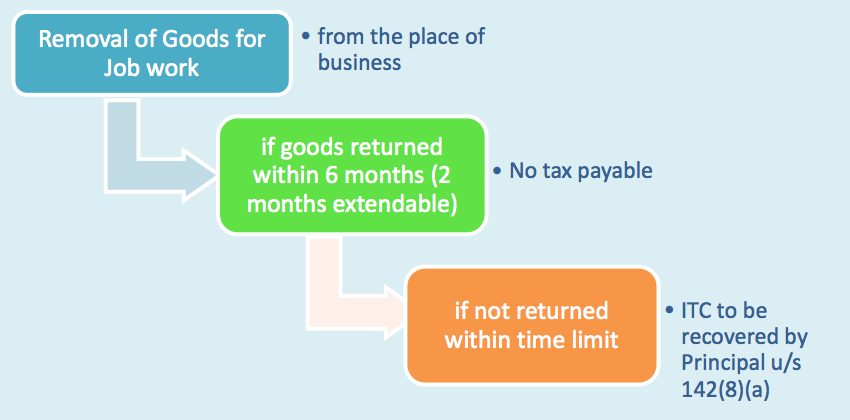

Transitional Provision for Job Work: Section 141 of the Central GST Act, 2017 specifies provisions for cases where the job worker holds goods belonging to the principal on the appointed day. Referring to the Goods and Services Tax (GST), which is set to be implemented from July 1, 2017, the President said that It will be the biggest ever tax reforms in the country. While admitting that there is likely to be some teething troubles when the GST system comes into effect, he expressed hope of ironing them out within the shortest possible time. No tax is required to be paid under following situations:

The manufacturer and the job worker have declared the details of the inputs or goods held in stock by the job worker on behalf of the manufacturer on the appointed day in form GST Tran-1, specifying therein, the stock of inputs, semi-finished goods or finished goods, as applicable, within 90 days of the appointed day

| Inputs (1) | Semi finished goods (2) | Finished goods (3) |

| Removed from place of business as such or removed after being partially processed to a job worker for further processing, testing, repair, reconditioning | removed from the place of business to any other premises for carrying out certain manufacturing processes | manufactured at a place of business had been removed without payment of duty for carrying out tests or any other process not amounting to manufacture, to any other premises |

| Returned to the place of business within 6 months from appointed date (extendable by 2 months) | ||

| The manufacturer and the job worker have declared the details of the inputs or goods held in stock by the job worker on behalf of the manufacturer on the appointed day in form GST Tran-1, specifying therein, the stock of inputs, semi-finished goods or finished goods, as applicable, within 90 days of the appointed day | ||

If above conditions are not fulfilled input tax credit claimed by the principal shall be liable to be recovered under section 142(8)(a) of the CGST Act, 2017.

Proviso to section 141(2) and (3) provides that the manufacturer may, in accordance with the provisions of the existing law, transfer the said goods from the said other premises on payment of tax in India or without payment of tax for export

Recommended Articles

- Role of Company Secretary

- Role of CS in GST

- When will GST be applicable

- Filing of GST Returns

- Returns Under GST

- GST Registration

- GST Rates

- Role of CMAs in GST

- Role of Chartered Accountants

- HSN Code List

- GST Login

- GST Rules