Levy and Collection of CGST, SGST, IGST, UTGST.GST is levied on supply of all goods or services or both except supply of alcoholic liquor for human consumption. Five petroleum products viz. petroleum crude, motor spirit (petrol), high speed diesel, natural gas and aviation turbine fuel have temporarily been kept out and GST Council shall decide the date from which they shall be included in GST. Electricity has also been kept out of GST.

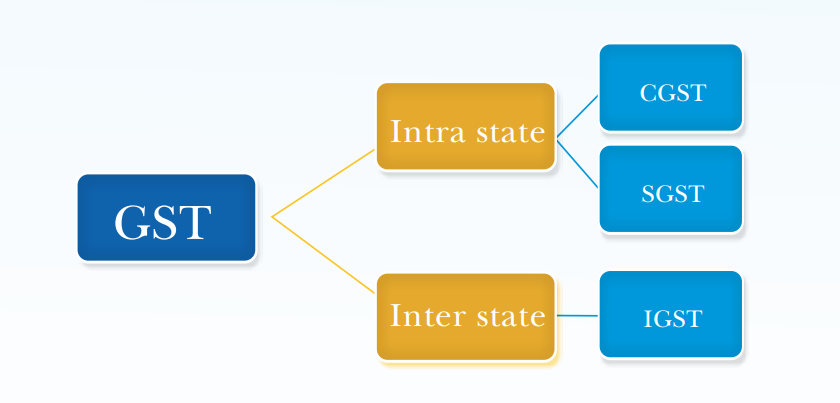

The structure provided under GST is dual in nature and under this , the Centre and the States will simultaneously levy tax on a common base. The GST levied by the Centre on intra-State supply of goods and / or services would be called the Central GST (CGST) and that levied by the States / Union territory would be called the State GST (SGST)/ UTGST. Similarly, Integrated GST (IGST) will be levied and administered by Centre on every inter-state supply of goods and services.

When we look back under the provisions of Excise, it was a levy on Manufacture and in Value Added Tax, the concept of Intra and Inter State Sale wasthe focus. Similar such provision exists under the imposition of service Tax, where the provision of service is the key.

Whereas under the GST regime, there is a paradigm shift from an Origin Based Tax to a Destination based Tax. All the above aspects like Manufacture, Sale, Provision of Service become irrelevant and the term Supply linked to destination is the key.

Advertisement

Content in this Article

Levy and Collection of CESS

Under GST (Compensation to States) Act, 2017

Section 8 of GST (Compensation to States) Act, 2017 forms the basis for levy and collection of cess which will be levied on for the purposes of providing compensation to the States for loss of revenue arising on account of implementation of the goods and services tax with effect from the date from which the provisions of the Central Goods and Services Tax Act were brought into force. The cess is levied on:

- such intra-State supplies of goods or services or both, as provided for in section 9 of the Central Goods and Services Tax Act, and

- such inter State supplies of goods or services or both as provided for in section 5 of the Integrated Goods and Services Tax Act

The same shall be collected in such manner as may be prescribed, on the recommendations of the Council, for a period of five years.

However, no such cess shall be leviable on supplies made by a taxable person who has decided to opt for composition levy under section 10 of the Central Goods and Services Tax Act.

The cess shall be levied on such supplies of goods and services as are specified in Schedule to the Act.

Where the cess is chargeable on any supply of goods or services or both with reference to their value, for each such supply the value shall be determined under section 15 of the Central Goods and Services Tax Act for all intra-State and inter-State supplies of goods or services or both

Cess on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975, at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962, on a value determined under the Customs Tariff Act, 1975.

Levy and Collection of CGST, SGST, IGST, UTGST

A tax called the Central Goods and Services Tax (CGST)/ Union Territory Goods and Services Tax (UTGST)/ State Goods and Services Tax (SGST)shall be levied on all intra-State supplies of goods or services or both and shall be collected in such manner as may be prescribed and shall be paid by the taxable person. However, intra-State supply of alcoholic liquor for human consumption is outside the purview of CGST/UTGST/SGST.

Similarly, Integrated Goods and Services Tax (IGST) shall be levied on all inter-State supplies of goods or services or both with the exception of alcoholic liquor. However, IGST on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975 on the value as determined under the said Act at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962.

Value for levy: Transaction value under section 15 of the CGST Act

Rates of CGST/IGST/SGST/UTGST: Rates for CGST/UTGST/SGST are rates as may be notified by the Government on the recommendations of the GST Council [Rates notified are 5%, 12%, 18% and 28%]. IGST will be approximately the sum total of CGST and SGST/UTGST.

Maximum rate of CGST will be 20% while for IGST, maximum rate will be 40%.

However, CGST/UTGST/SGST/IGST on supply of the following items has not been levied immediately. It shall be levied with effect from such date as may be notified by the Government on the recommendations of the Council:

- petroleum crude

- high speed diesel

- motor spirit (commonly known as petrol)

- natural gas and

- aviation turbine fuel

Reverse charge – Tax payable by recipient of supply of goods or services or both

CGST/UTGST/SGST/IGST shall be paid by the recipient of goods or services or both, on reverse charge basis, in the following cases:

- Supply of goods or services or both, notified by the Government on the recommendations of the GST Council.

- Supply of taxable goods or services or both by an unregistered supplier to a registered person

All the provisions of the relevant GST law shall apply to the recipient in the aforesaid cases as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Tax payable by the electronic commerce operator on notified services

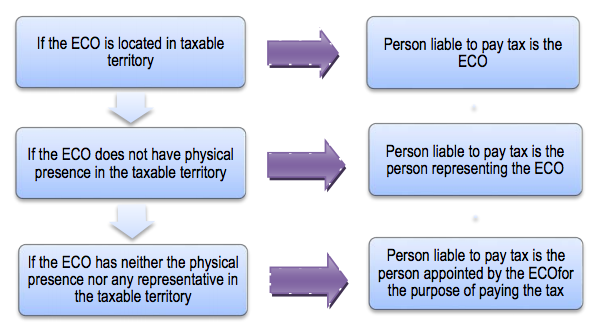

The Government may notify specific categories of services the tax on intra-State supplies (inter-State supplies in case of IGST) of which shall be paid by the electronic commerce operator (ECO) if such services are supplied through it. Such services shall be notified on the recommendations of the GST Council.

All the provisions of the relevant GST law shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

Must Read –

- When will GST be applicable

- GST Definition, Objective, Framework

- Supply of Goods to Job Worker under GST

- Filing of GST Returns

- Returns Under GST

- GST Current Tax Structure and proposed

- Expected Scheme of GST

- GST Registration

- GST Rates

- Reverse Charge under GST

If you have any query regarding “Levy and Collection of CGST, SGST, IGST, UTGST” then please tell us via below comment box…