Pre – Open session of Stock markets NSE and BSE. Any stock market in the world is highly volatile at the time of beginning of the day. There are many initiatives maintained by the regulatory bodies of these stock exchanges across the world. Pre-open session is one among these sort of practices. It’s a regularly used while discussing about the stock market in the morning at the opening time of the trading. Let’s learn about this pre-open session at a glance.

Pre – Open session of Stock markets NSE and BSE

1. Pre-Open Session:

Before learning what a pre-open session is we have to be aware of the term “call auction”. Call auction enables the buy order and sale order to be continuously placed till the end of the order entry period. This is a mechanism designed to obtain the market opening price and quantity traded are derived based on aggregated supply and demand for the underlying stocks.

Pre-open session is a time where the call auctions are placed till the market gets started. The main intention of this session id to arrive at an ideal opening price of a stock for the current day’s trading session. Generally at the beginning of the trading early in the morning there will be very high volatility in the market. To avoid the effect of this unitability pre- open session was brought into practice.

2. Timings of Pre-Open Session

| Time | Session’s task | |

| 9:00 AM – 9:08 AM | Period for “Order entry” | Orders are placed and can be modified within this time. |

| 9:08 AM – 9.12 AM | Period for “matching the Orders” | Orders are executed and price will discovered |

| 9:12 Am – 9:15 AM | Buffer period | Acts as a transition period for switching into normal trading session. |

At 9:15 AM normal trading will be started and continuously be operative till the day’s trading ends at 3:30 PM.

Advertisement

Content in this Article

3. Unmatched orders :

During the period for matching the orders all the orders which would match with a similar requirements will be executed and will form part of the price discovery (opening) process for the day. It’s common that certain orders will not be matched and cannot be executed by the system during this period. These type of unmatched orders will be carried forwarded to the normal trading session at previous day’s closing price.

4. Price at which the orders places during Pre-Open Session will be executed?

Before knowing about the price we will just see what type of the orders can be made in the market having the price and quantity as main aspect. There are mainly 2 types of orders.

a. Market order :

Those orders placed by the participants with no pre-determined price for their execution. These are executed based on the best available price. Unmatched orders of this type are carried forwarded to normal trading session at Opening Price.

b. Limit order :

These are the orders where the participants specify the price and quantity for buying or selling. Limit Orders that are not matched during Pre-Open Session will be moved to normal trading session at the same price.

Must Read –

- Various ways to minimize loss in share trading

- First Step to Enter in Market by A CA Students

- SEBI Overview

5. How the opening price is discovered :

The system automatically arrives at an equilibrium price for every stock in respect of which the orders are matched. Price at which maximum number of scrips can be traded based on the demand and supply quantity and the price is marked as equilibrium price. This is called as the discovered price for starting the day’s trading of a particular stock.

Let’s see an example of an order book of a particular share as follows:

| Buy price | Buy quantity | Sell price | Sell quantity |

| ₹ 1000 | 1 | ₹ 1000 | 5 |

| ₹ 995 | 2 | ₹ 995 | 4 |

| ₹ 990 | 3 | ₹ 990 | 3 |

| ₹ 985 | 4 | ₹ 985 | 2 |

| ₹ 980 | 5 | ₹ 980 | 1 |

The automated systems of the stock exchange platforms will calculate the cumulative quantity can be traded at each point as follows:

| At a price of | Cumulative qty (Buy) | Cumulative qty (Sell) | Maximum tradable quantity |

| 1000 | 1 | 15 | 1 |

| 995 | 3 | 10 | 3 |

| 990 | 6 | 6 | 6 |

| 985 | 10 | 3 | 3 |

| 980 | 15 | 1 | 1 |

In the above illustration 1st table has the price and quanity details of the various orders placed (limit orders) in the market. And 2nd table has the cumulative number of shares based on the information furnished in 1st table.

- At a price of ₹ 1000 the trader wants to buy 1 share

- At ₹ 995 a trader wants to buy 2 scrips

- This goes on same till the price ₹ 980 where the order maker wants to have 5 shares.

- In the sale orders data at a price of ₹ 1000 he wants to sell 5 shares

- At a price of ₹ 995 he will sell 4 quantity

- This will go on till ₹ 980 where he can sell only 1 share.

Cumulative Analysis:

- At a price of ₹ 1000 maximum 1 share can be bought and 15 shares can be sold ie the demand is 1 and supply is 15.

- At a price of ₹ 995 maximum 3 share can be bought and 10 shares can be sold ie the demand is 3 and supply is 10.

- At a price of ₹ 990 maximum 6 share can be bought and 6 shares can be sold ie the demand is 6 and supply is 6.

- At a price of ₹ 985 maximum 10 share can be bought and 3 shares can be sold ie the demand is 10 and supply is 3.

- At a price of ₹ 980 maximum 15 share can be bought and 1 share can be sold ie the demand is 15 and supply is 1.

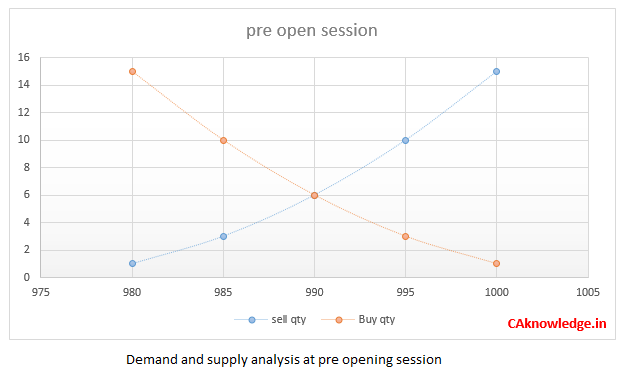

Graphical Representation:

If we give a graphical chart to the data presented in 1st table it looks as follows:

Here if u closely observe at a price of ₹ 990 Demand = Supply. So this is the price that can be taken as equilibrium. So this will be used as the opening price for the day. The point of intersection of the both curves is equilibrium point.