How to decide IGST, CGST, SGST while raising invoices in GST Regime.The Indian economy is all set for economic overhaul with the implementation of GST which is expected to create a Common National Market and provide a boost to Indian exports. GST, based on the notion “One Nation; One Market; One Tax”, will roll-out from July 1, 2017. GST being the biggest tax reform will be a turning point for the economy and would benefit all stakeholders i.e. the Government, Businessman, and consumers. In this constantly changing scenario, the Institute is proactively supporting the Government by contributing its suggestions on the one hand and disseminating awareness among the members and other stakeholders on the other hand. Now check more details forHow to decide IGST, CGST, SGST while raising invoices in GST Regime from below….

How to decide IGST, CGST, SGST while raising invoices in GST Regime

Invoice – when to raise and what are the contents?

Invoice to be raised before or at the time of removal of goods for stock transfer

Contents of the Invoice:

- 1. Name, address and GSTIN of the supplier.

- 2. A consecutive serial number containing alphabets, numerals and/ or special characters unique for a financial year.

- 3. Date of its issue.

- 4. Name, address and GSTIN or UIN of the recipient if he is registered.

- 5. Name and address of the recipient and the address of delivery, along with the name of State and its code if he is un-registered. Only in cases where the value of taxable supply is fifty thousand rupees or more.

- 6. HSN code of goods or Accounting Code of services.

- 7. Description of goods or services.

- 8. Quantity in case of goods and unit or Unique Quantity Code thereof.

- 9. Total value of supply of goods or services or both.

- 10. Taxable value of supply of goods or services or both after taking into account discount or abatement.

- 11. Rate of tax.

- 12.Amount of tax charged.

- 13. Place of supply along with the name of State, in case of a supply in the course of interState trade or commerce.

- 14. Address of delivery where the same is different from the place of supply.

- 15. Whether the tax is payable on reverse charge basis.

- 16. Signature or digital signature of the supplier or his authorized representative

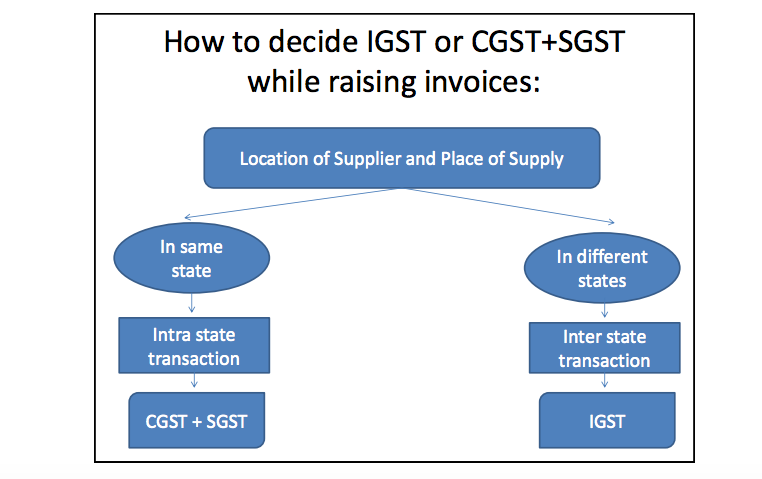

How to decide IGST or CGST+SGST while raising invoices:

Location of Supplier and Place of Supply

Advertisement

Content in this Article

In same state⇒Intra state transaction⇒ CGST + SGST

In different states⇒Inter state transaction⇒ IGST

Other points of determination:

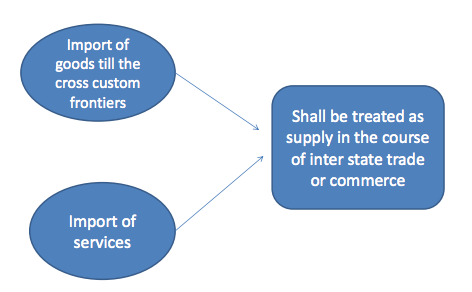

Shall be treated as supply in the course of inter state trade or commerce

- When the supplier is located in India and the place of supply is outside India

- Supply to or by a SEZ developer/ Unit

- Supply made to a tourist referred to in Sec. 15

- Supply in taxable territory – not being intra state supply and not covered elsewhere

How to decide IGST/CGST/SGST while raising invoices

Place of supply-Analyse Intrastate / Interstate

Type of GST Registration

- Regular, Composition, Casual Taxable person Input Service distributor

- Location

- Additional Place – Job work

- State wise

- Business Verticals

Type of Transactions Covered

- Schedule

- Service /Goods

- Composite / Mixed

- Exempted transactions/

- Reverse Charge Mechanism

- Taxable Transactions

- URD purchase

- HSN/ Rates

- Orders in hand

Transition for GST

- Goods sent from agent site

- Goods sent from warehouse

- Goods sent from transporter place

- Exempt v/s taxable – 2 separate invoices

- Composition – Bill of Sale

- Regular – Tax Invoice

- URD Purchase – Purchase invoice

- Advances- Receipt Voucher

- Discounts/price revision – credit note/Debit Note

- Changes in shipping bill formats and Bill of Entry

Goods Receipt Inwards from

- Vendors

- States

- Godown

- Import

Goods sent Outwards to

- Depot

- Agents

- Branches

- Customers

Records keepings –

- Formats,

- E-way bills

- Inventory records and its provisions with reference to Finished Goods and Raw Material as well

- Debit note and credit note

Tax Accounts

The important accounts to be maintained are of input and output accounts, transaction wise and business place wise general ledger are to be created and assigned. The accounts are to be separately. The main ledgers are

- Input CGST

- Input SGST

- Input IGST

- Output CGST

- Output SGST

- Output IGST

Transitional impacts

Temporary provisions may be required in the system to handle scenarios, such as returns of goods sold or purchased before GST and returned after GST implementation, stock in transit during cutover activities, etc.

- Open transactions, such as contracts, purchase orders, and sales orders need to be migrated to the new tax scenario. These would need changes in the system.

- Partially open transactions, such as goods received but invoice not booked, or goods issued for sales but not received by the customer, etc. need to be closed or reversed and migrated to the new tax scenario.

Invoice

- HSN/ SAC to be mentioned in invoice, which will have to be uploaded in the GST portal.

- HSN Code/Accounting Code -for each line item of an invoice in case of multiple codes in an invoice.

- For all B2B supplies, line-item level data in case multiple tax rate or HSN/ Service Accounting Code in one invoice.

- The GST Rules provides that the Commissioner by notification specify

- the number of digits of HSN code for goods or the Accounting Code for services, that a class of registered persons shall be required to mention, for such period as may be specified in the said notification, and

- the class of registered persons that would not be required to mention the HSN code for goods or the Accounting Code for services, for such period as may be specified in the said notification.

Recommended articles

- GST Quiz

- GST Rules

- Returns Under GST

- GST Registration

- GST Rate

- GST Forms

- HSN Code List

- GST Login

- GST Software

- GST Suvidha Provider

- State GST Act