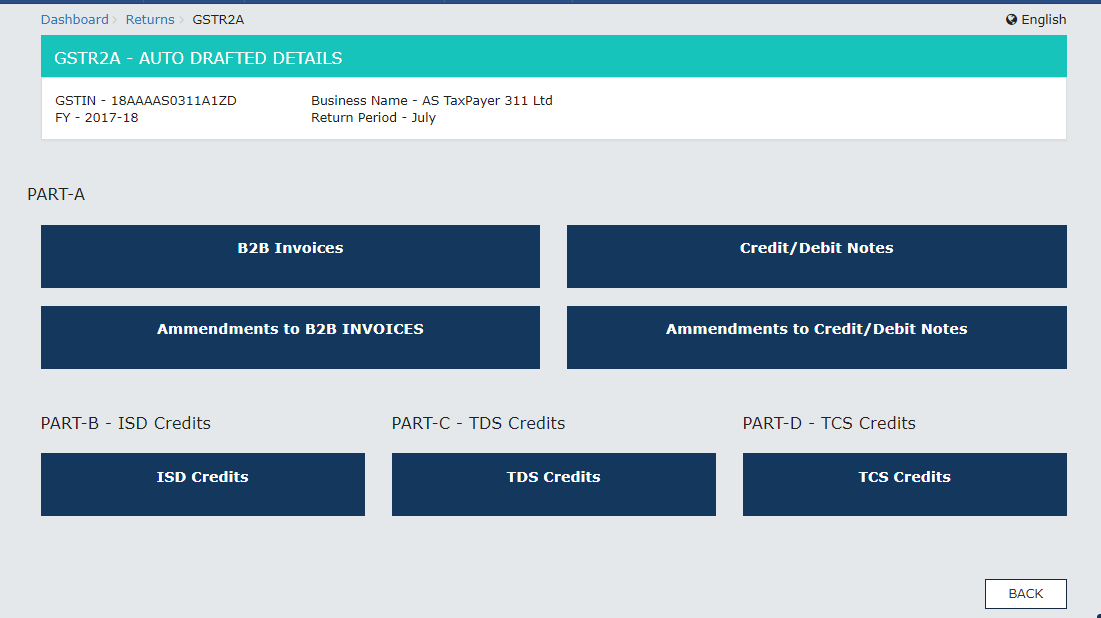

The GSTR2A – AUTO DRAFTED DETAILS page is displayed.

Click the tile names to know more details:

PART- A

- • B2B Invoices

- • Amendments to B2B INVOICES

- • Credit/Debit Notes

- • Amendments to Credit/Debit Notes

- PART- B – ISD Credits

- PART- C – TDS Credits

- PART- D – TCS Credits

PART- A (B2B Invoices)

B2B Invoices displays all the invoices added by the supplier through their GSTR 1 and/ or GSTR 5. The B2B section of PART A of GSTR 2A is auto-populated on uploading or saving of invoices by the Supplier in their respective returns of GSTR 1 and GSTR 5.

1. Click the B2B Invoices button. The B2B Invoices – Supplier Details page is displayed.

2. Click the GSTIN hyperlink to view the invoices uploaded by the supplier.

3. Click the Invoice No. hyperlink to view the invoice details.

The item details are displayed.

PART- A (Amendments to B2B Invoices)

Amended B2B Invoices section covers the invoices which are amended by the supplier in their returns of GSTR-1/5 respectively.

1. Click the Amendments to B2B Invoices button. The Amend B2B Invoice page is displayed.

PART- A (Credit/Debit Notes)

This section covers the Credit/Debit notes added by the supplier in their respective returns (GSTR-1/5).

1. Click the Credit/Debit Notes button. The Credit/Debit Notes – Supplier Details page is displayed.

2. Click the GSTIN hyperlink to view the credit or debit notes uploaded by the supplier.

3. Click the Credit/Debit Note No hyperlink to view the details.

The item details are displayed.

PART- A (Amendments to Credit/Debit Notes)

Amendments to Credit/Debit Notes section covers the amendments of Debit / credit notes done by the supplier in their respective returns (GSTR-1/5).

1. Click the Amendments to Credit/Debit Notes button. The Amend Credit/Debit Notes – Supplier Details page is displayed.

PART- B (ISD Credits)

1. Click the ISD Credits button. The ISD Credit Received page is displayed.

PART B of GSTR 2A is auto-populated from GSTR-6.

PART- C (TDS Credits)

1. Click the TDS Credits button. The TDS Credit Received page is displayed.

PART C of GSTR 2A is auto-populated on filing of GSTR-7 by TDS Deductor.

PART- D (TCS Credits)

1. Click the TCS Credits button. The TCS Credit Received page is displayed.

PART D of GSTR 2A will be auto-populated on filing of GSTR-8 by TCS Collector.

Recommended Articles

- List of all Important Questions of GSTR 2A

- How to Register and Update Digital Signature

- List of all Important Questions of GSTR 1

- FAQs on GST Invoice Upload / Download Offline Tools

- Important Question Related to Exports

- GST Questions Related to Textiles Business

- Online Information Data Base Access

- Advance Ruling Mechanism in GST

- Pure Agent Concept in GST