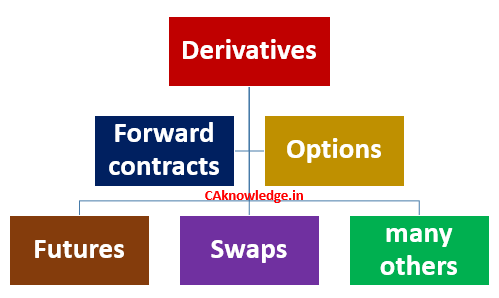

Derivatives is a product whose value is derived from the value of one or more basic variables, called bases (underlying asset, index, or reference rate), in a contractual manner. The underlying asset can be equity, forex, commodity or any other asset. For example, wheat farmers may wish to sell their harvest at a future date to eliminate the risk of a change in prices by that date. Such a transaction is an example of a derivative. The price of this derivative is driven by the spot price of wheat which is the “underlying”.

Derivatives Meaning

A financial instrument whose value is derived from the value of one or more underlying things like commodities, precious metals, currency and bonds etc., since the value of these is linked to various other securities in the market, they are considered as highly risky.

Examples: Options, futures and swaps

How do they work?

VRP Ltd is a company engaged in making sweets on large scale having operations across all the major cities in India. Most of the materials they use in their regular operations are jiggery, sugar, edible oil, cashewnut etc.,

Advertisement

Content in this Article

The prices of these items are continuously changed depending upon various factors such as production of sugarcane, cashewnut etc., So in order to manage the risk of higher prices VRP ltd enters into agreement with those who produce sugar and other items as needed by them to purchase certain amount of materials at certain agreed prices at a point of time. In future if the prices of these items go above than the prices agreed in the contract then VRP ltd will get benefit in terms of the differences between the current market price and agreed price. Here the value of the contract is a dependent of various commodities.

Let’s understand some of the financial derivatives:

1. Options:

These are the binding contracts between the parties to buy or sell a particular security, commodity, metal etc., at a given price. Options give the right to buy to the buyer and does not bring any obligation. An option to buy certain security at certain price is a “call option” and the other one which gives the right to sell a security is “put option”.

2. Futures:

It is a derivative where two parties enter into a contract to buy or sell a security or any property at certain agreed price for a “future delivery”. There will be an agreement to buy or sell a specified quantity securities or any commodities y in a designated future month at a price agreed upon by the buyer and seller. They facilitate the trading on future exchange.

3. Forward contracts:

Most of the difference between forwards and futures lies in terms of liquidity, trading platform and settlement. Forward contracts are customized bilateral contracts between two parties where settlement takes place in future on a specific date at a price agreed today. They are less liquid than futures.

4. Swaps:

They are the agreements between the parties to exchange the financial instruments or the resulted future cash flows in future based on agreed criteria such as rate of interest, stock indices etc.,

Advantages of Derivatives :

1. Leverage:

The ability and chances to make huge and extreme profits is high in derivatives than incase of primary securities or mutual funds.

2. Manages the risk:

Derivative contracts helps to hedge the risk of high prices in the future. Most important purpose of these contracts is managing the risk.

Disadvantages of Derivatives:

1. High volatility:

Since the value of derivatives is based on certain underlying things such as commodities, metals and stocks etc., they are exposed to high risk. Most of the derivatives are traded on open market. And the prices of these commodities metals and stocks will be continuously changing in nature. So the risk that one may lose their value is very high.

2. Requires expertise:

In case of mutual funds or shares one can manage with even a limited knowledge pertaining to his sector of trading. But in case of derivatives it is very difficult to sustain in the market without expert knowledge in the field.

3. Contract life:

The main problem with the derivative contracts is their limited life. As the time passes the value of the derivatives will decline and so on. So one may even have chances of losing completely within that agreed time frame.

Must Read –