Book building: Book building is a popular method in the context of an Initial public offer, used to determine the price at which the shares have to be offered.

SEBI guidelines define Book Building as “a process is undertaken by which the demand for the securities proposed to be issued by a body corporate is elicited and built-up and the price for such securities is assessed for the determination of the quantum of such securities to be issued by means of a notice, circular, advertisement, document or information memoranda or offer document”.

Generally, companies while coming up with an initial public offer (IPO), use 2 methods namely fixed pricing or book building as a mechanism to decide the issue price. Over the years, because of book building has become more opted choice for pricing the securities in IPO.

How Book building works?

When a company wants to go and offer their shares to the public by way of Initial public offer, it has to price the shares at which they will be issued. If the company is not sure about the exact price at which their shares can be offered, they can set up a price range asking the investors to bid their prices at which they are willing to buy the shares. Then the bids are collected from investors at various prices, which are within the price band specified by the issuer.

Advertisement

After the bid closing date, based on the bids received from the prospective shareholders, company will determine the quantity and price of the shares to be issued. This is the most preferred method recommended by most of the stock exchanges across the world because share prices in this method are determined on the basis of real demand at various price levels among the investors.

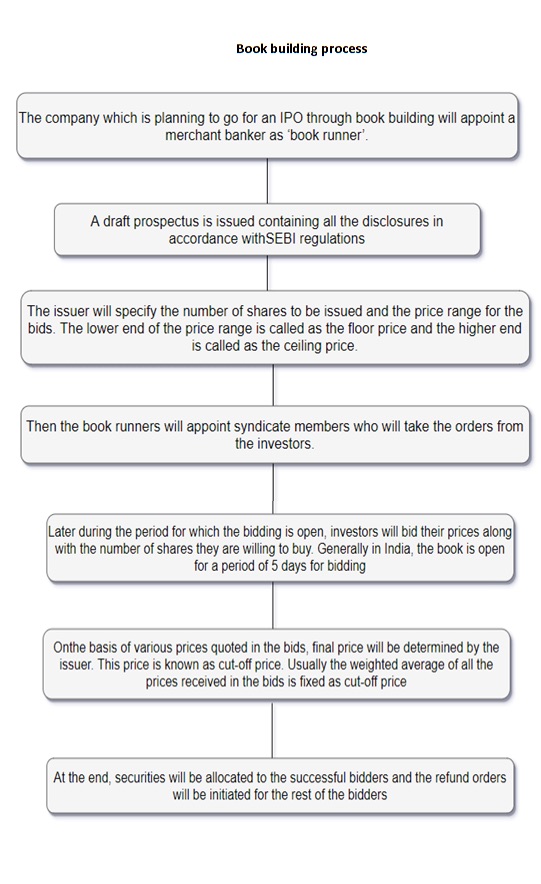

Book building process:

- The company which is planning to go for an IPO through book building will appoint a merchant banker as ‘book runner’.

- A draft prospectus is issued containing all the disclosures in accordance with SEBI regulations

- The issuer will specify the number of shares to be issued and the price range for the bids. The lower end of the price range is called as the floor price and the higher end is called as the ceiling price.

- Then the book runners will appoint syndicate members who will take the orders from the investors.

- Later during the period for which the bidding is open, investors will bid their prices along with the number of shares they are willing to buy. Generally in India, the book is open for a period of 5 days for bidding.

- On the basis of various prices quoted in the bids, final price will be determined by the issuer. This price is known as cut-off price. Usually the weighted average of all the prices received in the bids is fixed as cut-off price.

- At the end, securities will be allocated to the successful bidders and the refund orders will be initiated for the rest of the bidders.

As per SEBI guidelines, an issuer company may, subject to the requirements specified in these guidelines, make an issue of securities to the public through a prospectus in the following manner:

| 1 | 100% of the net offer to the public through book-building process, or |

| 2 | 75% of the net offer to the public through book-building process and 25% at the price determined through book building. |

Recommended Articles

- What are the ways in which an IPO can be initiated ??

- What is listing, its Importance and Benefits of listing

- SME IPO – BSE’s SME Exchange and NSE’s Emerge

- Are you an SME? Know your Eligibility

- What is IPO Grading?

- What does the Recognised Stock Exchange do ?

- Different Types of Orders Placed in Stock Market

- Delisting of Shares

- What is Market making?

- Difference between Main board IPO and SME IPO

can u give one real example of last 3 years?