Six thing to know about Time of supply under GST: The liability to pay GST will arise at the time of supply (ToS) as determined for goods and services. In this regard, separate provisions i.e. section 12 and section 13 prescribe time of supply for goods and services as discussed below:

Six thing to know about Time of supply under GST

Point of taxation means the point in time when goods have been deemed to be supplied or services have been deemed to be provided. The point of taxation enables us to determine the rate of tax, value, and due dates for payment of taxes. Under GST the point of taxation , i.e., the liability to pay CGST / SGST, will arise at the time of supply as determined for goods and services. CGST Act, 2017 states provisions to determine time of supply of goods under section 12 and time of supply of services under section 13 of the Act.

I. What is ToS for goods?

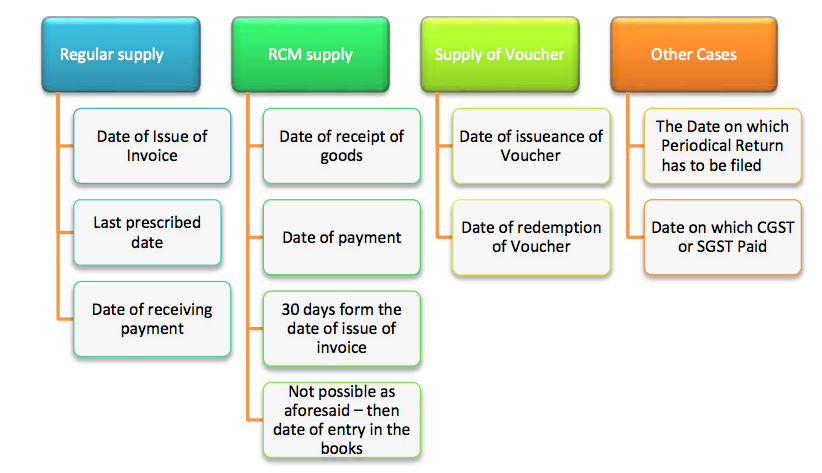

As per Section 12 of CGST Act, time of supply shall be earliest of:

In GST regime, tax collection will be earliest of the specified events as given above and this will be altogether a new concept for the current VAT and excise taxpayers as even on advance received GST will be payable.

II. What is ToS for services

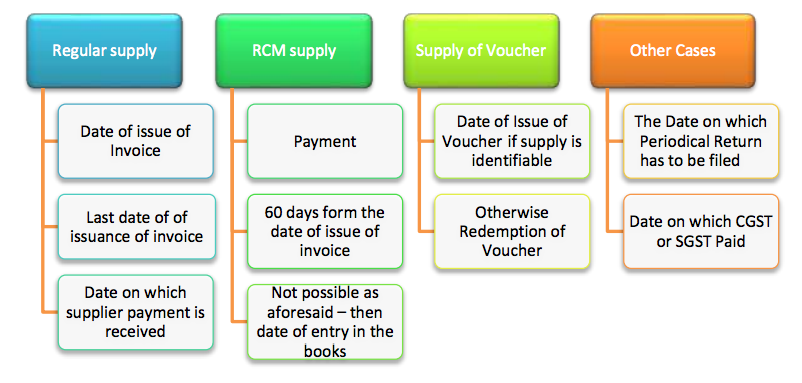

As per Section 13 of CGST Act, time of supply shall be earliest of:

III. What is ToS for Reverse Charge Mechanism (RCM) for goods?

In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely:-

- (a) Date of the receipt of goods; or

- (b) Date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

- (c) Date immediately following thirty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier

Also, it is provided that where it is not possible to determine the time of supply under clause (a) or clause (b) or clause (c), the time of supply shall be the date of entry in the books of account of the recipient of supply.

IV. What is ToS for Reverse Charge Mechanism for services?

In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earlier of the following dates, namely:

(a) Date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(b) the date immediately following sixty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier:

It is also provided that where it is not possible to determine the time of supply under clause (a) or clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply:

Further in case of supply by associated enterprises, where the supplier of service is located outside India, the time of supply shall be the date of entry in the books of account of the recipient of supply or the date of payment, whichever is earlier.

Re-conciliation required!

It can be observed that there are many parameters in determining ‘time’ of supply. Thus, determining the ‘time’ of supply and further maintaining re-conciliation between revenue as per financials and as per GST could be a major challenge to meet.

V. What is ToS for vouchers?

In case of supply of vouchers by a supplier, the time of supply shall be:

- (a) Date of issue of voucher, if the supply is identifiable at that point or

- (b) Date of redemption of voucher, in all other cases

VI. What is ToS for interest, late fees and penalty?

The CGST Act provides that the ‘time of supply’, to the extent it relates to an addition in the value of supply, by way of interest, late fee or penalty for delayed payment, of any consideration, shall be on the date on which the supplier receives such additional value.

Author: CA Pritam Mahure ([email protected])

Recommended Articles