Tally Ledgers Groups List, Accounting Groups in Tally 3.0

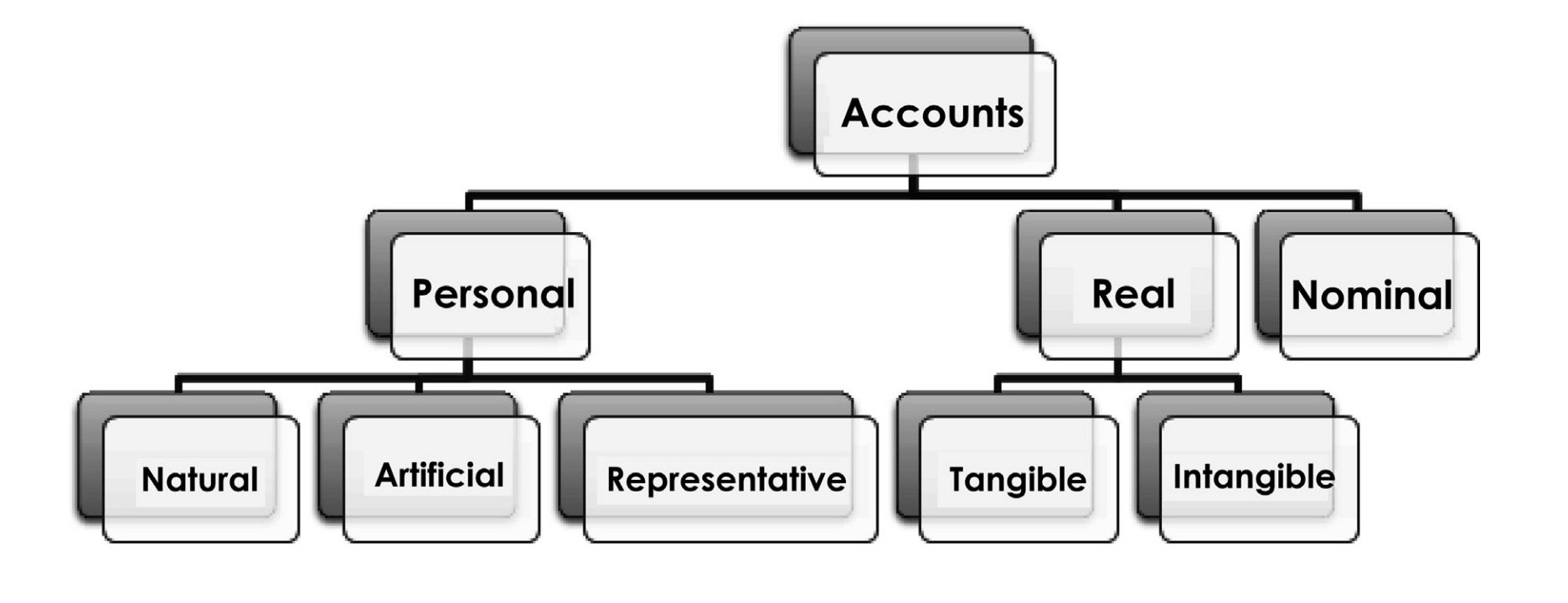

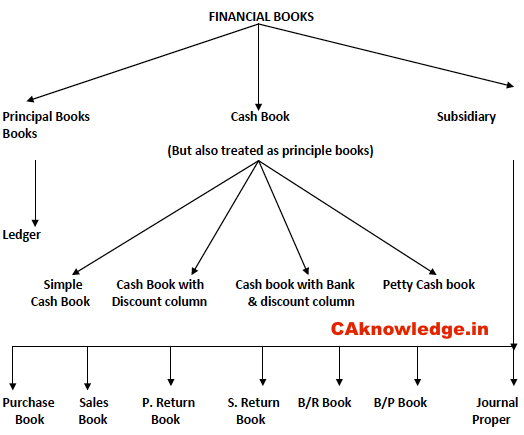

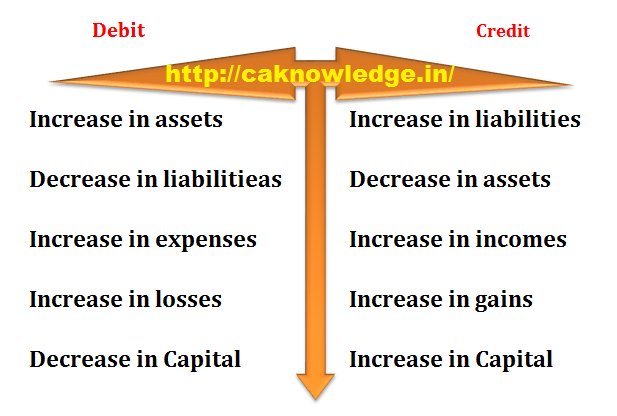

List of Tally Ledgers Groups List pdf: (Tally ledger under which head). check the complete list of tally ledgers created under the group list of Tally ERP 9 AND Earlier tally versions. tally ledger under group list in Hindi, Ledgers are a very important part of Journal Entries in Tally. Here we provide a list of common ledgers created … Read more