India witnesses a significant growth of startups. Now the startups are stepping into semi urban and rural area as well. Managing finance of a startup is the key to success. Financial management of a startup is not like the same as of an ongoing business. At the initial stage, when there is small fund availability, uncertainty about the market and a number of jobs to be carried out together to bring the project on track to commence the business, at that time managing finance constitutes a close vigil on cash flow movement and a robust business plan for next one to five years.

Management Accountants require to equip with techniques of financial modeling, cash flow forecast, right time to raise the fund capital, convincing ability to the lenders and investors in order to grow the business and how to save the business from negative cash flow.

This Article is written with a view to understand the Cash flow model, forecasting technique and application of business valuation model to raise the capital fund for a startup.

When we think about startup, a full cycle of business activity at a tiny level developed in observance. But hardly we think about managing the finance. Managing finance for most of the startups is not well-thought-out seriously for obvious reason of ‘business is meant for earning revenue and profit’. A number of activities, events, actions and trails are being conducted at the beginning of a startup. Goal of each activity is to set up the project, run the project and get the desired output from the project as early as possible. Needless to say, that each activity counts Expenses and Revenue and /or Cash inflow and Cash-outflow. Managing finance of these activities is the key to success for a startup.

Advertisement

Content in this Article

Startups Managing Finance

Sure, every startup has self-belief and introspection, If the business is financially sustainable! Is the business needs funding! How to bring the business debts free at the earliest! How to maximize the business value to attract more investments! Etc. Answer to all those is one – manage the cash flow forecast effectively. Unfortunately, many startups avoid or make poor use of cash flow forecast land them to disrepute.

Long term sustainability of any business is always measured by two major KPIs. Startup is also not exceptional to those

Solvency – Judged by income statement and the balance sheet.

Cash Flow – Measured by detail cash flow analysis and cash availability to meet the future obligations. In other words, get an idea of liquidity in the business.

Liquidity – Ensures cash availability, working capital need and robust working capital cycle.

Measuring financial matrix

Renouncing all accounting, financial and taxation jargons, an investor of the startup always interested to know his return on investments in physical cash. That is, how fast and how much the return could be expected from the investments. An income statement and Balance sheet may be good indicators to measure the performance of the business, however it does not show financial success outlook, when we closely monitor the activities in terms of cash. A business may be showing some profit in the income statement, but if it fails to pay its obligation bills, the business may fall.

Thus, Cash flow model is much more valuable financial tool than the income statement and the balance sheet. If we do not put the cash flow at the top, we are going to put the business at very high risk. Further, if we seek debt or venture funding from outside, only cash flow statement helps to review the business by an investor.

A robust business plan helps to understand where the business will go, and how this will look-alike after a span of 2 – 3 or next 5 years down the line. Seeking help of competent financial professionals is always advisable to dealt in. In course of fund-raising process, bankers typically ask for financial plan with sensitivity analysis spread over normal to worst scenario case.

Some banks or investors may ask for more detailing to understand, how much the business needs funds and when. At a later stage, the Financial planning model proves to be a strong tool to make the business valuation under discounted cash flow method (DCF) by applying the present value of free cash flow at the terminal value of the financial model.

Cash Flow

Cash flow management is the Key. Many startups fail for various of reasons, but one is far more common than others ‘Running out of Money’. Contrary to that, if a startup is keeping the Cashflow model at the heart- success is imminent. Therefore, it is required to know where every single penny is coming from and going out. When we discuss about ‘Cash Flow Model’ it always ‘Direct Cash Flow method Model’. At this stage when primary focus is on the structure building exercise of the new business, pondering about finance, and others is not warranted.

it is very. But, at the same time, the owner must vigil about the cash expenses and others. Thus, let us start with simple excel sheet model and template of cash incoming and outgoing detail. While developing the cash flow model, it is largely to be made in two forms. Short-term Cash flow forecast and long-term cash flow forecast.

Short term Cash Flow forecast

Generally made for next one year on monthly basis, and the major items of monthly data is broken down on weekly basis. This is most valuable financial tool exercise the internal control mechanism. This applies to all the activities of the startup and understand from where/ when to bring the cash and where / when to spend the money. While doing so, we list down all the sources, from where the cash is going to in-flow and all those activities, where the cash has to spend out.

Revenue and Cash Inflow

There is always an ambiguity between revenue and cash in-flow. Golden rule is all revenue is not always cashflow and all cash inflow is not a revenue. Thus, revenue stated in the income statement would not necessarily equal to cashflow. Revenue provides measures of effectiveness of sales and marketing, where cashflow is money or liquidity monitoring exercise. Cash flow includes cash sales revenue, collection from debtors and other collections, like advance deposits, refunds etc.

