CBDT Takes Steps to discourage Cash transactions & curb Black Money

CBDT Takes Steps to discourage Cash transactions in India. Budget 2017 takes Steps to discourage …

CBDT Takes Steps to discourage Cash transactions in India. Budget 2017 takes Steps to discourage …

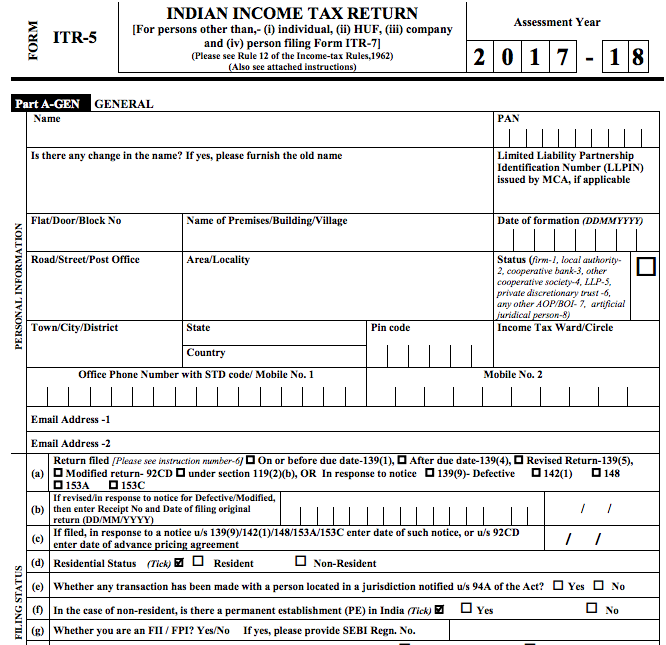

Instructions for Filing ITR 5 For AY 2017-18. These instructions are guidelines for filling the particulars …

Mandatory Quoting of Aadhaar For PAN Applications & Filing Return of Income: CBDT Issued new press …

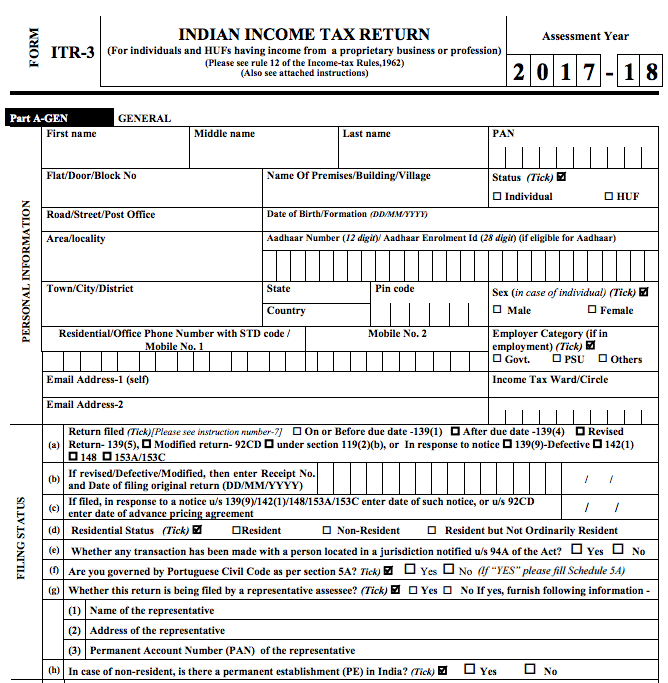

Instructions for Filing ITR 3 For AY 2017-18. These instructions are guidelines for filling the …

CBDT Notification on Transfer Pricing Rules, CBDT Notification of Transfer Pricing Rules incorporate “range concept” and …

Various Queries Related to Tax Audit for AY 2017-18, Check Frequently Asked Questions on Tax …

TDS Payment Due Dates, TDS Return Due Dates – TDS Due Dates, Check Complete details …

Google Tax, Amazon Tax or Facebook Tax: A New Tax In India, All might not be …

Transfer pricing secondary adjustments – Section 92CE. Budget 2017 introduces secondary adjustments in transfer pricing. Practical …

Tax Implications of Mutual Funds on NRIs Full Guide. Before you make your investment in …

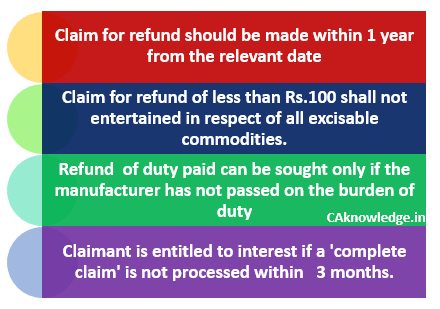

Refund of the Excise Duty – Claim for Refund of Excise Duty, Central excise law …

Tax Benefits Available Only to Senior Citizens, List of 7 tax Benefits available to Senior …

Securities Transaction Tax, What is STT, Rates of STT & Calculation of SST, Recently Amendments, Calculation of …

Section 44AD – Tax on Presumptive Basis – Complete Details. Section 44AD – Income on …

Deduction in Respect of Various Loans. Well, taking a loan has its own advantages. Your …

e-TDS and e-TCS – Complete Details, Overview of e-TDS and e-TCS. Hi Friends here we are …

Income from Salaries – Charging Section and Allowances, Income from Salaries at a glance. Find …

Tax Benefits to Special Economic Zone (SEZ), Special Economic Zones and Tax Incentives in India, Check …

Electronic Verification Code (EVC) for e-filed Income-tax return. Notification 2/2015 : Electronic Verification Code (EVC) for …

Interest on Non Payment or Non Deduction of TDS. Interest on late payment/short deduction of TDS. …

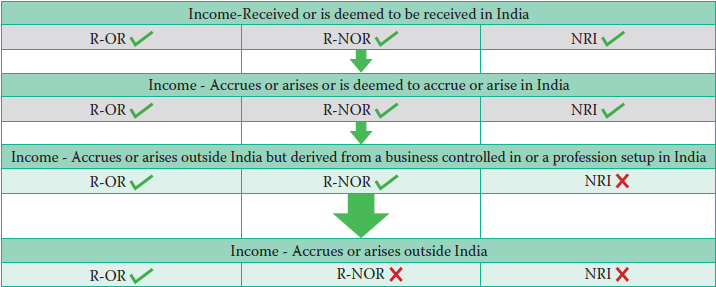

Taxation of NRIs – Complete Details, Find Everything You want to know about Taxation of NRIs, …

How does a Tax Return Preparer help for Filing IT Return, In this article you …

How to Become TRP – Procedure, Eligibility, Remuneration. Find Complete Procedure for How to Become Tax …

Penal Provisions on Undisclosed Income found during the Course of Search, Check Complete Details or …

Tax Planning for Salaried Individual For FY 2015-16. This article help in tax planning for …

Clarifications on Tax Compliance for Undisclosed Foreign Income and Assets. The Black Money (Undisclosed Foreign Income …

Annual Information Return (AIR) – Complete Details. Check Income TAX AIR Details, Find Complete details …

Taxation of IT Enabled Business Process Outsourcing Units In India, Double Taxation Relief is one of …

Simplification of procedure for Form No. 15G and 15H. Simplification of procedure for Form No. …

TDS Section 194IA – Objectives, Concepts, Rate of TDS, Find Complete Details Related TDS u/s …