GSTR 5: How to file GSTR5 for Non-Resident Foreign Taxpayers on GST Portal? (www.gst.gov.in).This form contain the details of outward supplies, imports, input tax, tax paid and reaming stock. The form has to be filed by non-resident taxable person by 20th of the next month. Every registered non-resident taxable person is required to furnish a return in GSTR-5 electronically through the GST Portal. Read here to know more details for Filing GSTR 5 at gst.gov.in..

Basis such information registered foreign taxpayer shall pay the tax, interest, penalty, fees etc. within twenty days after the end of a tax period or within seven days after the last day of the validity period of registration, whichever is earlier.

1. Terms used:

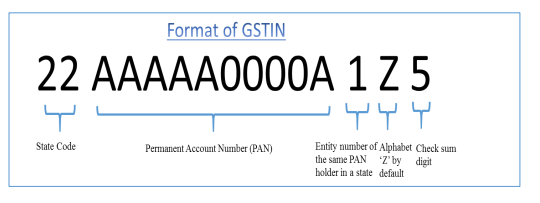

- GSTIN: Goods and Services Tax Identification Number

- UIN: Unique Identity Number

- UQC: Unit Quantity Code

- HSN: Harmonized System of Nomenclature

- POS: Place of Supply (Respective State)

- B to B: From one registered person to another registered person

- B to C: From registered person to unregistered person

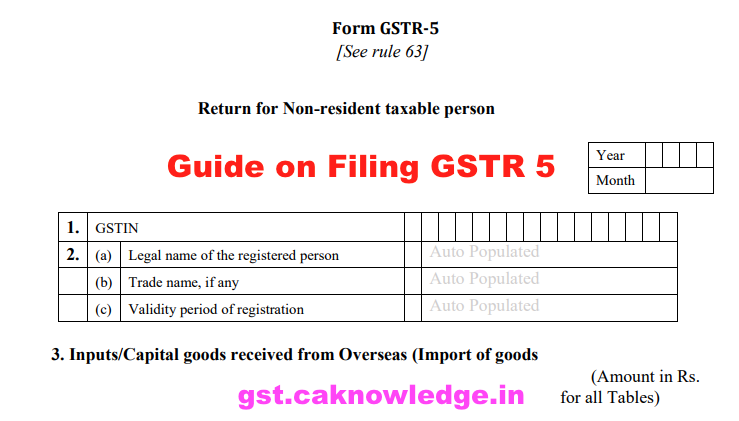

Guide on Filing GSTR 5 on GST Portal

Form and manner of submission of return by non-resident taxable person.- Every registered non-resident taxable person shall furnish a return in FORM GSTR-5 electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner, including therein the details of outward supplies and inward supplies and shall pay the tax, interest, penalty, fees or any other amount payable under the Act or the provisions of this Chapter within twenty days after the end of a tax period or within seven days after the last day of the validity period of registration, whichever is earlier.

Heading along with the details required for GSTR 5:

Advertisement

GSTIN – GST Number (GSTIN) is a unique 15 digit number which is allotted to the assessee at the time of filing an application for registration for Goods & Service Tax. Each taxpayer will be allotted a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN). Just like PAN Card No is required for payment and filing of Income Tax Returns, similarly GSTIN is required for payment and filing of GST Returns.. The GSTIN of the taxpayer will be auto-populated at the time of return filing.

Legal name of the registered person or Trade Name – Name of the taxpayer, will also be auto-populated at the time of logging into the common GST Portal.

Applicability – GSTR-5 is applicable to non-resident taxable person and it is a monthly return.

Due Date – The details in GSTR-5 should be furnished by 20th of the month succeeding the relevant tax period or within 7 days from the last date of the registration whichever is earlier.

Address – Business address of the composition dealer will get auto-populated here.

Period of Return – A Taxable person is required to select from a drop down the relevant month and year respectively for which GSTR-5 is being filed.

Goods Imported – This section will hold details of all physical goods that have been supplied into a taxable territory in India. This includes the Bill of Entry No. 8-digit HSN Code and other basic description of the goods imported.

4. Table 3 consists of details of import of goods, bill of entry wise and taxpayer has to specify the amount of ITC eligible on such import of goods.

5. Recipient to provide for Bill of Entry information including six digits port code and seven digits bill of entry number.

6. Table 4 consists of amendment of import of goods which are declared in the returns of earlier tax period.

7. Invoice-level information, rate-wise, pertaining to the tax period separately for goods and services should be reported as under:

- i. For all B to B supplies (whether inter-State or intra-State), invoice level details should be uploaded in Table 5;

- ii. For all inter-state B to C supplies, where invoice value is more than Rs. 2,50,000/- (B to C Large) invoice level detail to be provided in Table 6; and

- iii. For all B to C supplies (whether inter-State or intra-State) where invoice value is up to Rs. 2,50,000/- State-wise summary of supplies shall be filed in Table 7.

Import of Services – Under this head, the foreign taxpayer is required to furnish details of services received from a supplier located outside India. This is a case wherein one foreign taxable person has received services from another foreign taxable person in Indian Territory

Amendments in Services received from a supplier located outside India – Any subsequent modification in service invoice and eventual change in IGST rate and the amount will need to be reported under this head. This modification will also result in IGST credit admissibility.

Outward Supplies made – Once all the details of inputs are captured, the foreign taxpayer is required to furnish details of outward supplies or sales in simple words under this head. This will be a GSTIN based entry wherein GSTIN of the buyer must also be reported. The Foreign taxable person is required to furnish this information along with the complete break-up of IGST, CGST and SGST charged.

Amendments to the details in Outward Supplies – Any kind of modification in outward supplies of previous taxable period/months is required to be made under this head. This will include revised particulars of the new invoice issued for such amendments.

8. Table 8 consists of amendments in respect of

- i. B2B outward supplies declared in the previous tax period;

- ii. “B2C inter-State invoices where invoice value is more than 2.5 lakhs” reported in the previous tax period; and

- iii. Original Debit and credit note details and its amendments.

9. Table 9 covers the Amendments in respect of B2C outward supplies other than interState supplies where invoice value is more than Rs 250000/-.

10. Table 10 consists of tax liability on account of outward supplies declared in the current tax period and negative ITC on account of amendment to import of goods in the current tax period

On submission of GSTR-5, System shall compute the tax liability and ITC will be posted to the respective ledgers.

Recommended Articles.