How to Change Mobile no and Email Address on GST portal. Guidelines For Changing Email and Mobile Number of Primary Authorized Signatories Mentioned At The Time Of Enrolment Or New Registration. now check step by step procedure for how to updateMobile no and Email Address on GST portal @gst.gov.in. from below..

Change Mobile no and Email Address on GST portal

The steps which need to be followed by the user taxpayer for changing of email and mobile number: –

- Step-1:Taxpayers are require Login to GST portal (https://www.gst.gov.in/) with your user id and password.

- Step-2:After Successfully login please click on the registration menu and then select the non-core amendment.

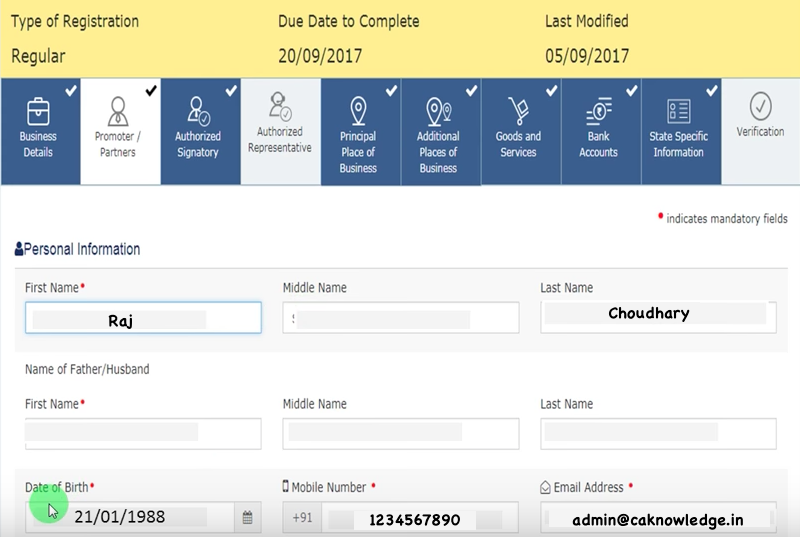

- Step-3: Click on the authorized signatory tab.

- Step-4: Add new authorized signatory whose email and mobile number user wants to use.

- Step-5: Go to verification tab and submit the application.

- Step-6: After submission of application please wait for some time ( 15 minutes).

- Step-7: Login again with user id and password.

- Step-8: Go to the authorized signatory tab – deselect the primary authorized signatory check box.

- Step-9: Select the newly added authorized signatory as primary authorized signatory (Important: Older mobile and email id will be prefetched by the system. Please ensure to change the mobile and email id to which you want to add.)

- Step-10: Go to the verification tab and submit, Now you mobile number is update successfully..

[Note: For Company/LLP DSC will be allowed. For EVC submission, OTP will come on newly added email/mobile number]

Recommended Articles

- GST Registration

- GST Definition, Objective

- When will GST be applicable

- GST Forms

- GST Rates

- GST India

- GST Login

- GST Overview 2017

- GST Bill 2017

- All About GST E Way Bill

- GST Rates Changed on Certain Goods

- GST Return Filing Due Date

- GST Due Dates