What to Do After Becoming Chartered Accountant, What to do after CA, After the Passing CA Final, the first decision to trouble CA’s is to choose the career option of their choice. Confusion is created by choices and options. No other profession gives such versatility to your career. Audit and taxation are fields commonly associated with Chartered Accountants. Hard work, talent, Luck, market conditions, opportunities, contacts, location, the field of interest, and ‘being at the right place at the right time’ will play a very significant role in your career.

Don’t take up a career only for the remuneration or the glamour attached to it. Do something that interests you. A job or practice is something that you will be doing day in and day out. If you don’t enjoy what you are doing, it will become difficult to sustain yourself. Now check out details for what to do after qualifying as a chartered accountant from below.

Must read –How to Become Chartered Accountant

What to Do After Becoming Chartered Accountant

A good Chartered Accountant has sound business skills and numerical ability. Also good communication skills, objectivity, independence of thought, and integrity coupled with the ability to work under the pressure of deadlines form the ingredients of your magic potion. The profession is highly challenging as a career choice.

Advertisement

Content in this Article

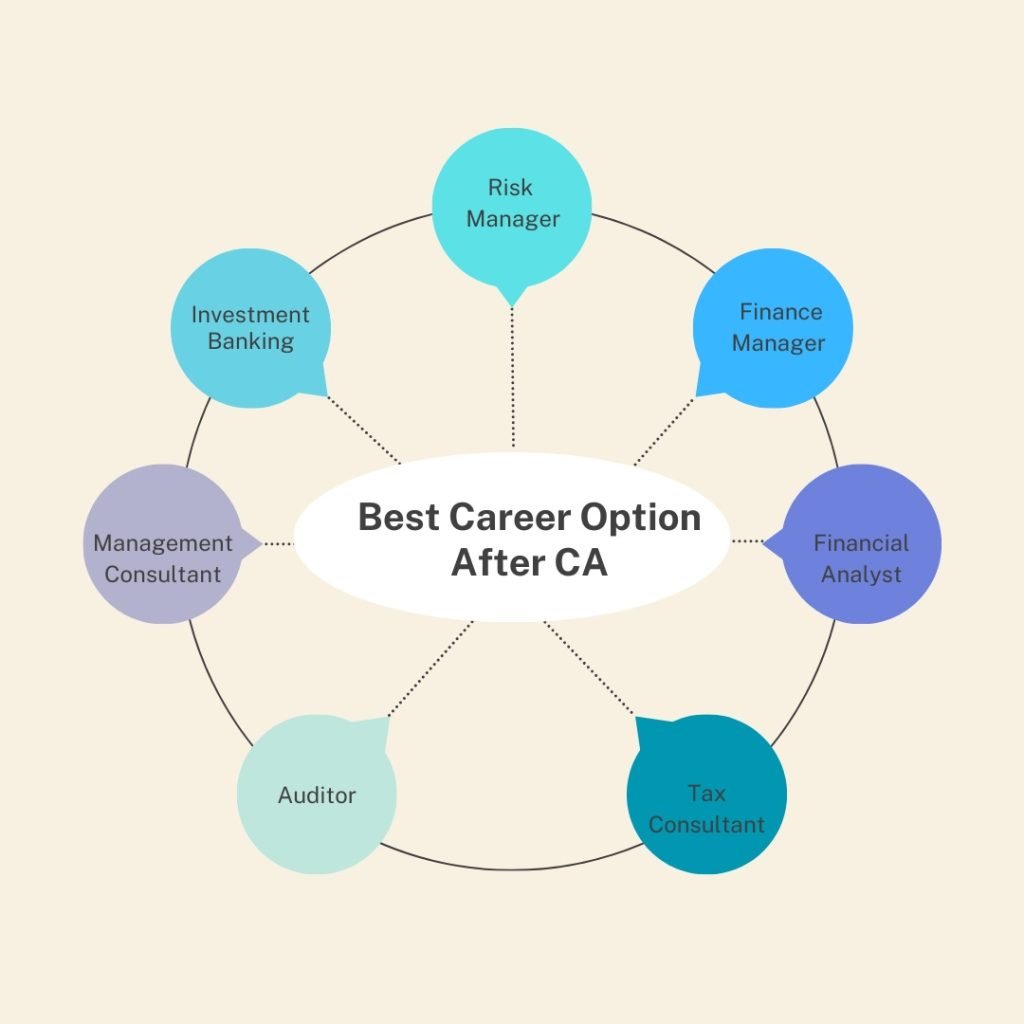

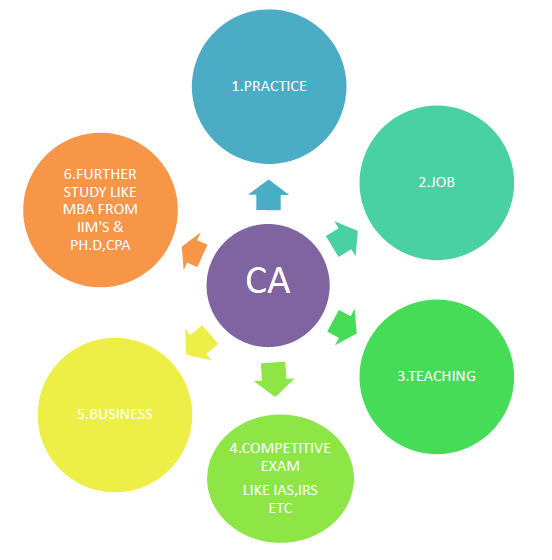

I have discussed here are just some of the popular opportunities available for CAs. Like we read in many of our books, ‘this list is just illustrative and not exhaustive’. So let us evaluate and understand some of the conventional career options available for Chartered Accountants.

Career after CA

Practice:

Practice is the real world of chartered accountants. In practice Audit, Taxation and Accounting is the main area of work, lot of CA firms earn main revenue from this area. A practicing chartered accountant gets more reputation to compare to those who are in jobs. With the increasing trends of outsourcing huge opportunities in practice for CA’s. Many CA’s worked in the industry as employees for some years and then start their own practice when they were able to get work. Practice required a lot of patience in starting years. The success of practice depends on the following factors:

- Quality of work we provide to your client.

- Links in the industry

- Patience

Under Audit, you can go for Statutory Audit, Internal Audit, Tax Audit, System Audit in Banks, SOX Audit, Information Technology Audit, Certification related work, etc. Taxation is again divided into Direct Taxation and Indirect Taxation. Under Direct Taxation, there is Tax filings and Compliances, Appeals and Proceedings, International Taxation, Transfer Pricing, Taxation Advisory with respect to Mergers and Acquisitions, etc. Those interested in Indirect Tax can explore the areas like excise and customs, gst, MandA Advisory, valuation for duty purposes, IDT Compliances, Appeals and Proceedings, etc.

A CA can Do the following Jobs A Practicing CA (can associate with CS, Advocates or can do his practice ) As a CA he can pursue…

- Internal Auditing

- Forensic Auditing

- Statutory Audit

- Taxation Consultancy (Direct and Indirect)

- Financial Management

- Tax Auditing

- Financial Reporting and Financial Reporting Consultancy

