How to pass journal entry in tally prime 2023? All entries that do not come under Purchase, Sales, Bank or cash voucher are registered under Journal Entry in Tally. An accountant can record even the payment transaction using a journal voucher in TallyPrime. In this Tally article, we will discuss in detail the journal voucher and journal entry in tally Prime 2023.

Few relevant groups needs to be created during creation of ledgers:

- Any Party under Sundry debtors or sundry creditors

- Income under direct or indirect income

- Expense under direct or indirect expense.

- How to Pass Purchase and Sale Entry

Record Transaction as Journal Entry in Tally

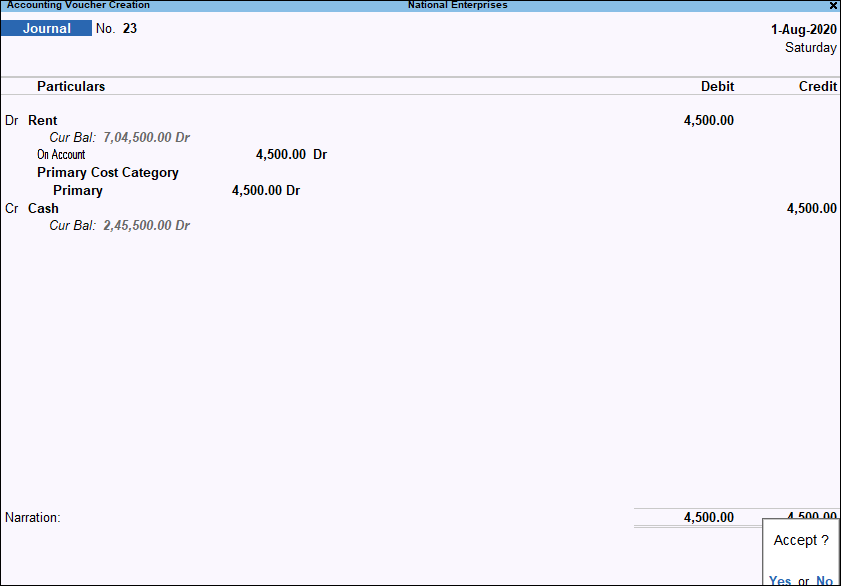

To record transactions under journal entry, follow the following steps given below:

- Go toGateway of Tallyandgt; SelectVouchersandgt; pressF7for (Journal) entry. Or you can pressAlt+G(Go to) andgt;Create Voucherandgt; pressF7(Journal).

- Press f2 to change the date of a journal entry, if needed.

- To enter the transaction first, Select the By/Dr (Debit) side of the transaction.

- In By/ Dr, select the expense ledger. For example, Rent. Then specify the rent amount.

A user can also create the Ledger while passing the journal entry by pressingAlt+C. Or pressAlt+G(Go To) andgt;Create Mastertype or selectLedgerandgt; and pressEnter.

- The second step is to Select the To/Cr (Credit) side of the transaction.

- In To/cr, select the payment mode. For example, Cash. Enter and specify the amount.

- To determine Cash, an F12 setting for JV is needed.

- If the amount of credit is not equivalent to the debit amount, you need to choose another Credit ledger.

- After doing the entry successfully, the last step is to Provide Narration, if any, and accept the voucher. To accept, you can also pressCtrl+A.

However, TallyPrime has specialised voucher types for specific business transactions like purchase, debit, sales, credit, payment, receipt, contra for error-free and easy data entry.

Advertisement

A payment transaction can be recorded as a journal entry in TallyPrime, although there is already a specialised Payment voucher (F5) type to help ease the data entry. Similarly, one can use a journal voucher to record an accounting transaction.

Adjustment Entries Using Journal Vouchers

Journal vouchers are mostly used for adjustment entries. Adjustment entries for finalisation of books. Sometimes, there occurs unadjusted Forex gain or loss balance because of the exchange rate fluctuations. The effects of foreign exchange rates change to lead the company to account for the Forex gain/loss. It consists of both Realised and Unrealised forex gain/loss that must be recorded in their Final Reports.

