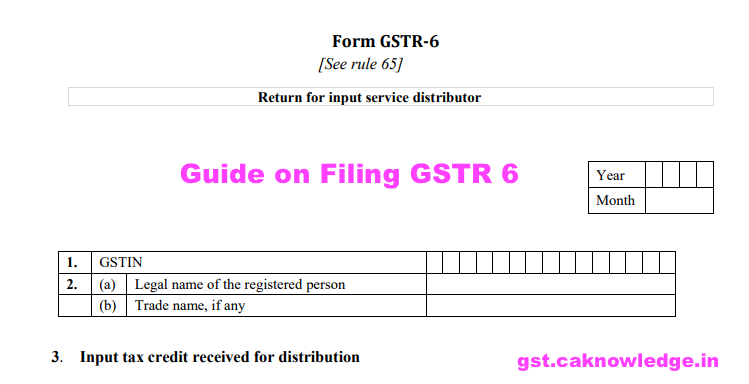

GSTR 6:How to file GSTR- 6 for Components of a Valid ISD Return on GST Portal.This form contains the details of return for input service distributor and it is filed by input service distributor by 13th of the next month.Any Taxable person registered as an Input Service Distributor is required to furnish details of input credit distributed in form GSTR-6. Read more here

Terms Used in Form GSTR 6 :-

- a. GSTIN :- Goods and Services Tax Identification Number

- b. ISD :- Input Service Distributor

- c. ITC: – Input tax Credit.

Guide on Filing GSTR 6 on GST Portal

Form and manner of submission of return by an Input Service Distributor.- Every Input Service Distributor shall, on the basis of details contained in FORM GSTR-6A, and where required, after adding, correcting or deleting the details, furnish electronically the return in FORM GSTR-6, containing the details of tax invoices on which credit has been received and those issued under section 20, through the common portal either directly or from a Facilitation Centre notified by the Commissioner.

Heading along with the details required for GSTR 6:

GSTIN–GST Number (GSTIN) is a unique 15 digit number which is allotted to the assessee at the time of filing an application for registration for Goods and Service Tax. Each taxpayer will be allotted a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN). Just like PAN Card No is required for payment and filing of Income Tax Returns, similarly GSTIN is required for payment and filing ofGST Returns.. The GSTIN of the taxpayer will be auto-populated at the time of return filing.

Advertisement

Name of the Registered Person –Name of the taxpayer, will also be auto-populated at the time of logging into the common GST Portal.

Period – (Month – Year) –A Taxable person is required to select from a drop down the relevant month and year respectively for which GSTR-6 is being filed.

Supplies From Registered Taxable Persons –Input Service Distributor is required to furnish details of supplies received from a registered person and the amount of input credit to be availed under current tax period. All inward supply related information will be auto-populated from counter-partyGSTR-1andGSTR-5. Under this heading, the taxable person is required to enter the amount of credit to be availed for CGST/SGST or IGST as the case may be. If the supply is received in more than one lot, the invoice information should be reported in the period in which the last lot is received and recorded in the books of accounts.

Amendments to the details of inward supplies –Any change or modification in the details of inward supplies received in earlier tax periods must be reported under this section. Here the taxpayer is required to provide details of revised/original invoices along with the CGST/SGST and IGST charged.

Details of Credit/Debit Notes –All debit/credit notes raised by the Input Service Distributor must be reported under this heading. Needless to say, Counter-party debit note will result in Input Service Distributors’ credit note and vice versa. Differential taxable value and differential tax will also get calculated here.

Amendment to Details of Credit/Debit Notes –Further in case any amendment is made with respect to debit/credit notes issued in the earlier tax period in current month needs to be reported under this head.

Input Service Distribution –This is one of the most critical headings for input service distributor. Here an input service distributor is required to provide details of the receiver of input credit corresponding to his GSTIN number. Here ISD is also required to specify the amount of ISD credit distributed under IGST, CGST, and SGST respectively.

Revision of Input Service Distribution of Earlier Tax Periods –Any revision in the amount of credit distributed in earlier tax period can be made under this heading. Here Input Service Distributor is required to submit details of the original invoice and the revised invoice along with the GSTIN of the receiver of credit and revised ISD credit distributed

Other Details Related to GSTR Form 6

2. GSTR-6 can only be filed only after 10th of the month and before 13th of the month succeeding the tax period.

3. ISD details will flow to Part B of GSTR-2A of the Registered Recipients Units on filing of GSTR-6.

4. ISD will not have any reverse charge supplies. If ISD wants to take reverse charge supplies, then in that case ISD has to separately register as Normal taxpayer.

5. ISD will have late fee and any other liability only.

6. ISD has to distribute both eligible and ineligible ITC to its Units in the same tax period in which the inward supplies have been received.

7. Ineligible ITC will be in respect of supplies made as per Section 17(5).

8. Mismatch liability between GSTR-1 and GSTR-6 will be added to ISD and further ISD taxpayer has to issue ISD credit note to reduce the ITC distributed earlier to its registered recipients units.

9. Table 7 in respect of mismatch liability will be populated by the system.

10. Refund claimed from cash ledger through Table 11 will result in a debit entry in electronic cash ledger

Input Service Distribution –This is one of the most critical headings for input service distributor. Here an input service distributor is required to provide details of the receiver of input credit corresponding to his GSTIN number. Here ISD is also required to specify the amount of ISD credit distributed under IGST, CGST, and SGST respectively.

Revision of Input Service Distribution of Earlier Tax Periods –Any revision in the amount of credit distributed in earlier tax period can be made under this heading. Here Input Service Distributor is required to submit details of the original invoice and the revised invoice along with the GSTIN of the receiver of credit and revised ISD credit distributed

ISD Ledger –This is a repository of all the credit distribution transaction between the head office and the branches. This heading holds detail of Input Tax Credit Received, Input Tax Credit reverted and Input Tax Credit distributed as SGST, CGST, and IGST.

After Furnishing all the information and flown into GSTR-6, Input Service Distributor is required to electronically sign a declaration regarding the correctness of the information furnished under various heads.

Check more about Goods and Services Tax,Click Here.

Recommended Articles

- FAQ on Electronic Commerce

- FAQ on Input Tax Credit

- FAQ on Job Work

- FAQ on Concept of Input Service Distributor

- FAQs on Returns Process and matching

- FAQ on Assessment and Audit

- FAQ on Refunds

- Company Secretary

- FAQ on Demands and Recovery

- GST Questions Related to Mining business

- GST Questions Related to Food Processing