GST is all about a smooth flow of funds and compliances till the end. To facilitate such a smooth flow, it is imperative for the Government to provide for a hassle-free refund process.

GST provides for a clearer and efficient invoice based tracking system, verifying the transactions on an individual basis, thus, allowing systematic checking of the same. It comes as a huge relief for manufacturers or exporters, especially those in a 100% EOU or Special Economic Zone, whose working capital gets tied up in this cumbersome refund process.

In this article, I have tried to cover the GST refund process in detail.

Situations Leading to Refund Claims

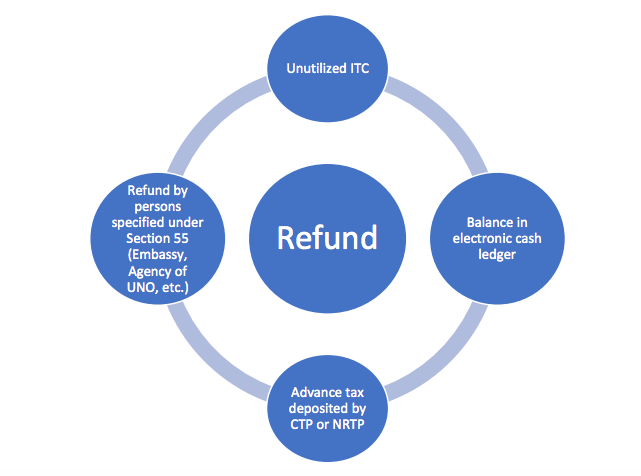

A claim for refund may arise on account of:

Advertisement

Content in this Article

1. Export of goods or services

2. Supplies to SEZs units and developers

3. Deemed exports

4. Refund of excess tax paid in advance by casual tax payer

5. Refund of CGST and SGST paid by treating the supply as intra- State supply which is subsequently held as interState supply and vice versa

6. Refund on account of issuance of refund vouchers for taxes paid on advances against which, goods or services have not been supplied

7. Refund arising on account of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court

8. Finalization of provisional assessment

9. Refund of accumulated Input Tax Credit on account of inverted duty structure

10. Refund of pre-deposit

11. Refunds to International tourists of GST paid on goods in India and carried abroad at the time of their departure from India

12. Refund of taxes on purchase made by UN or embassies etc.

Time Limit

Refund claim needs to be filed within two years from relevant date. A refund of unutilized input tax credit can be claimed at the end of any tax period.

Relevant Date

As per explanation to Sec. 54 of CGST Act, 2017, “relevant date” means –

a) in the case of goods exported out of India where a refund of tax paid is available in respect of goods themselves or, as the case may be, the inputs or input services used in such goods, –

- if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India; or

- if the goods are exported by land, the date on which such goods pass the frontier; or

- if the goods are exported by post, the date of despatch of goods by the Post Office concerned to a place outside India;

b) in the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods, the date on which the return relating to such deemed exports is furnished;

c) in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of –

- receipt of payment in convertible foreign exchange, where the supply of services had been completed prior to the receipt of such payment;

- issue of invoice, where payment for the services had been received in advance prior to the date of issue of the invoice;

d) in case where the tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court, the date of communication of such judgment, decree, order or direction;

e) in the case of refund of unutilized input tax credit on account of inverted duty structure, the end of the financial year in which such claim for refund arises;

f) in the case where tax is paid provisionally under this Act or the rules made there under, the date of adjustment of tax after the final assessment thereof;

g) in the case of a person, other than the supplier, the date of receipt of goods or services or both by such person; and

h) in any other case, the date of payment of tax.

Interest on delayed refunds

If any tax ordered to be refunded is not refunded within 60days from the date of receipt of application for refund claim, interest at such rate not exceeding 6% shall be payable to the applicant by government from the date immediately after the expiry of 60 days from the date of receipt of application under the said subsection till the date of refund of such tax.

In case of refund arises from an order passed by an adjudicating authority or Appellate Authority or Appellate Tribunal or court which has attained finality and the same is not refunded within sixty days from the date of receipt of application filed consequent to such order, interest at such rate not exceeding 9% shall be payable in respect of such refund from the date immediately after the expiry of 60 days from the date of receipt of application till the date of refund.

Procedure for refund claim:

A. Export of goods with the payment of IGST

- The shipping bill filed by an exporter shall be deemed to be an application for refund of integrated tax paid on goods exported out of India. No separate application is required to be filed as shipping bill itself will be treated as application for refund.

- The application shall be deemed to have been filed only when Export Manifest or Export Report is filed and the applicant has furnished a valid return in FORM GSTR-3 or FORM GSTR-3B.