Like-wise, expenses are not synonymous to cash outflow. A simple example of insurance premium paid for one year or more is a cash outflow but, amortization of that premium over monthly basis is the expenses, forming part of income statement. At the beginning, real number may be far from truth, thus the cash flow statement must be reviewed periodically, in particular on weekly basis and monthly cash flow to be detailed at weekly basis. This exercise will help to monitor each element of cash flow at the micro level.

Developing Cash Flow Model

A business plan or cashflow forecast is conceptual or theory. Creating a model or template is not a difficult task. Even a number of spread sheet model are easily available online could be used, which suits to the business. Game starts when we start putting the numbers in the template. In a running business forecasting the sales, revenue and expenses is comparatively easier than the startup.

Obvious reason, the running business have a historical trend and industry available bench mark. But for startup! There is not historical data at all. Also, industry benchmark can’t be applied so easily, when the growth pattern is unknown. From here real thinking and brain storming process starts and a professional finance makes a valuable contribution to the business.

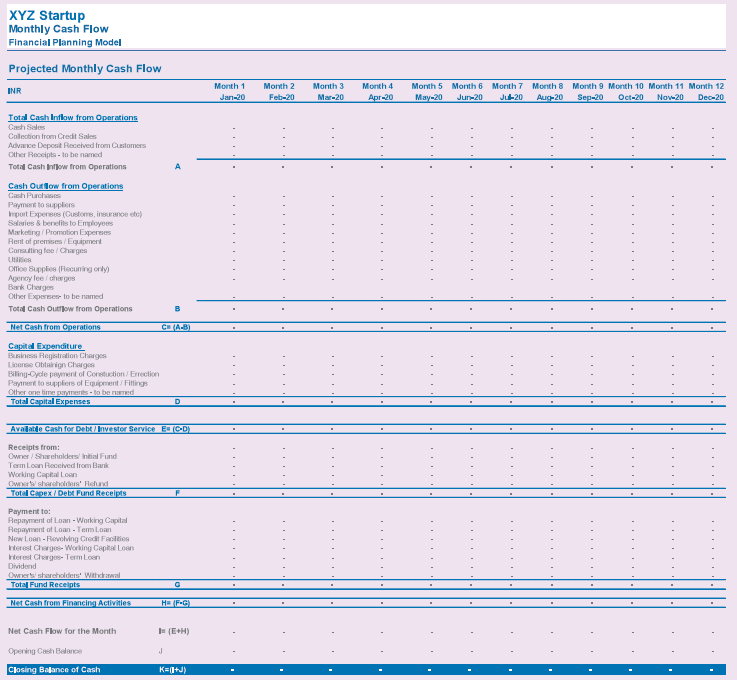

A Cash flow statement is not straightforward or standardized. It’s purely depends on the nature of the business and how the business needs to be controlled, which gives maximum information to the investors. Basic feature of a typical Cash Flow model should have:

- 1. Easy to handle and convincing to all the users.

- 2. Element of cash flow headings must match with the business model.

- 3. Must be at least on monthly basis. Even the month should be backed by on weekly basis.

- 4. The owner / investor must be strict to achieve the numbers forecasted in the cash flow.

- 5. The data must be regularly (on daily basis)to be updated and revised, based on the previous feedback.

- 6. A detail variance analysis to be reviewed with actual figures. Accountability to be fixed and action plan to be chalked for forthcoming period.

- 7. Any significant variation or changes should be communicated to the key stakeholders with all explanations.

- 8. Business-related cash transaction must be absolutely identical to family / personal related.

- 9. Always commit to Positive Cash Balance. A typical Cash Flow template is appended below to understand what and when the items of in-flow and outflow are to be captured.

Forecasting Process

For an ongoing business, forecasting of revenue as well as expenses is easier than the ‘Startup’. It is a diving exercise into the unknown scenario. Expenses and cost could be forecast to some extent, because market price of most of goods and services are available online, for which startup going to buy or avail in coming periods. But revenue is one of the most difficult tasks for a startup to visualized and put into the template for next one year or more on monthly basis.

If it is a running business, planning a budget for next one year or more could be made by applying a certain growth factor, but for a startup, two key factors make difficult to forecast revenue. Firstly, it is an exercise to start from zero level and secondly, the growth trend is unaware

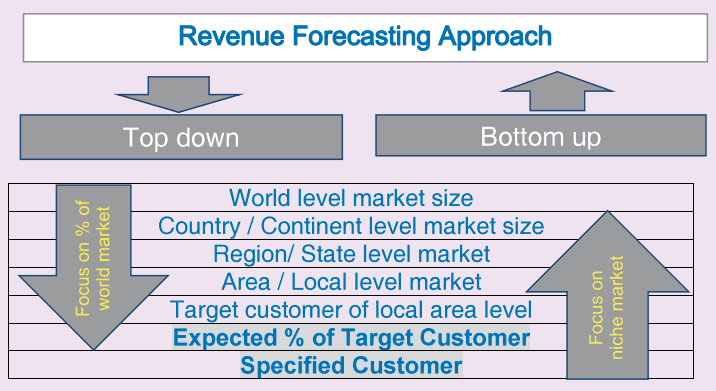

We all know that firstline of forecasting process is- Revenue. Forecasting revenue is depend on a number of variables and largely it depends on owner’s confidence level, market research, data availability, target customers and business ability to spend on marketing and promotion or in other words, size of startup. If we go deep and more precise for revenue forecast, for simplicity purpose, two approaches are explained. Top down approach and Bottom up approach. Under top down approach, we acknowledge the whole size of the market at world level and region or country level.

