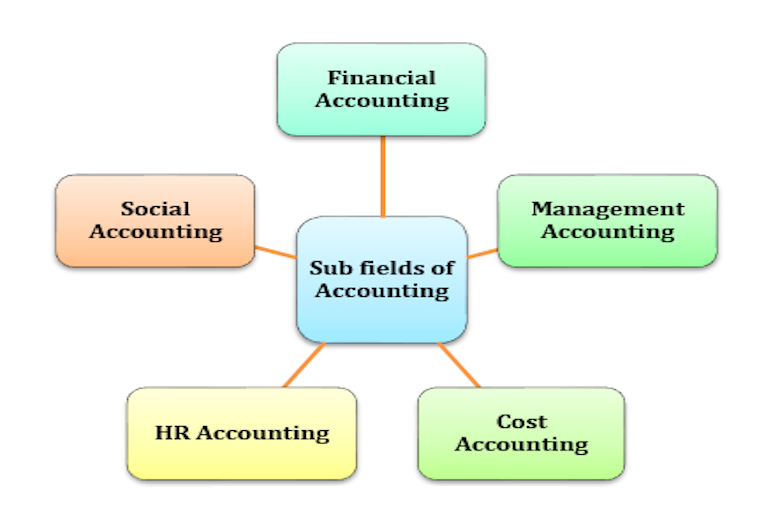

Sub Fields of Accounting, Types or branches of accounting. Accounting is a system meant for measuring business activities, processing of information into reports and making the findings available to decision-makers. The documents, which communicate these findings about the performance of an organisation in monetary terms, are called financial statements.

Find Everything you want to know about Sub fields of Accounting like – what isFinancial accounting,Details for Management accounting, Details for Cost accounting, Details for Human Resource accounting, Details for Social responsibility accounting etc. Recently we provide many Articles on Accounting like –What is Book Keeping and a comparison with Accounting, What is an Account and Types of Accounts – Complete Details etc. Now you can scroll down below and check complete details regarding “Sub Fields of Accounting”

If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Sub Fields of Accounting

(1) Financial accounting :

Financial accounting consist of preparation and presentation of financial statements with actual interpretation. It’s a language to communicate the performance of business in the form of a summary to the stakeholders of the entity.Financial accounting is historical in nature. Because in financial accounting we record and summarise the transactions which had already been occurred.

The main purpose of financial accounting is to generate financial statements and reports to depict the true financial position of the entity. It helps in taking sound financial decisions.

Advertisement

Content in this Article

(2) Management accounting :

Management accounting consist of various ways of summarising the information and generating the reports as desired by the management. As the management is responsible for planning , controlling , executing the business activities in an useful manner, it requires various reports which facilitate them to take sound decisions. The main difference between financial accounting and management accounting is that the financial accounting focuses on reporting to the stakeholders outside the organization where as management accounting is for reporting to the Internal management. In simple management accounting combines accounting ,finance and management so as to carry on the managerial operations successfully.

(3) Cost accounting :

As per The institute of cost and management accountants of england cost accounting is ” the process of accounting for cost which begins with the recording of income and expenditure or the bases on which they are calculated and ends with preparation of periodical Statements and reports for ascertaining and controlling costs “. Cost accounting consist of various methods to determine the cost per unit of the entity and it has a significant role in assisting the management in making the decisions related to cost ascertainment and cost control. The main difference between financial accounting and cost accounting is cost accounting is the results of financial accounting is used by outsiders whereas the results of cost accounting are used by management.

(4) Human Resource accounting :

As per The American Association of Accountants (AAA) ” HRA is a process of identifying and measuring data about human resources and communicating this information to interested parties “. It mainly focuses on ascertaining the costs that are being incurred on human resources and the value of output the entity is obtaining from them.In service sector major concern is Human Resource. Recruiting , training, staffing the human resources in a manner so that they can be used by the company in running its operations. HR accounting helps these organizations in successful management of Human Resource by providing the reports required for the wise HR decision making.

(5) Social responsibility accounting :

Socially responsibility accounting explains various methods to ascertain the social cost incurred by enterprise’s activities along side of ascertaining the social benefits created.

As per Information Systems Audit and Control Association (ISACA), “Social accounting aims to assess theimpact of an organisation or company on people-both the internal and external participant environments.” It helps the stakeholders to know the impact of organization’s activities on society and environment.

Recommended Articles