- Upon the receipt of the information regarding the furnishing of a valid return in FORM GSTR-3or FORM GSTR-3B, as the case may be from the common portal, the system designated by the Customs shall process the claim for refund and an amount equal to the integrated tax paid in respect of each shipping bill or bill of export shall be electronically credited to the bank account of the applicant mentioned in his registration particulars and as intimated to the Customs authorities.

- Where the goods are not exported within 90 days the time specified in sub-rule (1) and the registered person fails to pay the amount mentioned in the said sub-rule, the export as allowed under bond or Letter of Undertaking shall be withdrawn forthwith and the said amount shall be recovered from the registered person in accordance with the provisions of section 79.

- Any order regarding withholding of such refund or its further sanction respectively in PART-B of FORMGST RFD-07 or FORM GST RFD-06 shall be done manually till the refund module is operational on the common portal.

B. Claim of unutilized ITC on account of Export of goods and services without payment of IGST

- The application for refund of unutilized input tax credit on inputs or input services used in making such zerorated supplies shall be filed in FORM GST RFD- 01A on the common portal.

- The amount claimed as refund shall get debited in the electronic credit ledger to the extent of the claim.

- The common portal shall generate a proof of debit (ARN – Acknowledgement Receipt Number) which would be mentioned in the FORM GST RFD-01A submitted manually, along with following documents:-

- The print out of FORM GST RFD-01A to the jurisdictional proper officer.

- A statement containing the number and date of shipping bills or bills of export and the number and the date of the relevant export invoices, in a case where the refund is on account of export of goods;

- a statement containing the number and date of invoices and the relevant Bank Realization Certificates or Foreign Inward Remittance Certificates, as the case may be, in a case where the refund is on account of the export of services;

- No refund of unutilized input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty:

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC ÷Adjusted Total Turnover

Where,-

(A) “Turnover of zero-rated supply of goods” means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking;

(B) “Turnover of zero-rated supply of services” means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking, calculated in the following manner, namely:- Zero-rated supply of services is the aggregate of the payments received during the relevant period for zero-rated supply of services and zero-rated supply of services where supply has been completed for which payment had been received in advance in any period prior to the relevant period reduced by advances received for zero-rated supply of services for which the supply of services has not been completed during the relevant period;

(C) “Adjusted Total turnover” means the turnover in a State or a Union territory, as defined under clause (112) of section 2, excluding the value of exempt supplies other than zero-rated supplies, during the relevant period;

C. Zero Rated Supplies to SEZ unit / Developers with payment of IGST

- Application for refund is required to be filed in FORM GST RFD-01A by the supplier on the common portal.

- A print out of the said form shall be submitted before the jurisdictional proper officer along with

- a statement containing the number and date of invoices as provided in rule 46 along with the evidence regarding the endorsement by the specified officer of the zone ; and

- a declaration to the effect that the Special Economic Zone unit or the Special Economic Zone developer has not availed the input tax credit of the tax paid by the supplier of goods or services or both,

D. Claim of unutilized ITC on account of Zero rated supplied to SEZ Unit / Developers without payment of IGST

- The application for refund of unutilized input tax credit on inputs or input services used in making such zerorated supplies shall be filed in FORM GST RFD- 01A on the common portal.

- The amount claimed as refund shall get debited in the electronic credit ledger to the extent of the claim.

- The common portal shall generate a proof of debit (ARN- Acknowledgement Receipt Number) which would be mentioned in the FORM GST RFD-01A submitted manually.

- Following documents shall be submitted:-

- The print out of FORM GST RFD-01A to the jurisdictional proper officer.

- Statement containing the number and date of invoices as provided in rule 46 along with the evidence regarding the endorsement by the specified officer of the zone ; and

- a declaration to the effect that the Special Economic Zone unit or the Special Economic Zone developer has not availed the input tax credit of the tax paid by the supplier of goods or services or both,

E. Supplies regarded as deemed export

As per Notification No. 48/2017, following supplies of goods shall be treated as deemed exports:-

- Supply of goods by a registered person against Advance Authorization

- Supply of capital goods by a registered person against Export Promotion Capital Goods Authorization

- Supply of goods by a registered person to Export Oriented Unit

- Supply of gold by a bank or Public Sector Undertaking specified in the notification No.50/2017-Customs, dated the 30th June, 2017 (as amended) against Advance Authorization.

The application may be filed by, –

a) the recipient of deemed export supplies; or

b) the supplier of deemed export supplies in cases where the recipient does not avail of input tax credit on such supplies and furnishes an undertaking to the effect that the supplier may claim the refund.