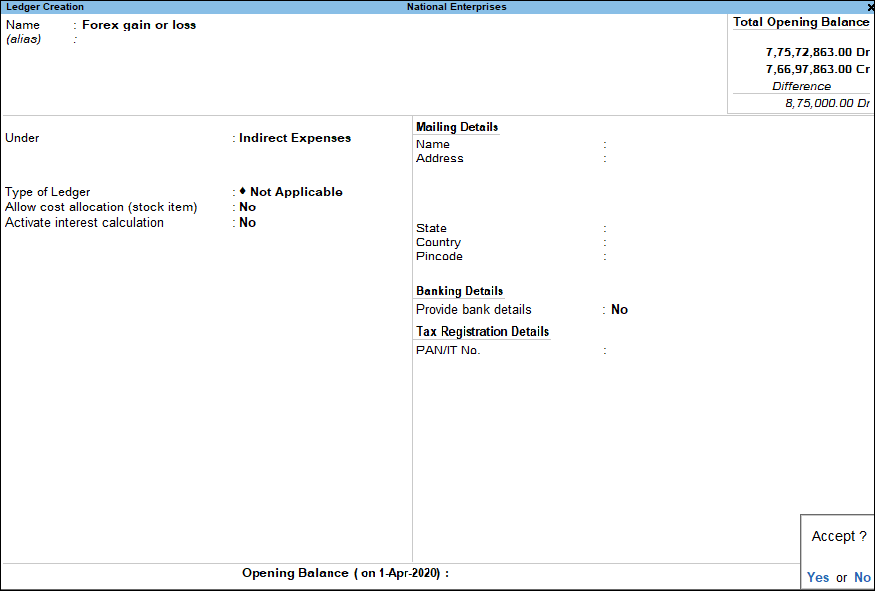

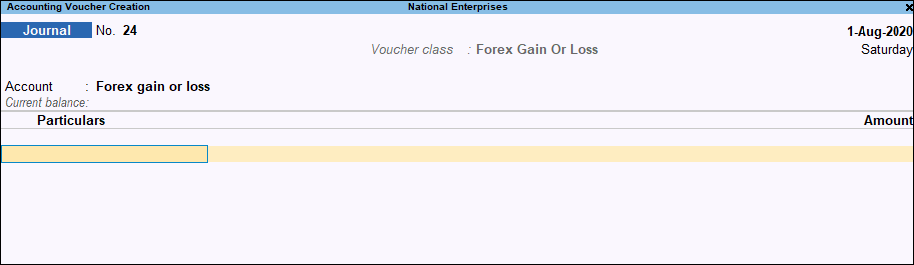

First, create a ledger named Forex gain or loss underIndirect ExpensesorIndirect Income to adjust these gains or losses.It is made to transfer the balance amount from the Balance Sheet to the Profit and Loss Account using Voucher Class.

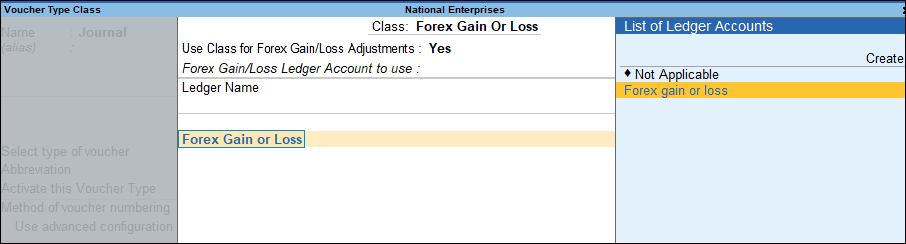

- Create a Voucher Class By pressingAlt+G(Go To) andgt;Alter Masterandgt; then type or selectVoucher Typeandgt; select Journal and pressEnter.

- Specify a Voucher Class name. For example, Forex Class.

- Now Set the option of “Use Class for Forex Gain/Loss Adjustments”toYes.

- Select Forex gain or loss ledger, as needed.

- Accept the screen. Or, to save the changes, you can press Ctrl+A.

While recording a journal entry, adjust the forex gain or loss:

- Go to Gateway of Tally andgt; Select Vouchers andgt; then pressF7(Journal). Or you can pressAlt+G(Go To) andgt; type or selectCreate Voucherandgt; pressF7(Journal).

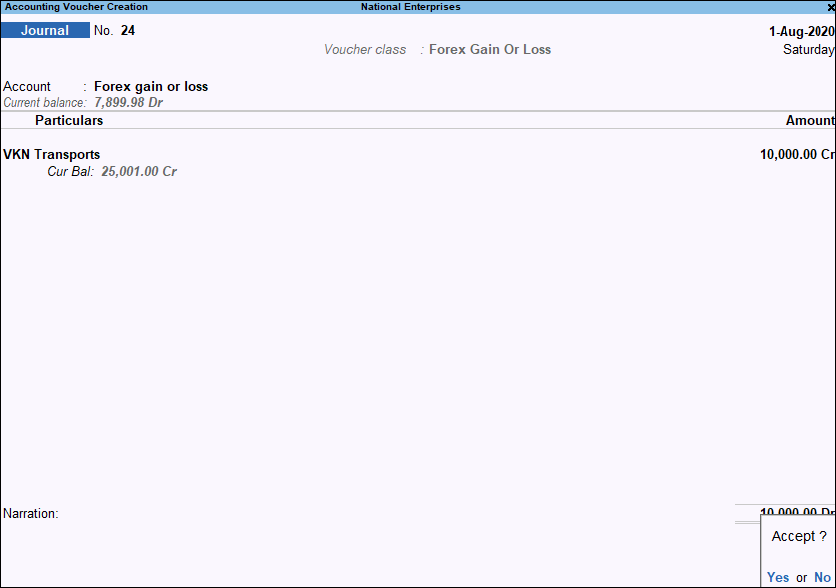

- Now Select the Voucher Class (Forex Class), and then Tally Prime will display all the ledgers that need to be adjusted under the Forex Gain or Loss.

- Select the required ledger, as needed

- Accept the voucher. Or, to save, you can pressCtrl+A.

The adjusted amounts will not be displayed in the Balance sheet as it is directly transferred to the Profit and Loss Account.

Also, if the ledger’s currency and the base currency are the same, Then while adjusting the forex gain and loss, only bill wise master details will appear

Recommended