This size is narrowed down to startup’s reach level in terms of geography or class of customers. Contrary to that, in the bottom up approach, the owner signifies the business at the niche market, where he finds to be suitable and a reasonable growth level of the revenue over a period of time. Whatever the method applied, the number must be fully backed by market research, data interpretation and sensitivity level from normal to worst case scenario. The number must be reasonably achievable and fit into the argument. A typical example of top down and bottom up approach of revenue forecasting is appended in the following picture.

Key elements of a robust forecast

1. Business Cycle -Understand the whole business cycle from beginning to end. From purchasing the goods/ services to processing, logistics, selling and collecting the money from the customer is one of the key elements to forecast the cash flow forecast. This cycle gives full glimpse of cash and non-cash activity in one go. Also, while forecasting of collections from debtors and payment to the suppliers in average number of days is calculated.

2. Apply both Approaches- Apply both methods (topdown and bottom-up) approaches while forecasting the revenue. This helps to understand the whole market size, target to achieve the market share as well as focus on the niche market to provide qualitative services.

3. Logical Data based research- All data, research and analysis should be logically captured, convincing to the third party and able to reach to a logical conclusion. In practice, this is a very lengthy exercise. A number of business uses google ‘Awords Keyword Planner’ a very useful tool for research-based analysis, powered by artificial intelligence, multilingual and locations. Using keyword planner, we can search a particular word, related to the product / output, how many people search this keyword, globally or at continent/ country level.

4. Fully aware about seasonality- If the nature of sales is affected by season, it must be drawn on monthly / weekly basis and level of inventory purchase, process and manufacturing timing, logistics and delivery system to be forecasted.

5. Sensitivity analysis- Afterall the forecast is not the truth. It is just an idea or direction to move forward. A cashflow forecast may fall short or excess against the actual by 1% to Nth %. Thus, it is advisable to maintain a sensitivity analysis minimum @5% to 50% at the beginning of the business. Also, the forecast should not be too optimist or too pessimist. As explained earlier each element of forecast must be normal to worst case scenario.

6. Understanding Tax aspects- In most of the cases, taxes are exempted for startup. But the Government provides a number of tax benefits and incentives to the business on fulfilling of certain conditions. Always try to achieve those targets and avail those incentives. This helps not only in monetary benefits but improve credit ratings in eyes of lenders.

7. Control on expenses– Keep a full control on expenses and meeting obligations- timely payments of dues and obligation, avoids penalties and non-productive expenses. Also, try to maintain a reasonable number of employees. At the beginning, it is always advisable to take the job through professionals to minimize recurring expenses. The business must ensure that the business should not fall under some statutory/ legal action, which ultimately divert the focus from the main business and leads to waste of money, energy and time.

8. Contingency Plan- After all forecast is forecast and is not the accurate number. Always there is possibility of some unforeseen or emergencies, which is not easy to visualize. Practically a certain % of revenue to be kept as a contingency.

9. Needs of Funding- In the cash flow forecast, fund requirement should be fully explained with month and heads of requirement. How and when to refund back the funds to the lenders. Collateral security if any to be identified with value of obligations. 10. Finance Professional- Seek help of a finance professional equips with in-depth and hands-on knowledge financial modelling, data-based research for startup and new business, ability to convince to lenders, investors and shareholders and helps to startups to grow their business at desired level.

Long term Cashflow forecast

When we prepare the cash-flow forecast for more than a year, it is called long term forecast. In general, the longterm cash flow forecast is made for one to five years or some time more than that if the debt refund tenure goes beyond five years. This is made with a view to look at ‘how the business looks like’ after one to five years. Also, if the business grows at a normal pace of economy or not. Sue this forecast is no way 100% accurate, but it gives a directional idea to the business in the future.

However, in-spite of its’ short coming the long term cashflow forecast has advantages, when it is backed by full scale business plan. Lenders mostly us this for the purpose of business valuation and estimating the free cash flow available to the business to meet the debts obligation. A research based, reasonable and logical long-term forecast is always required by a startup, to produce before the lenders and investors while seeking funds. Golden rule for long term cash flow statement is – Cash inflow must exceed the cash outflow, if it provides return to investors and ending cash balance must be positive.