Offences and penalties Under GST Regime.Offences are most important part of any ACT which provide stick to the Act for it smooth functioning and implementation. various Penalties under GST. check out more details for Offences and penalties Under GST.

Offences and penalties Under GST

Late Fees For Non Filing Or Late Filing Of Returns (Section 47)

Any Registered person who :

- a.Fails to furnish details of outward or inward supplies u/s 37 or 38 or 39 or 45 before the due date.

- b.Late fees : Rs. 100/- per day (Max of Rs. 5000/-)

Offences (Section 122 (1))

| Nature of Offence | Prescribed Penalty |

|---|---|

| Where a taxable person who:

Content in this Article

| Higher of the following

|

Section 122 (2)

Any registered person who supplies any goods or services or both on which any tax has not been paid or short paid or erroneously refunded or where ITC has been wrongly availed or utilized

Advertisement

Without a fraudulent intention.

Higher of the following

- Rs. 10000.00

- 10% of the tax due

With a fraudulent intention.

Higher of the following

- Rs. 10000.00

- Tax due

Section 122 (3)

Any Person who :

- Aids or abets any of the offences specified in clauses (i) to (xxi) of Sub Sec 1.

- Acquires possession of or conceals himself in transporting, depositing, keeping, concealing, supplying or purchasing goods which are liable to confiscation.

- Receives or is in any way concerned with the supply of services which are in contravention of this act.

- Fails to appear before the officer.

- Fails to issue invoice or fails to account for the an invoice in his books of accounts

Shall be liable to penalty which may extend upto Rs 25000.00

Section 123

- Penalty for failure to furnish Information Return u/s 150 :

- Rs. 100/- for each day during which the failure to furnish such return continues

Section 124

If any person required to furnish any information u/s 151

(a) Without reasonable cause fails to furnish information or return.

(B) Wilfully furnishes or causes to furnish any information or return which is false.

- He shall be punishable with a fine which may extend to Rs. 10000/-

- Which may extend upto Rs. 100/- for each day during which the offence continues subject to a maximum of Rs. 25000/-

General Penalty (Sec 125)

- Any person who contravenes the provisions of this Act.

- For which no penalty is prescribed

- Penalty – may extend upto Rs. 25000/-

General Disciplines Related To Penalty

- No Penalty for Minor Breach of Tax Regulation or Procedural Requirement –Minor breach : amount of tax involved is less than Rs. 5000/-

- No Penalty for a mistake which is easily rectifiable.

- No penalty without following the principles of Natural Justice.

- The officer imposing penalty shall specify thenature of breach and the applicable law under which the amount of penalty has been specified

- Voluntary Disclosure of a breach: –The proper officer may consider this fact as a mitigating factor when quantifying for the penalty.

- The provisions of this section shall not be followed if penalty is fixed under this law.

Detention of Goods

- Notwithstanding anything contained in this act

- Where any person transports or stores any goods which are in contravention of the act.

- All such goods and the conveyance used to transport such goods shall be liable to detention or seizure.

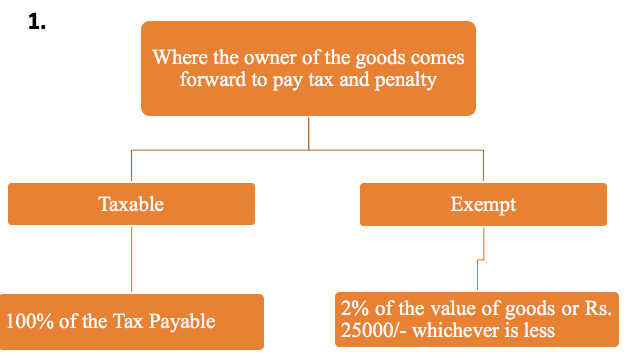

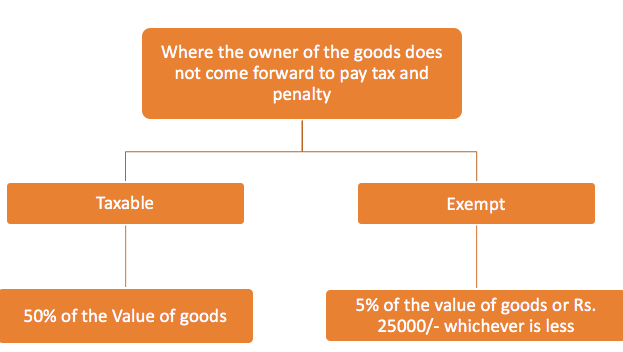

Release of Detained Goods

Confiscation of Goods (Section 130)

- Supplies or receives any goods in contravention of this act with an intent to evade payment of tax.

- Does not account for any goods on which he is liable to pay tax under this act.

- Supplies any goods liable to tax under this act without getting registered.

- Contravenes any of the provisions of this Act with an intent to evade payment of tax.

- Uses any conveyance as a means of transport for carriage of goods in contravention of the act unless the owner of the conveyance proves that it was so used without knowledge or connivance of the owner

Fine in lieu of Confiscation

- The Adjudging officer shall give an option to pay fine in lieu of confiscation.