Auditors and Tax advisers command a significant amount of respect from their clients. On the flip side, professionals often complaint that Audit tends to get monotonous over a period of time and that there is little room for creativity and innovation. Taxation requires you to be updated with all the latest amendments, notifications and judgments that keep coming on a daily basis.

Main works of CA’s in practice: Auditing, Taxation, Accounting means preparing Balance sheet etc, Management Consultant, Investment Banker, CMA (Credit Monitoring Arrangement) Report, Search Report, Financial Management planning, Conducting Feasibility studies, Inventory Management, Advisor, Preparing Profitability statement, ROC filling Work, Incorporation of companies, liquidation of companies, Sales tax, GST related work and certification etc these are just some examples.

Main advantages of starting practicing are: You will build a base of clients for your future generation also, in job there is time limit of up to age you will work like 65 etc but in practice you can work up to u want. Practice always give a satisfaction that you are working for your own firm and the growth of which depend upon your hard work so you always try more and more hard work.

Job:

Job is also a better option for CA’s. With the increasing trend of globalization large No. of MNCs are coming to India so the scope for CA’s is also increasing. However in slowdown in economies sometimes creates lower demands but always remember that ‘’WITH THE PASSING OF NIGHT A DAY WILL ALWAYS COME’’. Always hoping for better is the key to growth. The people who are at the post of CFO in MNC’s or local companies are getting remuneration in Crores yearly. In job CA’s are getting a huge competition from M.B.A. (Fin).

Always remember that CA’s are always better than M.B.A. (Fin). There are a lot of CA’s who are working aboard because Indian CA’s are recognized as the best world-class professionals. When all the countries adopted the same Accounting Method like IFRS etc the demand for CA’s increased tremendously still a huge demand for Indian CA’s in abroad like the USA, CANADA, and Australia. The post occupied by CA’s are:

- Finance Manager

- Accounts Manager

- Internal Auditor

These jobs lead to senior management roles such as:

- Financial Controllers

- Advisors

- Directors

- CEO, CFO, Head of Finance

More conventional profiles for CA’s in the corporate sector are Finance and Accounts, Corporate Finance, Internal Audit, Book-Keeping, Treasury, Restructuring, Business Development, etc. Remuneration in the Corporate Sector in different industries is widely different. Again, many CAs find it difficult to move out of a particular profile or industry in the corporate sector. Top recruiters for CA’s in the industry are: Banks, KPOs, Investment Banking Firms, and Big 4 i.e. PWC, E and Y, KPMG, Deloitte

Teaching

Teaching is a noble profession. It not only provides you with money only but reputation also like CA. Parveen Sharma Sir, CA. Vinod Gupta Sir and CA. Bhagwan Lal sir. Some CA’s are teaching with doing job or practice. One can take up teaching jobs in educational institutions for CAs, commerce graduation coaching classes, certain post-graduation institutes or ICAI. Also, this need not even be a full-time thing. You may get into academics along with your job/practice.

