After the rollout of GST in July 2017, E-Invoicing seems to be a game changer not only in GST related compliances but also to the whole “Procure to Pay” and “Order to Cash” business cycles.

The GST Council on 20th September 2019, has recommended introduction of electronic invoice, while the initial date for roll out was 1st April, 2020, the Government has deferred by notifying it 1st October, 2020, as revised date for implementation of e-invoicing for taxpayers whose aggregate turnover (PAN based) in a financial year is exceeding Rs 500 crore. Although few sectors are exempted like Banking, SEZ Units, Insurance, GTA, Multiplex.

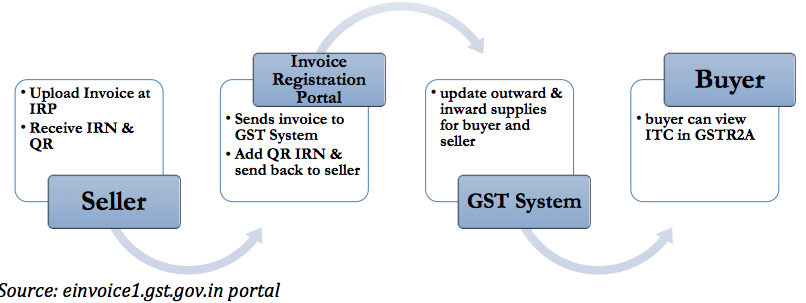

E-invoicing means reporting details of specified GST documents like GST Invoices, Credit notes and Debit notes to a Government-notified portal (At present NIC) and obtaining an Invoice reference number (IRN), Taxpayers will continue to create billing on their own ERP Systems, B2B invoices will be reported to ‘Invoice Registration Portal (IRP)’, further on reporting IRP returns e-invoice with unique ‘Invoice Reference Number (IRN)’ along with a QR Code. A GST invoice will be valid only with a valid IRN.

Needs for E-Invoicing

As per Government below are the needs for E-Invoicing

Advertisement

Content in this Article

- Ensures Digitization, Standardization, Interoperability and Paperless mode in invoice communication

- Eliminates data re-entry and reconciliation errors

- Improves payment cycles

- Reduces processing costs

- Reduces disputes among transacting parties

- GST reporting will be a lot more easier and indeed a by-product

- No further reporting to e-way portal.

There are several countries in the world who have implemented E-Invoicing like Brazil, Germany, France, New Zealand, and Malaysia.

Central Board of Indirect Taxes and Customs has issued below notification for giving legality for the purpose of generating E-Invoicing e.g notification No. (Central Tax) 68/2019 Dt. 13-12-2019 , 69/2019 Dt. 13-12-2019, 70/2019 Dt. 13-12-2019, 60/2020 Dt. 30-7-2020, 61/2020 Dt. 30-7-2020

E-Invoice Flow as per GSTN website:-

Further there are multiple modes are made available to the seller for uploading invoices to IRP like API based, Mobile app based, Offline tool based and GSP based modes.

E-Invoice schema has been introduced which is a JSON formatted (JavaScript Object Notation) machine readable, machine to machine language, there are total 133 fields out of which 45 are mandatory 88 are optional.

IRP will also generate a QR code containing the unique IRN along with key particulars like

- GSTIN of supplier

- GSTIN of Recipient

- Invoice number as given by Supplier

- Date of generation of invoice

- Invoice value (taxable value and gross tax)

- Number of line items

- HSN Code of main item (the line item having highest taxable value)

- Unique Invoice Reference Number

Android based QR code will enable Offline verification of invoices using Mobile App

Conclusion

Based on above we can say that the way business is dealing with other business entity is going to see a big structural changes after implementation of E-Invoicing, it will impact positive changes to whole procure to pay and order to cash business cycle as buyer will get to know that seller has raised the invoices and with the sophisticated used of technology there will be faster reconciliation activity, GST credits availment, working capital cycle improvement and there will be reduction in the processing costs and overall reduction in disputes among the transacting parties.

As shared in Bhagwat Gita by Lord Krishna who motivates Arjuna that “Changes are only Constant ” so take the above changes under GST regime positively as changes are the only constant for improvement , Let’s see and be part of that “best is Yet to come for Indian Economy post implementation of E-Invoicing