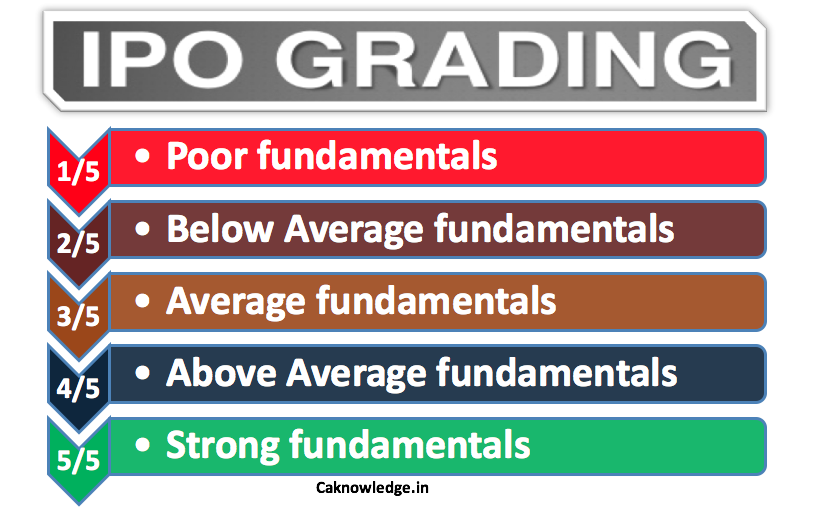

IPO Grading: As per The Securities and Exchange Board of India (SEBI), “IPO grading is the grade assigned by a Credit Rating Agency (CRAs) registered with SEBI, to the initial public offering (IPO) of equity shares or any other security which may be converted into or exchanged with equity shares at a later date. The grade represents a relative assessment of the fundamentals of that issue in relation to the other listed equity securities in India. Such grading is generally assigned on a five‐point scale with a higher score indicating stronger fundamentals and vice versa as below”.

| IPO Grade | Indication |

| 1/5 | Poor fundamentals |

| 2/5 | Below Average fundamentals |

| 3/5 | Average fundamentals |

| 4/5 | Above Average fundamentals |

| 5/5 | Strong fundamentals |

Why IPO Grading was introduced?

IPO grading has been introduced as an objective to make additional information available for the investors in order to supplement their assessment of fundamentals of the company offering equity issues through an IPO. SEBI had made it mandatory to grade all IPOs commencing from May 2007. Post this announcement many credit rating agencies such as ICRA, CARE and CRISIL registered with SEBI to provide IPO grading services.

However, IPO grading was not well received by many. With effect from 4th February 2014, on the request of Investor Associations and Association of Investment Bankers of India (AIBI) and the mounting corporate steer, SEBI had come up with a new guideline that made IPO grading optional.

Factors considered for in grading an IPO:

Though the actual factors evaluated for grading may not be identical or limited to the following, given below are the factors that are most widely considered:

| SL | Factor |

| 1 | Business Prospects and Competitive Position

|

| 2 | Management Quality |

| 3 | Financial Position of the issuer |

| 4 | Corporate Governance Practices |

| 5 | Compliance and Litigation History |

| 6 | New Projects—Risks and Prospects |

Grading details on IPO Documents:

If the issuers has opted for a grading their IPO, the Prospectus/Red Herring Prospectus, as the case may be, shall contain the grade received from the agencies. Along with this, description of the grades should be made available in issue advertisement or any other place where the issuer company is making advertisement for its issue

Benefits of grading an IPO:

- IPO grading facilitates the investors with supplementary information for making well informed decision about the investments he/she would want to do.

- Since it is an independent evaluation of the fundamental strength of the issuer, an IPO grade offers the investors an unbiased view of the issuer’s position.

- Grading enables relative assessment of different companies operating in same industry.

Recommended Articles

- What are the ways in which an IPO can be initiated ??

- What is listing, its Importance and Benefits of listing

- SME IPO – BSE’s SME Exchange and NSE’s Emerge

- Are you an SME? Know your Eligibility