Apportionment of Credit on Inputs and Input Services under GST. The entire scheme of taxation under GST is to reduce the cascading effect. At each stage of taxation, input tax credit is allowable to the registered taxable person. It being a destination based consumption tax; the burden of tax shall be borne by the ultimate consumer.

Provisions relating to eligibility to input tax credit are contained in section 16 of CGST Act. Further, section 17 provides for apportionment of credit and blocked credits.

Provisions relating to apportionment of credit are applicable to the cases where goods or services are partly used for business purpose and partly for other purposes. In such cases, credit is available only to the extent they are used for business purposes.

Apportionment of Credit on Inputs and Input Services under GST

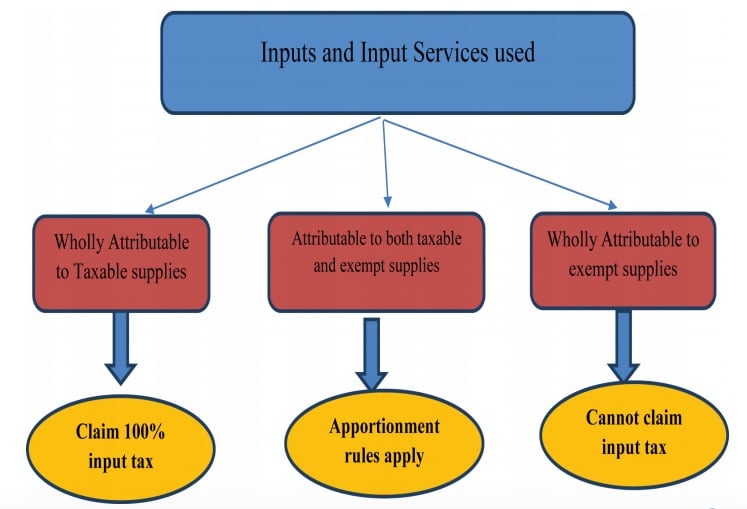

Similarly, wherever the goods or services have been used partly for effecting taxable supplies and partly for exempted supplies, the amount of credit shall be restricted to so much of credit as is attributable to the taxable supplies. For this purpose, taxable supplies would include zero rated supply also. As per section 16 of IGST Act, zero rated supply relates to supply of goods and services for export or supply to a Special Economic Zone developer or a Special Economic zone unit.

The procedure for apportionment of credit are contained in rule 7 of draft Input Tax Credit rules. These provisions are similar to the provisions contained in Rule 6(3) and Rule 6(3A) OF CENVAT Credit Rules, 2004

Rules provide that input/input services exclusively intended to be used for purpose other than business or for effecting exempt supplies shall not be eligible for credit.

Similarly, the amount of input tax in respect of inputs/ input services/ capital goods on which credit is not allowable (blocked credits) u/s 17(5) are also not eligible for credit. The details of blocked credits are not being discussed in this article.

Out of the remaining credit, credit which is exclusively relatable to taxable supplies or zero related supplies shall be fully eligible for credit.

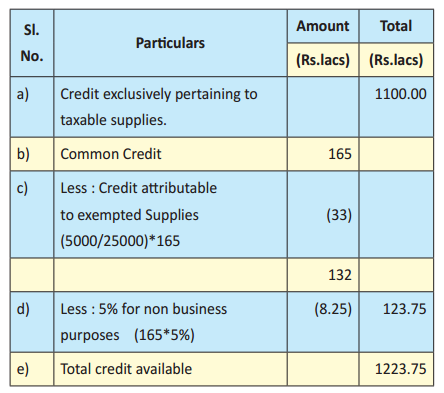

After allowing the aforesaid credit, the remaining credit shall be distributed on proportionate basis between the exempt supplies and taxable supplies (including zero related supplies).

In case, the remaining credit has also been used for non-business purposes, the rule provides that 5% of the credit should be excluded towards the said use for non-business purposes.

The aforesaid computation has to be done on the basis of exempt and taxable supplies of the same month. In case the data for exempt or taxable supplies is not available for the same month, the computation shall be done on the basis of exempt/ taxable supplies of the previous tax period.

The aforesaid exclusions are to be computed finally for the financial year before the due date for filing the return for the month of September following the end of the financial year and wherever the amount of credit allowable works out to be lesser than the amount of credit already taken, the difference shall be added to the output tax liability. The registered taxable person shall also be liable for the payment of interest at the appropriate rate from April of the succeeding financial year till the date of payment.

Wherever the amount of credit allowable works out to be more than the amount of credit already taken, the difference amount shall be claimed by the registered taxable person as credit in his return for the month not later than the month of September following the end of financial year to which such credit relates.

As mentioned earlier, the computation procedure in Rule 7 of draft Input Tax Credit rules is almost same as it is contained in Rule 6(3A) of Cenvat Credit Rules, 2004. New rules however provide for disallowance of credit relating to personal purpose or non business purpose also.

Another important feature of these rules is that it does not give any option of reversal at fixed percentage (which is presently 6% of the value of exempted goods and 7% of value of exempted services).

In the actual practice there may be several difficulties in computing the aforesaid amounts and may invite litigation as has happened under Rule 6 of the Cenvat Credit Rules, 2004

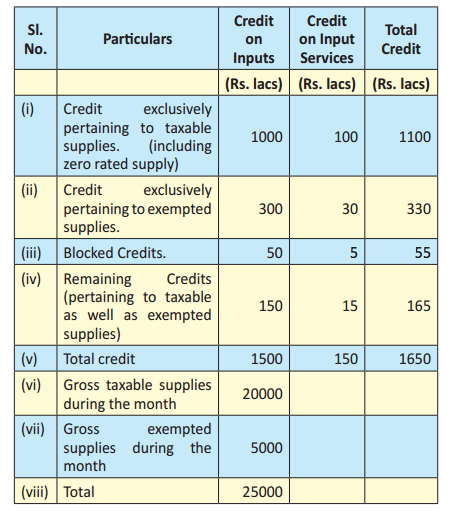

The aforesaid system of apportionment of credit may be clarified by the following example:

“A Pvt. Ltd., is engaged in the manufacture of sugar and molasses. It also has a distillery unit where it is engaged in the manufacture of potable liquor (non-taxable goods) and ethanol (taxable goods). Some of the goods/ services might have been used for nonbusiness purpose/ personal purpose of the proprietor.

The details of credit on inputs and input services for the month of December 2017 are as under:

As per Rule 7 of draft Input Tax Credit Rules, out of aforesaid Rs. 1650 lacs credit, sum of Rs.1223.75 lacs would be allowable to M/s A & Co. for the month of Dec 2017.

The aforesaid computation has to be separately done for CGST, SGST, UTGST & IGST.

Recommended Articles –