- Such fine shall not exceed the market value of goods less tax chargeable thereon.

- Provided also, that where any such conveyance is used for the carriage of the goods, the owner of the conveyance shall be given an option to pay a fine equal to the tax payable on the goods being transported thereon in lieu of confiscation.

Must Read –

- Why GST For India

- Role of Chartered Accountants in GST

- GST Objective

- GST Current Tax Structure

- Filing of GST Returns

- When will GST be applicable

- List of Taxes Included in GST

- Impact of GST in Indian Economy

- GST Registration

- GST Rates

If you have any query or suggestion regarding “Offences and Penalties Under GST” then please tell us via below comment box….

Dear sir,

I failed to submit GST monthly return for past two months(Aufusat and september).I am self employed and doing small business.Now I want to submit this two with current return(October) without penalty.Is it possible.Also I want to stop my business and get GST in live,is it possible?

Dear sir,

I failed to submit GST monthly return for past two months(Aufusat and september).I am self employed and doing small business.Now I want to submit this two with current return(October) without penalty.Is it possible.Also I want to stop my business and get GST in live,is it possible?

Dear Team,

I am located in Delhi & I deals in EOL (End of life) Used spare parts of Computers, like Motherboards, Power supplies & Screens etc. Some times i had purchased complete unit from Enduser and dis-mental it at my own and use to sell some working spares . So sometimes we didn’t had purchased invoice for material , Presently in this case we provide flat 5% of Sale value to Govt.

Here i wanna to know what will be the scenario in this case after GST.

Waiting for your suggestion

Thanks in Advance.

Regards

SIR, IT IS VERY DIFFICULT TO SAY ABOUT IT BECAUSE IT IS VERY WIDE RULES AND REGULATION UNDER GST REGIME U MAY CONTACT – 7042819068.

WE MAY CLEAR YOUR DOUBTS AS ALL.

THANKING FOR YOU.

Position regarding applicability of the Margin Scheme under GST for dealers in second hand goods in general and for dealers in old and used empty bottles in particular.

Doubts have been raised regarding the applicability of the Margin Scheme under GST for dealers in second hand goods in general and for dealers in old and used empty bottles in particular.

Rule 32(5) of the Central Goods and Services Tax (CGST) Rules, 2017 provides that where a taxable supply is provided by a person dealing in buying and selling of second hand goods i.e., used goods as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on the purchase of such goods, the value of supply shall be the difference between the selling price and the purchase price and where the value of such supply is negative, it shall be ignored. This is known as the margin scheme.

notification No.10/2017-Central Tax (Rate), dated 28.06.2017 exempts Central Tax leviable on intra-State supplies of second hand goods received by a registered person, dealing in buying and selling of second hand goods [who pays the central tax on the value of outward supply of such second hand goods as determined under sub-rule (5)] from any supplier, who is not registered. This has been done to avoid double taxation on the outward supplies made by such registered person, since such person operating under the Margin Scheme cannot avail input tax credit on the purchase of second hand goods.

Thus, Margin Scheme can be availed of by any registered person dealing in buying and selling of second hand goods [including old and used empty bottles] and who satisfies the conditions as laid down in Rule 32(5) of the Central Goods and Services Tax Rules, 2017. (PIB)

Dear Team,

I am located in Delhi & I deals in EOL (End of life) Used spare parts of Computers, like Motherboards, Power supplies & Screens etc. Some times i had purchased complete unit from Enduser and dis-mental it at my own and use to sell some working spares . So sometimes we didn’t had purchased invoice for material , Presently in this case we provide flat 5% of Sale value to Govt.

Here i wanna to know what will be the scenario in this case after GST.

Waiting for your suggestion

Thanks in Advance.

Regards

Position regarding applicability of the Margin Scheme under GST for dealers in second hand goods in general and for dealers in old and used empty bottles in particular.

Doubts have been raised regarding the applicability of the Margin Scheme under GST for dealers in second hand goods in general and for dealers in old and used empty bottles in particular.

Rule 32(5) of the Central Goods and Services Tax (CGST) Rules, 2017 provides that where a taxable supply is provided by a person dealing in buying and selling of second hand goods i.e., used goods as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on the purchase of such goods, the value of supply shall be the difference between the selling price and the purchase price and where the value of such supply is negative, it shall be ignored. This is known as the margin scheme.

notification No.10/2017-Central Tax (Rate), dated 28.06.2017 exempts Central Tax leviable on intra-State supplies of second hand goods received by a registered person, dealing in buying and selling of second hand goods [who pays the central tax on the value of outward supply of such second hand goods as determined under sub-rule (5)] from any supplier, who is not registered. This has been done to avoid double taxation on the outward supplies made by such registered person, since such person operating under the Margin Scheme cannot avail input tax credit on the purchase of second hand goods.

Thus, Margin Scheme can be availed of by any registered person dealing in buying and selling of second hand goods [including old and used empty bottles] and who satisfies the conditions as laid down in Rule 32(5) of the Central Goods and Services Tax Rules, 2017. (PIB)