Fund flow statement also called as statement of “source and application of funds” which provides insight into the movement of funds and useful to understand the changes in the structure of assets, liabilities and equity capital And to analyze the flow of funds.

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Meaning Fund Flow Statement

Funds flow statement is based on the concept of working capital while cash flow statement is based on cash which is only one of the element of working capital.

- Fund means Working capital – difference between current assets and current liabilities

- Funds flow statement analyses the reasons for change in financial position between two balance sheets

- Funds flow statement shows the inflows and outflows of funds – Sources and Application of funds during a particular period

Objective ofFund Flow Statement

Funds Flow Statement is a statement prepared to analyse the reasons for changes in the Financial Position of a Company between current year and previous financial year. It displays the inflow and outflow of funds.

Advertisement

Content in this Article

How to prepare funds flow statements :

A.Working capital – changes :

For preparing the Funds Flow Statement, the first and foremost thing to be done is to prepare the Statement of Changes in Working Capital. There may be several reasons for changes in the Working Capital Position of any business concern. Some of the reasons are as follows.

1.Repayment of a Long Term loans or Redemption of Preference Shares without raising other long term resource.

2.Payments of amount towards Dividends in excess of the Profits earned.

3.Purchase of Fixed Assets or Long Term Investments without raising other types of long-term Long Funds.

B.Calculation of funds from operations:

Apart from investing an financing activities the company generates its major revenue from normal business operations. This is to be prepared by noting all the cash generating operations of the business.

Net Income

Add:

- Depreciation

- Amortization of Intangibles and deferred charges

- Amortization of loss on sale of investments or fixed assets

- Losses from other non-operating items

- Current year tax provision

- Transfer to reserve

- Proposed dividend

Less:

- Profit on sale of investment or fixed assets

- Any subsidy credited to P and L A/c

- Any written back reserve and provision

C.Preparation of funds flow statement:

While preparing the Funds Flow Statement, the Sources of funds and application of Funds are to be disclosed clearly so as to disclose the Sources from where the Funds have been generated the uses to which these Funds have been applied. This Statement is also sometimes referred to as the Sources and Applications of Funds Statement this is also called as Statement of Changes in Financial Position.

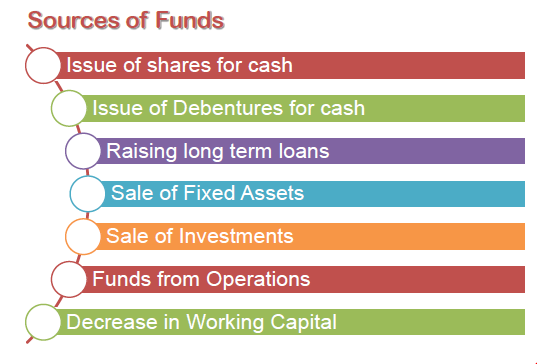

A. Sources of funds :

Funds can be procured from different sources available in the market Some of these are

- Decline in working capital assets

- Funds from Operations

- Sale of Investments and other Fixed Assets

- Issue of Shares and Debentures for Cash.

- Long Term Loans.

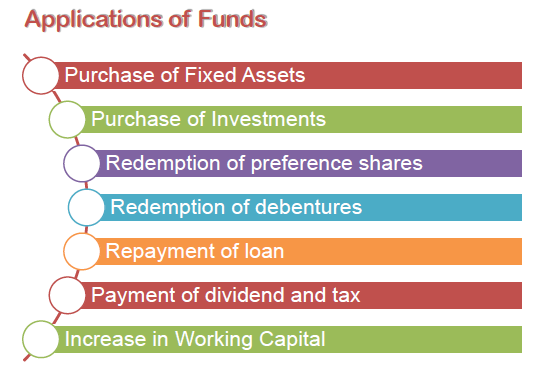

B. Applicatioon of funds :

Funds procured through different sources as stated above will be used in various applications as :

- Increase in Working Capital.

- Redemption of Debentures, Preference Shares and Repayment of Loan.

- Payment of Dividend and Tax.

- Purchase of Fixed Assets.

- Purchase of investments.

Recommended Articles

- Accrued Liabilities – Meaning, Definition with Example

- Accounting Entries for Service Tax, VAT and TDS

- Accounting Standard 15: Accounting for Retirement Benefits

- List of Ind AS Notified by MCA – Indian Accounting Standards

- Accounting for Rectification of Errors

- Distinguish Accounting, Auditing and Investigation

- Meaning of Accounting and Scope of Accounting

- Various Types of Vouchers In Accounting

- Subsidiary Books And Their Advantages