SME IPO – BSE’s SME Exchange and NSE’s Emerge. Check outSMEs – Advantages in going public. Check out Details for Various Types ofSME IPOs in Detailed.

Small and medium enterprises (SME):

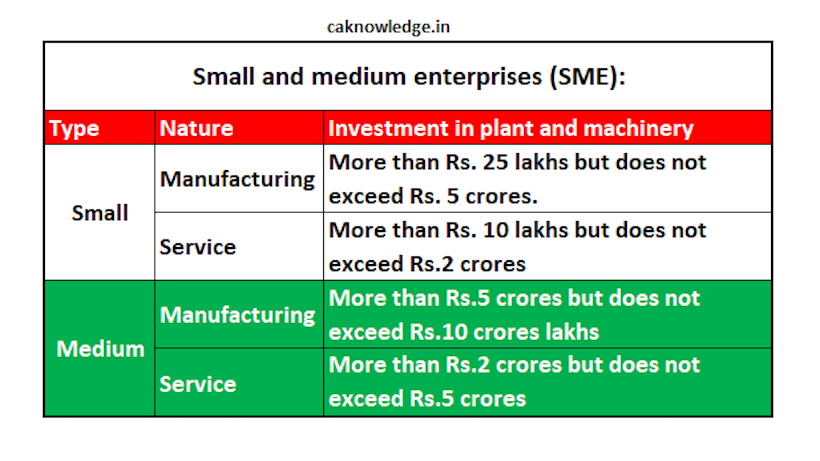

Micro, Small and Medium Enterprises development act (MSMED) 2006 defined small and medium enterprises (SME) as follows:

| Type | Investment in plant and machinery excluding land and building for enterprises engaged in manufacturing | Investment in plant and machinery excluding land and building for enterprises engaged in providing services |

| Small | More than Rs. 25 lakhs but does not exceed Rs. 5 crores. | More than Rs. 10 lakhs but does not exceed Rs.2 crores |

| Medium | More than Rs.5 crores but does not exceed Rs.10 crores lakhs | More than Rs.2 crores but does not exceed Rs.5 crores |

Small and medium enterprises contribute to over 40% of workforce in Indian economy. Though they have their major share in the economic development of the country, SMEs are still lagging behind in terms of funding and adequate support from the government. As a result, SME cannot adopt the new technology which involves huge capital. This eventually makes them less productive than their potential.

SME IPO:

In order to facilitate the SMEs with the opportunity to raise funds from the investors in stock market, a separate platform has been designed and implemented by BSE and NSE. SMEs will come up on to these platforms with initial public offers offering their shares to the wide range of investors.

Advertisement

Content in this Article

BSE SME:

The platform operated by Bombay stock exchange for SME to raise funds in stock market is called as BSE SME. It is the 1st SME Exchange in the country to get approval of the stock exchange regulator SEBI. BSE SME enables the listing of SMEs from the unorganized sector into a regulated and organized sector.

NSE EMERGE:

The platform operated by National stock exchange exclusively for the SMEs to raise funds through equity in the stock market is called as NSE EMERGE. The main focus is to bring together the potential investors and emerging corporates so that the businesses produce their best along with maximizing the investor’s wealth.

SMEs – Advantages in going public:

1. Wider access to capital:

For the SMEs having innovative business models, their growth story depends on how much access they have to capital. Through these platforms, SMEs can raise funds to transform themselves from today’s startups to tomorrow’s corporate giants.

2. High visibility in the industry:

Listed companies enjoy greater credibility and legal compliance. They will become known to wider section of the investors. This gives the companies an opportunity to penetrate into the existing market while creating base in the new arenas.

3. Tax benefits to the shareholders:

Listed securities are always advantageous in the events of sale. In case of sale of listed securities Short Term Gains Tax is charged at 15% and no question of Long Term Capital Gains Tax if it is a long term capital asset.

4. Enhanced liquidity to the shareholders:

In the stock market how easily can a share be sold decides whether that share has more market liquidity or not. Listed securities enjoy more liquidity than the unlisted bunch.

5. Enhanced market value:

A better performing listed company will lure the investors. This will increase the demand for the company’s shares making them valued at higher prices. This phenomenon will take the company’s value to another high level.

Recommended Articles

- What is listing and its Importance

- Pre – Open session of Stock markets NSE and BSE

- Various ways to minimize loss in share trading

- Is Stamp duty to be made on Share Certificate?

- Transfer of Shares in case of Death of the Holder

- What is short selling?

- IPO (Initial public offer)

- Are you an SME? Know Eligibility