Following documents are required to be submitted by a registered person who have made deemed export:-

- Copy of Form A i.e. intimation for procurement of supplies from the registered person by Export Oriented Unit (EOU)/Electronic Hardware Technology Park (EHTP) Unit/ Software Technology Park (STP) unit/ Bio-Technology Parks (BTP) Unit, submitted by receiver of deem export to

- the registered supplier;

- the jurisdictional GST officer in charge of such registered supplier;

- its jurisdictional GST officer.

- A statement containing the number and date of invoices

- Copies of endorsed tax invoices by the recipient of deemed export as a proof of deemed export supplies by the registered person to EOU/EHIP/STP/BTP unit.

- Acknowledgment by the jurisdictional Tax officer of the Advance Authorization holder or Export Promotion Capital Goods Authorization holder, as the case may be, that the said deemed export supplies have been received by the said Advance Authorization or Export Promotion Capital Goods Authorization holder, or a copy of the tax invoice under which such supplies have been made by the supplier, duly signed by the recipient Export Oriented Unit that said deemed export supplies have been received by it.

- An undertaking by the recipient of deemed export supplies that no input tax credit on such supplies has been availed of by him.

- An undertaking by the recipient of deemed export supplies that he shall not claim there fund in respect of such supplies and the supplier may claim the refund.

F. Refund on account of CGST and SGST paid by treating the supply as intra- State supply which is subsequently held as inter-State supply and vice versa

Application for refund required to be filed in FORM GST RFD-01 by the supplier on the common portal along with a statement showing the details of transactions considered as intra-State supply but which is subsequently held to be interState supply;

G. Refund on account of excess tax paid

Application for refund required to be filed in FORM GST RFD-01 by the supplier on the common portal along with astatement showing the details of the amount of claim on account of excess payment of tax;

A declaration to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed does not exceed two lakh rupees and Certificate by CA in prescribed format provided as Annexure 2 of FORM GST RFD-01 for the same.

H. Refund on account of issuance of refund vouchers for taxes paid on advances against which, goods or services have not been supplied Refund of account of excess tax paid

Application for refund required to be filed in FORM GST RFD-01 by the supplier on the common portal along with a statement showing the details of the amount of claim on account of issuance of refund vouchers for taxes paid on advances against which, goods or services have not been supplied

I. Claim of amount by casual tax payer on account of excess tax paid in advance

As per Sec. 27 of CGST Act, 2017, a casual tax payer is required to deposit an amount equivalent to the estimated tax liability of such person for the period for which the registration is sought in advance.

A claim can be made of any amount, after adjusting the tax payable by the applicant out of the advance tax deposited by him in the last return required to be furnished by him.

Application for refund is required to be filed in FORM GST RFD-01 by the supplier on the common portal and should be submitted with a declaration by the registered person and Certificate by CA or CMA to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed does not exceed two lakh rupees.

J. Refund arising on account of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court

Application for refund required to be filed in FORM GST RFD-01 by the supplier on the common portal along with

- The reference number of the order and a copy of the order passed by the proper officer or an appellate authority or Appellate Tribunal or court resulting in such refund

- reference number of the payment of the amount (predeposit)

A declaration by registered person and certificate from CA or CMA to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed does not exceed two lakh rupees

K. Refund of accumulated Input Tax Credit on account of inverted duty structure

As per Sub-section 3 of Section 54 of CGST Act, 2017 refund of unutilized input tax credit shall be allowed in cases where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on outputsupplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council.

Application for refund required to be filed in FORM GST RFD-01 by the supplier on the common portal along with a statement containing the number and the date of the invoices received and issued during a tax period.

Declaration of unjust enrichment is not required to be submitted in case of such refund claims.

Refund of input tax credit shall be granted as per the following formula –

Maximum Refund Amount = {(Turnover of inverted rated supply of goods) x Net ITC ÷Adjusted Total Turnover} – tax payable on such inverted rated supply of goods.

Due to the non-availability of the refund module on the common portal, it has been decided by the competent authority, on the recommendations of the Council, that the applications/ documents /forms pertaining to refund claims on account of zero-rated supplies shall be filed and processed manually till further orders.

Conclusion

To summarize, GST law to envisages a simplified, time bound and technology driven refund procedure with minimal human interface between the taxpayer and tax authorities. However, refund module has not been made available on GST portal till date.

Recommended Articles

- GST Registration

- State GST Act

- GST Downloads

- Returns Under GST

- GST Registration

- GST Rates

- GST Forms

- HSN Code

- GST Login

- GST Due Dates

- GST Rules

- GST Status

- Know your GSTIN