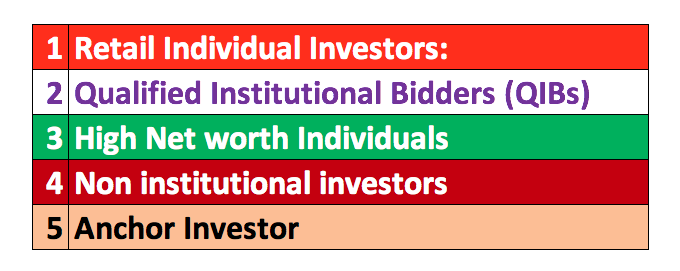

Different types of investors in stock market: Learn about the different types of investors and their behaviors in share market and mutual funds.

1. Retail Individual Investors:

As per the SECURITIES AND EXCHANGE BOARD OF INDIA (Issue of Capital and Disclosure Requirements) Regulations, 2009, retail individual investor means an investor who applies or bids for specified securities for a value of not more than Rs. 2 lakhs. This 2 lakhs limit is only for the purpose of bidding /subscribing for securities in an IPO. There is no bar on the existing shareholding of the investor. In case an issuer making the public issue through book building process, minimum 35% of the net offer to the public should be allotted to retail individual investors.

2. Qualified Institutional Bidders (QIBs):

As per the SECURITIES AND EXCHANGE BOARD OF INDIA (Issue of Capital and Disclosure Requirements) Regulations, 2009, “qualified institutional buyer” means:

- A mutual fund, venture capital fund and foreign venture capital investor registered with SEBI

- A public financial institution as defined in section 4A of the Companies Act, 1956

- A scheduled commercial bank

- A multilateral and bilateral development financial institution

- A state industrial development corporation

- An insurance company registered with the Insurance Regulatory and Development Authority

- A provident fund with minimum corpus of twenty five crore rupees

- A pension fund with minimum corpus of twenty five crore rupees

- Foreign institutional investor registered with SEBI

- National Investment Fund

- Insurance funds set up and managed by army, navy or air force of the Union of India

- Insurance funds set up and managed by the Department of Posts, India

In case of an IPO Book building QIB are allotted minimum 50% of the total issue.

3. High Net worth Individuals:

In the context of an IPO, a retail investor who applies for shares of more than Rs. 2 lakhs is considered as High Net worth Individuals.

4. Non institutional investors:

As per the SECURITIES AND EXCHANGE BOARD OF INDIA (Issue of Capital and Disclosure Requirements) Regulations, 2009, Non institutional investor means an investor other than a retail individual investor and qualified institutional buyer. They are allotted 15% of the total issue in case of book building issue in India.

5. Anchor Investor:

The concept of anchor investor was introduced in 2009 by SEBI. As per the SECURITIES AND EXCHANGE BOARD OF INDIA (Issue of Capital and Disclosure Requirements) Regulations, 2009, Anchor Investor means a qualified institutional buyer who makes an application for a value of 10 crore rupees or more in a public issue made through the book building process in accordance with SEBI regulations. Anchor investors are offered shares a day before the IPO open.

Their role in an IPO is more of an anchor who subscribes for minimum Rs. 10 crore and attract investors to public offers before they hit the market to infuse confidence. In Book built IPOs, Up to 30 % of the total issue size can be allotted to anchor investors. The anchor investor can’t sell his shares for at least 30 days after the allotment.

Recommended Articles

- What are the ways in which an IPO can be initiated ??

- What is listing, its Importance and Benefits of listing

- SME IPO

- Are you an SME? Know your Eligibility

- What is IPO Grading?

- What does the Recognised Stock Exchange do?

- Different Types of Orders Placed in Stock Market

- Delisting of Shares

- Earnings Per Share (EPS)

- What is Book building?

- Fixed price method