Capital Structure Meaning: What is Capital Structure? & Various Types of Capital Structure. When we plan to invest in a project, we also need to plan about procuring funds. And, procuring funds is not the end; we also need to decide the best composition of debt & equity so that we can get maximum funds at an overall combined lower rate. To do this, we need to plan a Capital Structure. Now check more details for “Capital Structure Meaning: What is? & Types of Capital Structure” from below…

Let us first understand what is a capital structure & then we will see what the various types of Capital Structures are.

Capital Structure Meaning

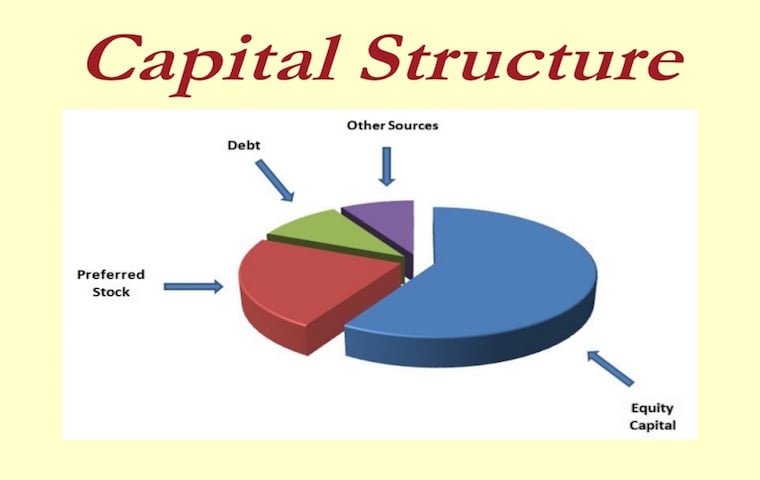

- Capital structure means the structure or constitution or break-up of the capital employed by a firm. The capital employed consists of both the owners’ capital and the debt capital provided by the lenders.

- Capital Structure of a firm is a reflection of the overall investment and financing strategy of the firm. It shows how much reliance is being placed by the firm on external sources of finance and how much internal accrual is being used to finance expansions etc. Let us now see what the various types of Capital Structure are:

KINDS of CAPITAL STRUCTURE:

- Horizontal Capital Structure: In a Horizontal Capital Structure, the firm has zero debt components in the capital structure mix. The structure is quite stable. Expansion of the firm takes in a lateral manner, i.e. through equity or retained earnings only. The absence of debt results in the lack of financial leverage. Probability of disturbance of the structure is very less. In simple words, all the funds required for a particular project are brought out by the owners only.

- Vertical Capital Structure: As the name suggests, it is contrary to Horizontal Capital Structure. In a vertical capital structure, the base of the structure is formed by a small amount of equity share capital. This base serves as the foundation on which the super structure of preference share capital and debt is built. The incremental addition in the capital structure is almost entirely in the form of debt. As a little proportion of owner’s capital is necessary for any organization, only this part is financed by equity, remaining financing is done by Debt.

- Pyramid Shaped Capital Structure: As the name suggests, a pyramid shaped capital structure has a large proportion consisting of equity capital and retained earnings which have been ploughed back into the firm over a considerably large period of time. The cost of share capital and the retained earnings of the firm are usually lower than the cost of debt. This structure is indicative of risk averse conservative firms. They have a high proportion of equity and considerably a very low proportion of debt.

- Inverted Pyramid Shaped Capital Structure: In the case of an inverted pyramid shaped capital structure, the structure is opposite as that of Pyramid Shaped Capital Structure. It is a capital structure which has a small component of equity capital, reasonable level of retained earnings but an ever increasing component of debt. Many large organizations go for this type of Capital Structures.

Deciding the type of Capital Structure is an important factor which you need to keep in mind before opting for a project. It is a very important part of Financial Analysis.

Recommended Articles