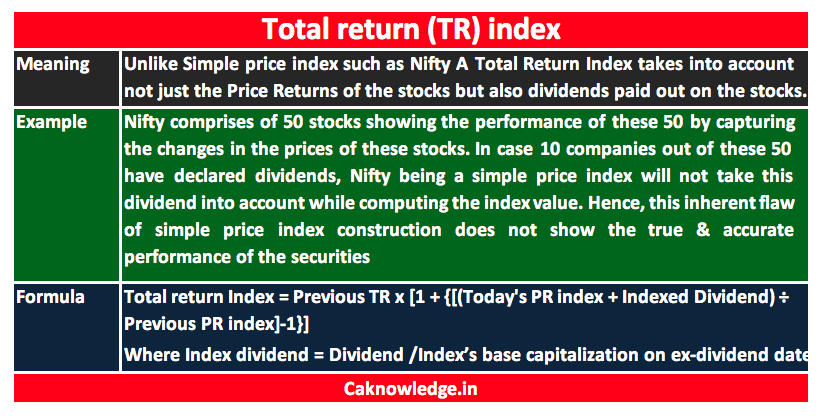

Total Return:An index is basket of securities taken the prevailing market prices. When we look at the most commonly referred Indian stock indices such as Nifty, Sensex etc. we realize that they are simple price indices. A simple price index considers only the gains made in the form of capital appreciations. It does not include the other form of returns such as dividends and interests etc. A price index captures only the changes in price of the stocks that are comprised in the said index. Thus, price index shows only the capital gains arising due to price movements.

Total Returns Index considers changes in the price as well as the additional returns such as dividend and interest receipts to calculate the index. Thus, total return index gives us the true picture of returns by capturing the gains arising in the form of dividends in addition to the capital appreciation.

Example:

Nifty comprises of 50 stocks showing the performance of these 50 by capturing the changes in the prices of these stocks. In case 10 companies out of these 50 have declared dividends, Nifty being a simple price index will not take this dividend into account while computing the index value. Hence, this inherent flaw of simple price index construction does not show the true and accurate performance of the securities.

As a result of inclusion of dividend and other returns, total return index tends to be higher than the corresponding simple price index.

Advertisement

Content in this Article

How is it calculated?

Dividends or interest receipts are indexed to on ex-dividend date

Index dividend = Dividend /Index’s base capitalization on ex-dividend date

Total return Index = Previous TR x [1 + {[(Today’s PR index + Indexed Dividend) ÷Previous PR index]-1}]

Base for both the Price index close and TR index close will be the same.

Total Return Index as a benchmark – A meaningful comparison:

As of now majority of the mutual fund firms in India benchmark their fund returns against the simple price index of the stock exchanges such as Nifty and Sensex. But the does not amount to be fair comparison given the fact that price index ignores the additional incomes such as dividend and interest in index construction.

So, to give a fair and accurate comparison of the returns earned by the mutual funds, they should be benchmarked with total return index of the exchanges. Generally, mutual fund companies practice several outperformance targets compelling the fund managers to outperform the scheme’s benchmark. So, when the benchmark is simple price index which tends to be lower than total return index, the out performance of mutual funds is seen as overstated.

TR index in India:

Recently asset management firm DSP BlackRock Investment Managers Pvt. Ltd. Announced that it would disclose the results of mutual funds with total return index as its benchmark. Globally, total return index is widely used to benchmark the returns of mutual funds and individual portfolios. This has not yet been adopted by the Indian asset management firms. With, DSP taking the leap of going with TR index, we might see more firms following the same.

Impact on stakeholders

- From an investor’s perspective, TR index gives the true picture of his earnings from the mutual funds. A fair comparison with the market’s total index would enable him assess whether his fund is under performing or over performing.

- From the view point of Fund managers and asset management firms, it will be little harder for them to achieve the outperformance targets set internally within the organization.

Recommended Articles

- What is Deemed Public Company

- What is listing and Benefits of listing

- What is IPO Grading?

- What does the Recognised Stock Exchange do ?

- Different Types of Orders Placed in Stock Market

- Delisting of Shares

- Earnings Per Share (EPS)

- What are Inter Institutional Deals and Bulk deals?

- CA FinalResult

- CA IPCCResult