There is also the option of starting up your own coaching institution with a very reasonable investment. The job satisfaction in this sector is tremendous. It may not be financially rewarding in the initial stages, but in the long run it is at par or at times even better than any other sector. This field is only for those people, who understand the problem of students, will want to continue in studies.

Competitive Exams:

Many CA’s preparing for competitive exams like Civil services however it’s not an easy job but always think that CA is also not an easy job. In civil services IAS, IRS, and IPS main reputed services. This is the field where you directly serve Society. Civil services exams are the most difficult or reputed exam in India. CA. Ruchika Katyal from Rohtak (Haryana) is a recent example she got all India 3rank in CA-FINAL and then selected in civil services by getting all India 176 rank.

Now civil services demand maths and English like other competitive exams in India. Indian civil services are considered as one of the premier services. All IAS IPS or IFS aspirants must first clear examinations conducted by the union public service commission (UPSC) or state civil services commissions. The stages of exams is as follow:

The Preliminary examination is an objective type of examination and is held in two papers viz. Paper-I and Paper-II. The syllabus of Paper-I comprises

- Current Events of National and International Importance

- History of India and the Indian National Movement

- Indian and World Geography

- Indian Polity and Governance

- Economic and Social Development

- General Issues on Environmental Ecology

- General Science.

The syllabus for Paper-II consists of Comprehension

- Interpersonal skills including communication skills

- Logical reasoning and analytical ability

- Decision making and problem solving

- General mental ability

- Basic numeracy.

- English language skills.

The Preliminary examination is normally held in the month of May/ June for which the notification is released in the month of November/ December of the previous year. Approximately two lakh candidates appear at the examination, the results of which are announced in the month of August. Approximately and 10000-12000 qualify for Main Examination.

The Main Examination is divided into two parts – the written and the personality test. The written test, held in October/November comprises three compulsory parts, which are General Studies, General Essay an India Language and English. Apart from this, the candidate must choose two optional subjects for the examination. The question papers are of conventional essay type. Candidates who qualify at the written part of the main Examination have to appear for the personality test held in April/May.

The personality test is the final stage where the candidate is interviewed to asses his/her personal suitability for a carrier in public service. The test is intended to judge the mental calibre of the candidate. The marks scored in the written test and the personality tests are added to determine the final order of merit. Usually about 700 to 800 aspirants are certified for appointment. The selected aspirants, after training, are assigned to various positions.

Must read –How to become an Income Tax officer?

Business:

You can go for self business or if you have a family business than it is a better option. There is a one of famous thoughts with self business is ‘’Apna business to apna he hota h’’ means there is no such other better option like self business it may be trading or manufacturing

Many CA’s join their family business to grow it and to make it better however starting your own business if you have not any background is very difficult. Always think about the great businessmen of India like Dhirubhai Ambani, Dhirubhai was not born in a rich family and he was not so studied but he was a great businessman.

‘’If you think you will do it you definitely do it.’’

Further Study:

if you think CA’s is not sufficient than go for MBA from IIM’s or reputed institute in India like FMS Delhi, MDI Gurgaon. It will added value to your job and you can start practice in Management Consultancy.

You can go for Ph.D. from IIM’s or reputed university in India. All IIM’s or university given on ICAI website are recognised CA’s for PH.D. This qualification added value to your profile.

CISA (Certified Information System Auditors) from America will certainly added value to your job if you want expert in IT related field.

DISA from ICAI added value to your profession if you are practicing in India you will get system Audits if you are DISA qualified.

LLB from a reputed university like Delhi University (DU). In DU a time of 6 to 9 P.M. is available for classes in south campus where some CA’s are studying in LLB.

There is some other professional course like CPA from America, CIMA from London, CFA, CS in India, and CMA in India.

These given above all course definitely added value not to your profile but in terms of money also.

Author – CARahul Sharma

Must Read

One of the most helpful article i found online. My kid is in 10th.

I was searching for this kind of information to give it to my son for deciding upon his career.

Thanks alot. A ton!!

Thank you sir!

I had been searching for something like this

And finally I found this useful information

Thank you sir for sharing this!

Thank you very much I got all information by this site and I request you kindly update me the latest updates.

great ….100% satisfied with this note,, thanks

Kindly update me with all the latest syllabus of ca

Very useful site

One of the most helpful article i found online. Thanks alot.

Kindly update me with all the latest syllabus of ca

Hi ashish

Please subscribe our mailing list to get all updated automatically at your inbox.